- Token Terminal

- Posts

- Weekly fundamentals – Rebuilding coinBASE onchain

Weekly fundamentals – Rebuilding coinBASE onchain

Weekly fundamentals – Rebuilding coinBASE onchain

Have feedback or suggestions for Token Terminal?

Book a product feedback session to influence our roadmap, and join our early release group.

Introduction

This week’s newsletter covers Base, the Ethereum L2 incubated by Coinbase. We start by looking at Base from the point of view of a startup, dive into the Terminal to review it’s onchain KPIs, and finally, take a look at how it’s performing against other leading Ethereum L2s in the market.

In our view, Base is a means for Coinbase to rebuild itself onchain in 4 steps:

Build an onchain developer platform to serve the teams at Coinbase.

Build an onchain developer platform to serve external teams.

Integrate the onchain developer platform with the Coinbase product suite.

Rebuild Coinbase onchain.

A really ambitious mission worth covering, let’s jump in!

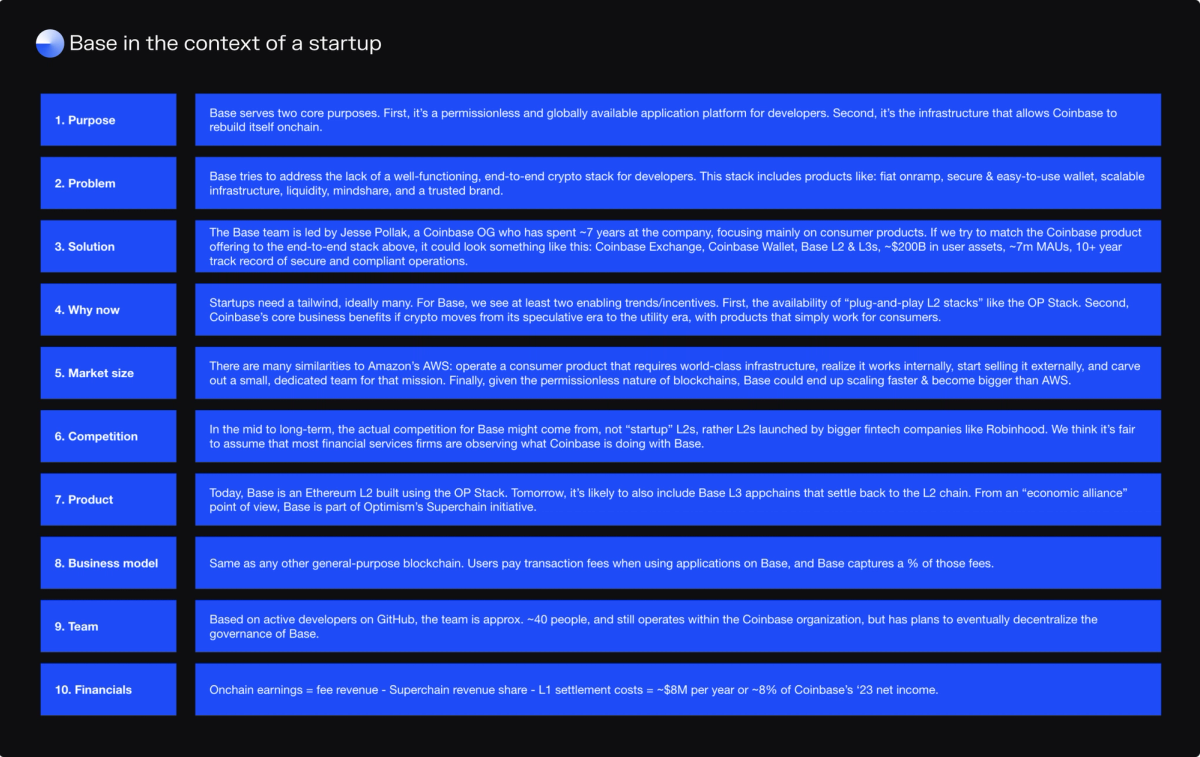

The Base pitch deck by Token Terminal.

How we think Wall Street analysts should view Base:

Purpose. Base serves two core purposes. First, it’s a permissionless and globally available application platform for developers. Second, it’s the infrastructure that allows Coinbase to rebuild itself onchain.

