- Token Terminal

- Posts

- Weekly fundamentals – NFT marketplaces and the Top tokenholders dataset

Weekly fundamentals – NFT marketplaces and the Top tokenholders dataset

Weekly fundamentals – NFT marketplaces and the Top tokenholders dataset

Weekly fundamentals – NFT marketplaces & the Top tokenholders dataset

Today in Weekly fundamentals

New listings

New dataset: Top tokenholders

State of the NFT marketplaces sector

📊 New listings

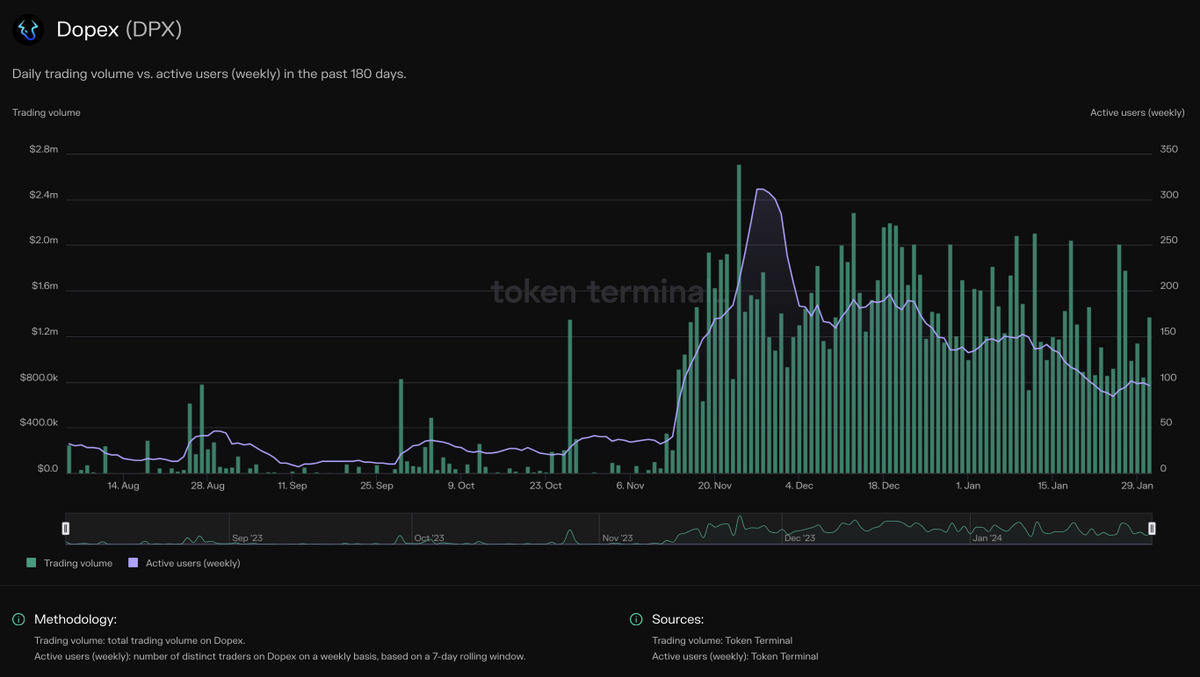

Dopex – a non-custodial exchange for options contracts built on Arbitrum.

Liquidity providers deposit funds into Dopex and receive premiums from options traders (supply-side fees). DPX tokenholders own and govern the protocol. They currently take a cut of the total trading fees paid by traders (revenue). Dopex’s investors include Tetranode, DefiGod, Orca Traders, Pattern Research, etc.

https://tokenterminal.com/terminal/projects/dopex

Launched in mid-November '23, Dopex's Concentrated Liquidity Automated Market Maker (CLAMM) options product has seen over $110m in cumulative trading volume. Over the same period, liquidity providers on Dopex have cumulatively earned over $600k in supply-side fees.

CLAMM is a key component of the Dopex v2 upgrade, designed to enhance onchain options trading. It allows liquidity providers to contribute liquidity in a more focused and efficient manner, akin to models used in e.g. Uniswap v3. The aim is to optimize yield for LPs while offering a new, intuitive trading experience for options traders. For a detailed explanation, you can read more on the Dopex website.