Problem. Base tries to address the lack of a well-functioning, end-to-end crypto stack for developers. This stack includes products like: fiat onramp, secure & easy-to-use wallet, scalable infrastructure, liquidity, mindshare, and a trusted brand.

Solution. The Base team is led by Jesse Pollak, a Coinbase OG who has spent ~7 years at the company, focusing mainly on consumer products. If we try to match the Coinbase product offering to the end-to-end stack above, it could look something like this: Coinbase Exchange, Coinbase Wallet, Base L2 & L3s, ~$200B in user assets, ~7m MAUs, 10+ year track record of secure and compliant operations.

Why now? Startups need a tailwind, ideally many. For Base, we see at least two enabling trends/incentives. First, the availability of “plug-and-play L2 stacks” like the OP Stack. Second, Coinbase’s core business benefits if crypto moves from its speculative era to the utility era, with products that simply work for consumers.

Market size. There are many similarities to Amazon’s AWS: operate a consumer product that requires world-class infrastructure, realize it works internally, start selling it externally, and carve out a small, dedicated team for that mission. Finally, given the permissionless nature of blockchains, Base could end up scaling faster & become bigger than AWS.

Competition. In the mid to long-term, the actual competition for Base might come from, not “startup” L2s, rather L2s launched by bigger fintech companies like Robinhood. We think it’s fair to assume that most financial services firms are observing what Coinbase is doing with Base.

Product. Today, Base is an Ethereum L2 built using the OP Stack. Tomorrow, it’s likely to also include Base L3 appchains that settle back to the L2 chain. From an “economic alliance” point of view, Base is part of Optimism’s Superchain initiative.

Business model. Same as any other general-purpose blockchain. Users pay transaction fees when using applications on Base, and Base captures a % of those fees.

Team. Based on active developers on GitHub, the team is approx. ~40 people, and still operates within the Coinbase organization, but has plans to eventually decentralize the governance of Base.

Financials. Onchain earnings = fee revenue - Superchain revenue share - L1 settlement costs = ~$8M per year or ~8% of Coinbase’s ‘23 net income.

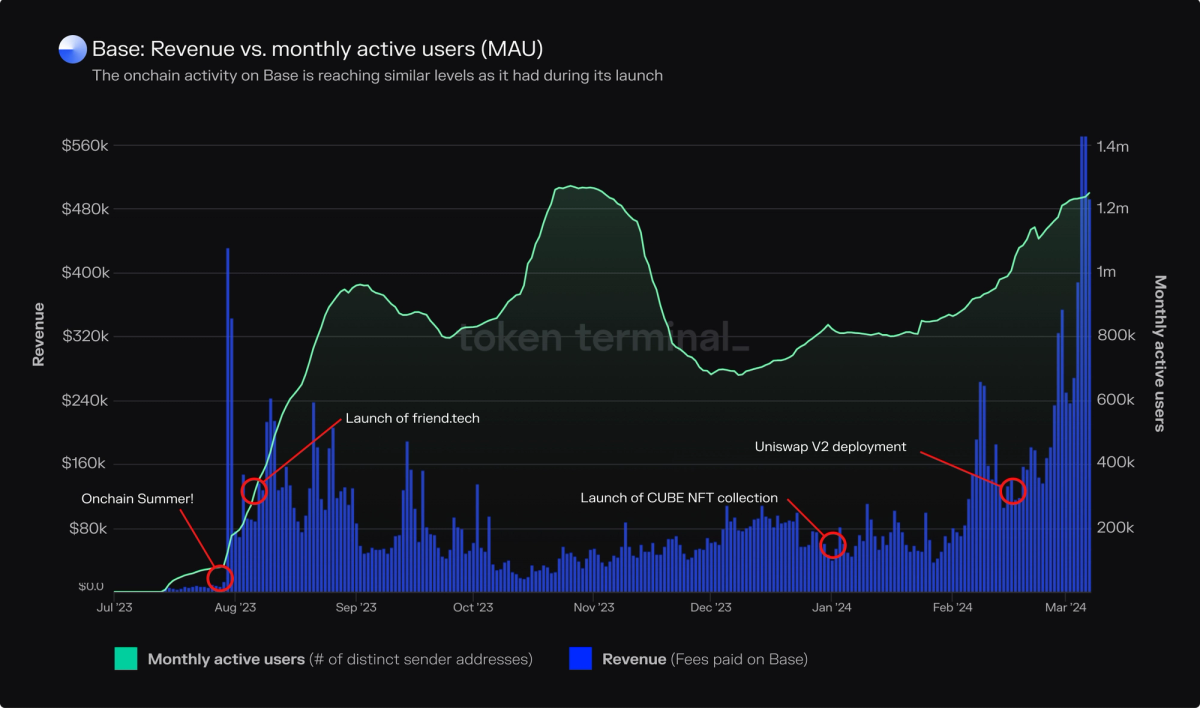

An overview of key events on Base to date.

The onchain activity on Base is reaching similar levels as it had during its launch, with ~1.2M monthly active users (addresses) and ~$500k daily transaction fee revenue.

We’ve mapped out some key events on the chart above:

Onchain Summer! https://onchainsummer.xyz/

Launch of friend.tech. https://www.friend.tech/

Launch of CUBE NFT collection. https://layer3.xyz/collections/intro-to-cubes

Uniswap V2 deployment. https://blog.uniswap.org/uniswap-v2-now-live-across-more-major-chains

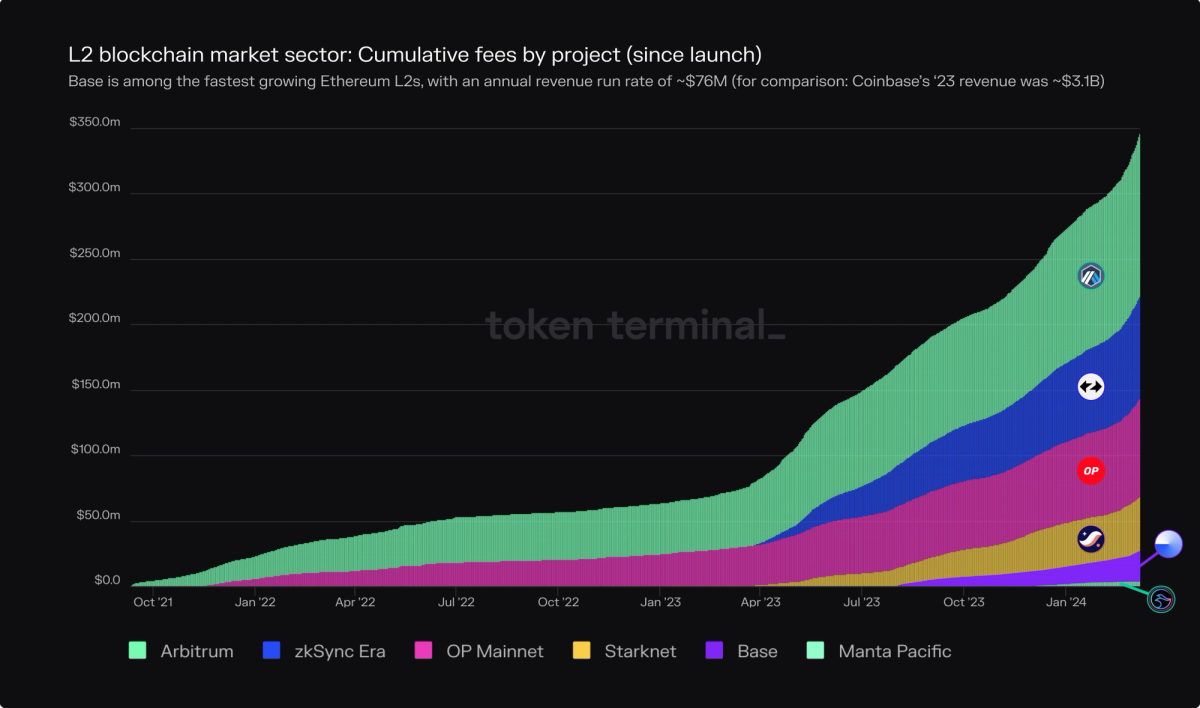

The Ethereum L2 landscape is growing fast.

Key takeaways:

The chart above shows the all-time transaction fees paid on Arbitrum, zkSync Era, OP Mainnet, Base, Starknet, and Manta Pacific.

All of the above L2s are general-purpose application platforms, not application-specific chains.