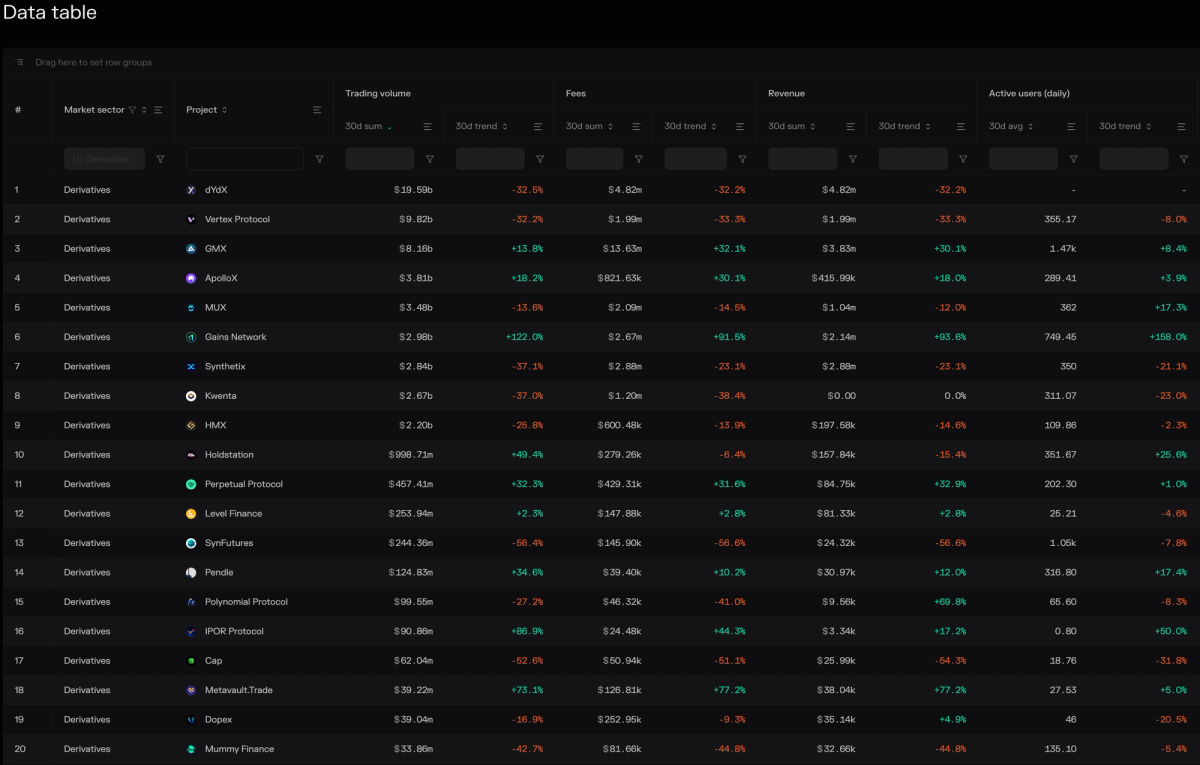

The Derivatives market sector ranked by fees (30-day sum).

📈 New datasets

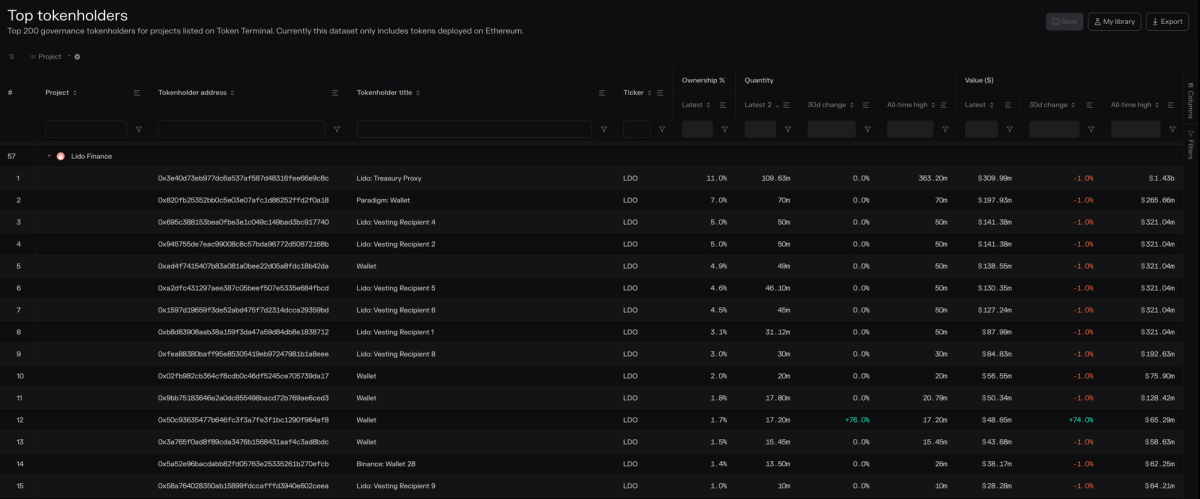

We recently introduced a new dataset: Top tokenholders.

What is the Top tokenholders dataset?

The Top tokenholders dataset displays the top 200 governance tokenholders for projects listed on Token Terminal.

We track the token flows of all governance tokens and calculate the balances for all addresses at the end of each day.

In addition to balances, we display several key metrics that are relevant for analyzing the activities of the tokenholders.