Arbitrum is in the lead with $80.3M in realized transaction fee revenue over the past 365d.

In terms of fees, Base is among the fastest growing Ethereum L2s, with an annual revenue run rate of ~$76M (for comparison: Coinbase’s ‘23 revenue was ~$3.1B).

Base’s monthly onchain financials.

Let’s take a look at Base’s onchain financials:

Firstly, notice how the data is presented monthly (not quarterly!), which is possible since all of the data is publicly available onchain 24/7.

The data for March includes only 1 week, so it’s not fully comparable with the other months, yet.

Outlier data point: Fees grew by ~2x from January to February.

Now, let’s review the data on the Income statement line by line:

Fees: total transaction fees paid on the Base L2.

Supply-side fees: N/A, since Base has a single sequencer at the moment.

Revenue: In the context of L2s, the same as Fees.

Expenses:

Cost of revenue: (i) transaction settlement on Ethereum & (ii) OP Superchain revenue share.

Operating expenses: N/A from onchain sources. But looking at GitHub data: Base has ~40 core developers. We can estimate the annual & monthly salary expenses using $200k as avg. compensation = $8m per year & $666k per month.

Token incentives: if Base had a native token, this would include $BASE tokens distributed to users.

Gross profit: Revenue minus Cost of revenue = “Net revenue for Base”.

Earnings: Revenue minus all Expenses = “what’s left for $COIN shareholders”. Note that this excludes offchain operating expenses, which are today covered by Coinbase.

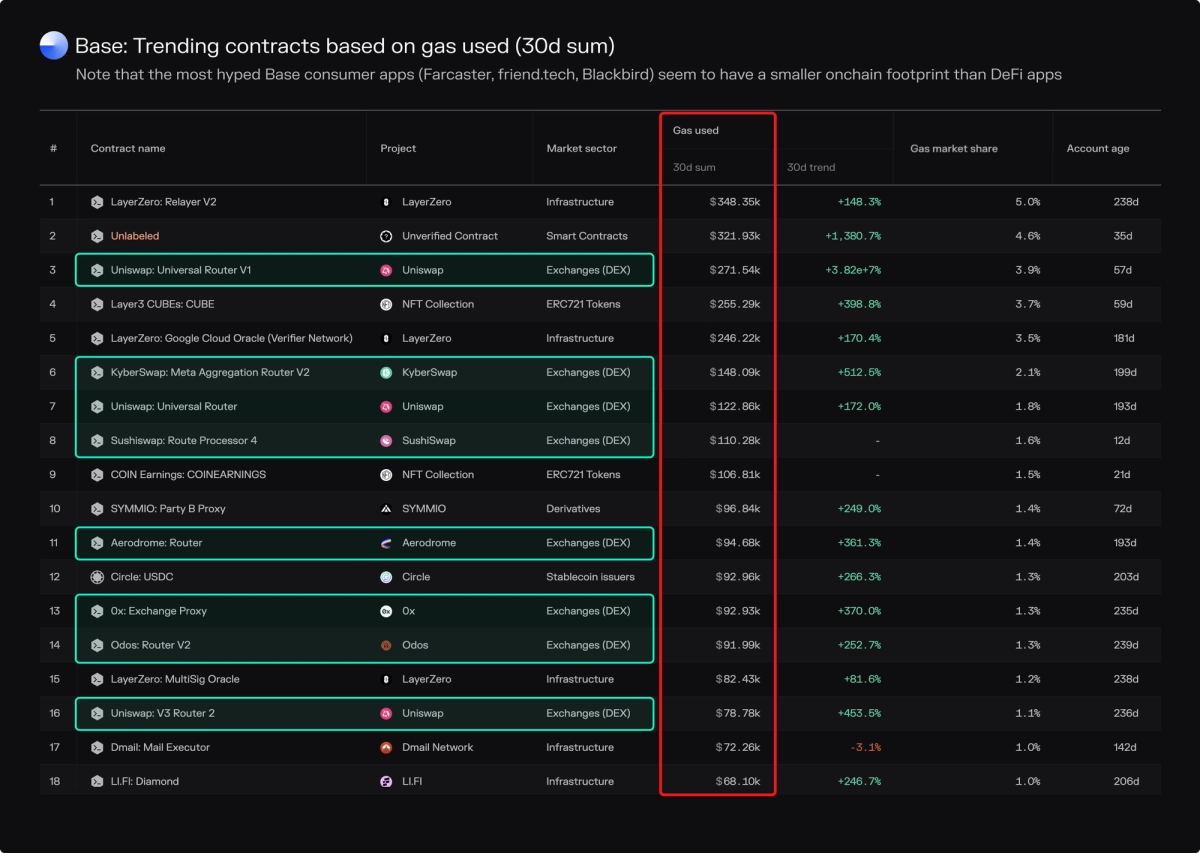

DeFi activity is most visible onchain.

Which applications and contracts drive fees on Base?

Base has an outspoken focus on consumer and payments applications. It’s been successful in attracting consumer applications like friend.tech, frenpet, and Farcaster to build on top of it. On the payments side, USDC has quite naturally emerged to become the most used stablecoin on Base.

The most hyped consumer/social applications seem to have a lower onchain footprint than DeFi applications. One explanation for this could be that for most consumer applications, it’s enough that they’re “sufficiently decentralized”, with only the minimum viable part of the application running onchain.

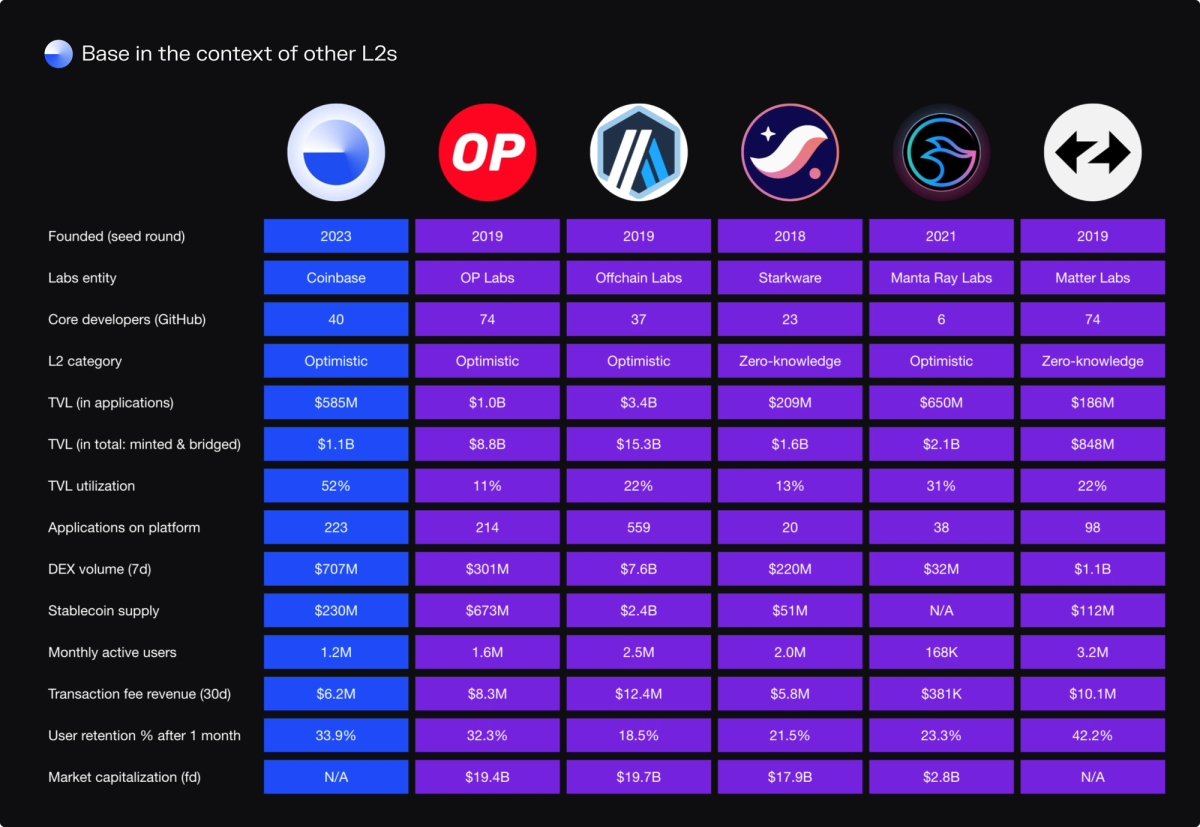

Base alongside other leading Ethereum L2s.

How does Base stack up against other Ethereum L2s?

Quick takeaways from the above slide, line by line:

Founded → Note that as an L2 team, Base is “2-3” years behind others.

Labs entity → In contrast to other L2 teams, Base is a startup within a publicly listed crypto company.

Core developers → Base runs a lean operation, albeit with a rapidly growing headcount.

L2 category → Tech: OP Stack. Economic alliance: Superchain.

TVL (in apps, total, and utilization) → Note that Base has been live for ~6 months & Coinbase has ~$200B of user assets that it wants to bring onchain.

Apps on platform → In terms of traction among app developers, Base comes second after Arbitrum.

DEX volume → Perspective: Coinbase CEX has a quarterly trading volume ~$150B.

Stablecoin supply → Coinbase is partnered with Circle on USDC, the 2nd largest stablecoin in the market.

MAUs → The combo of onchain & Coinbase product suite: potential to increase user adoption from current levels.

Transaction fee revenue → Base is still “small” in the context of Coinbase.

User retention → ⅓ of new users come back to Base after 1 month.

Market cap → Looking at the comparables, it’s easy to see how Base could contribute meaningfully to Coinbase’s market cap over time.

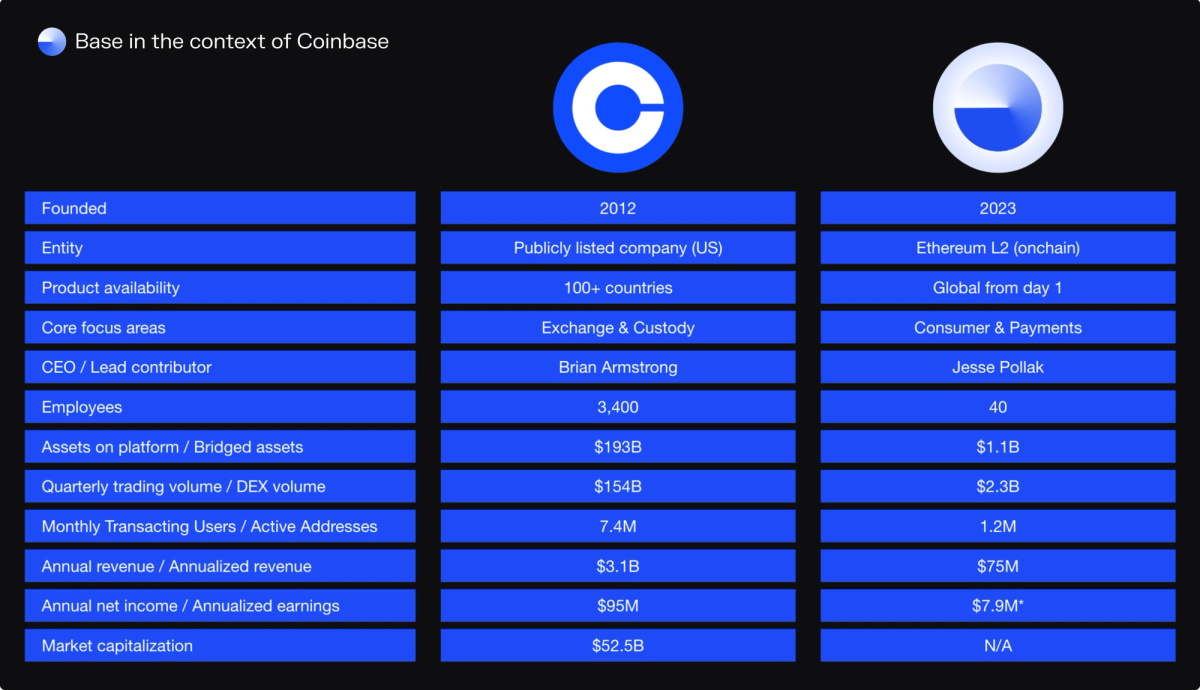

Coinbase vs. Base

Key takeaways:

From a headcount perspective, Base represents 1% of Coinbase.

From an earnings* perspective, Base represents 8.3% of Coinbase.

Base represents the “permissionless innovation arm” of Coinbase, with over ~200 protocols already building on the platform.

* Onchain earnings. Earnings for Base are annualized from the past 30d earnings, and include costs for (i) Ethereum L1 settlement, and (ii) OP Superchain revenue share, but exclude all offchain personnel (~40 core contributors), infrastructure, and other costs.

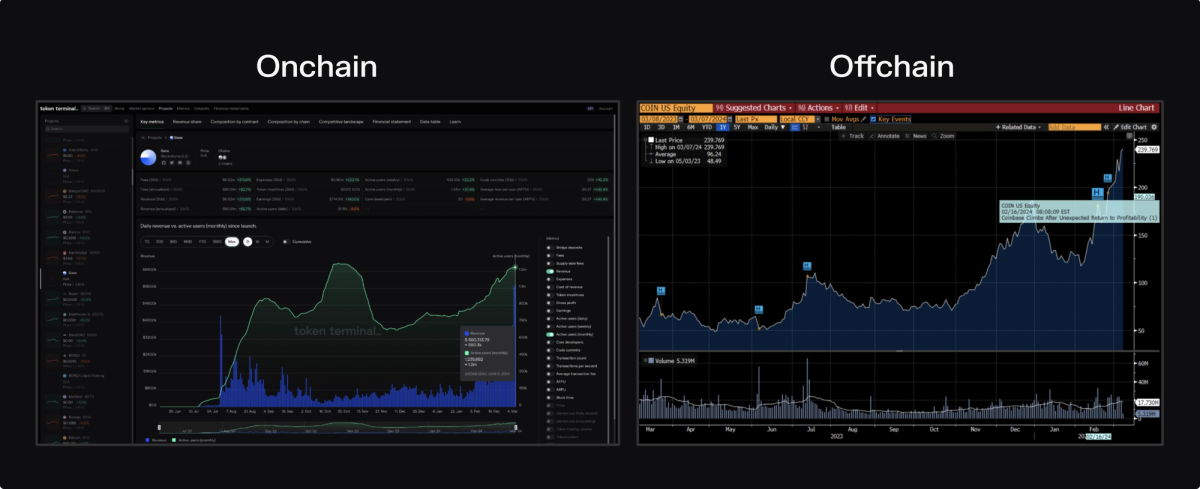

Token Terminal vs. Bloomberg Terminal.

Onchain first, offchain second:

Given that Base’s data is not yet singled out in Coinbase’s own reporting (= included only in the other category), Base-specific data is not yet available on the Bloomberg Terminal (other than through our Crypto Fundamentals application!).

Since Base's data is publicly available onchain, we at Token Terminal are already able to provide our users a granular breakdown of the onchain activity in real-time – already before Base potentially grows into a more meaningful part of Coinbase’s total business and gets its stats reported separately. Even then, that reporting will (at least initially) be done on a quarterly vs. ongoing basis.

As other bigger fintechs, like Robinhood, start to build products onchain = this data will be available on Token Terminal first.

📣 Insights from our community

Data-driven insights from analysts using Token Terminal PRO

Interesting table from Token Terminal, breaking down the differences between Ethereum L2s.

— Patrick Scott | Dynamo DeFi (@Dynamo_Patrick)

3:31 AM • Mar 8, 2024

Yes Jason, really. More users and revenue for Solana.

— Tiger (@NotChaseColeman)

5:16 PM • Mar 7, 2024

Thanks to @base, Wall Street has to learn the business model of Ethereum L2s

— Forrest Norwood ⚡️⛓️ (@forrestnorwood)

12:45 AM • Mar 7, 2024

Tether Surpasses US$100 Billion in Market Capitalisation

Stablecoins have emerged as a cornerstone of the crypto asset landscape, offering stability and liquidity in a market often characterised by volatility.

Amidst the burgeoning crypto ecosystem, there's a whirlwind of… twitter.com/i/web/status/1…

— Tommy Rogulj (@tommyrogulj)

4:33 AM • Mar 7, 2024

When you have an elegant design that results in low fees and rapid settlement, you take market share - it's that simple for @AcrossProtocol.

(h/t @_LewisHarland_@ournetwork__)

— Chris Burniske (@cburniske)

9:55 PM • Mar 6, 2024