Key metrics include:

Ownership percentage of the token's total supply

Value denominated in USD

Holding period

Transaction count

Historical changes and all-time highs for relevant metrics

Why it is important for investors

Investors can utilize this new dataset in several ways; here are a few examples:

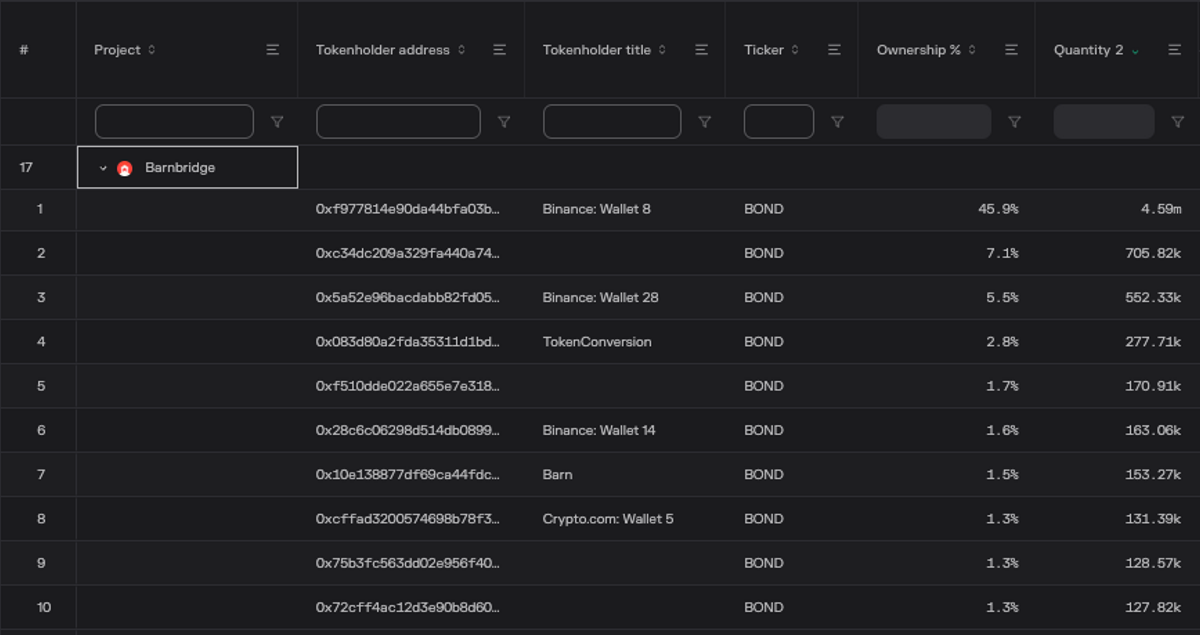

Assess project ownership and control. The dataset offers a detailed breakdown of ownership percentages of a project's governance token by address. For investors, understanding this distribution is crucial as it directly impacts their stake and voting power. For instance, it is notable that over 50% of BarnBridge's total supply is held in Binance-associated wallets.

Barnbridge's top tokenholders as of 23.1.2024 EOD.

Understand total supply distribution. For many projects, a significant portion of the total supply is non-circulating. By monitoring the balance changes in addresses considered to be part of the locked supply, investors can identify sources of new circulating tokens.

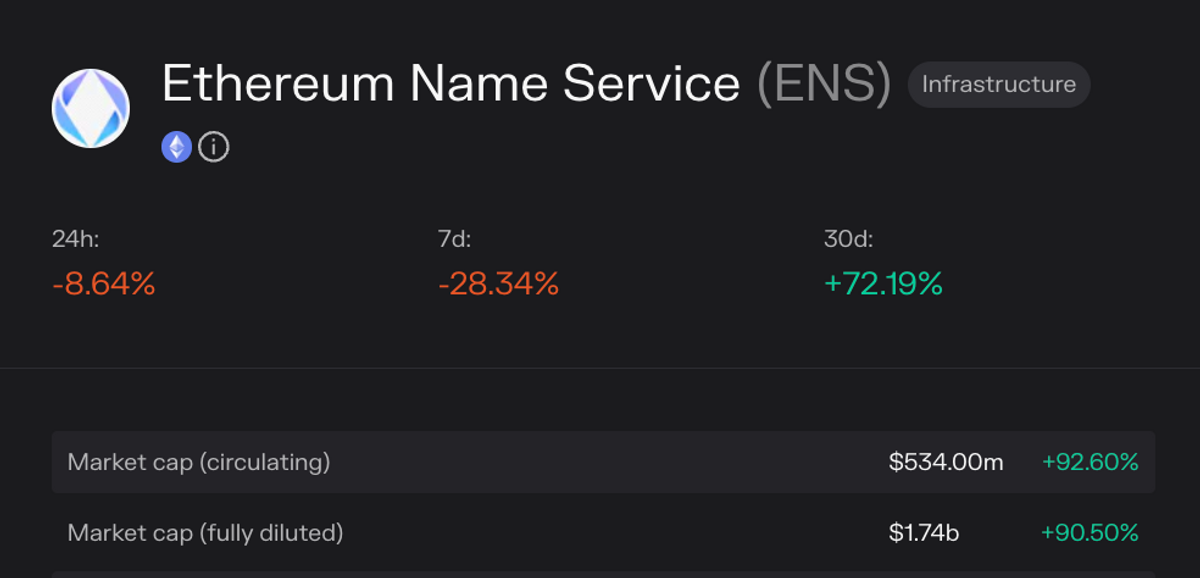

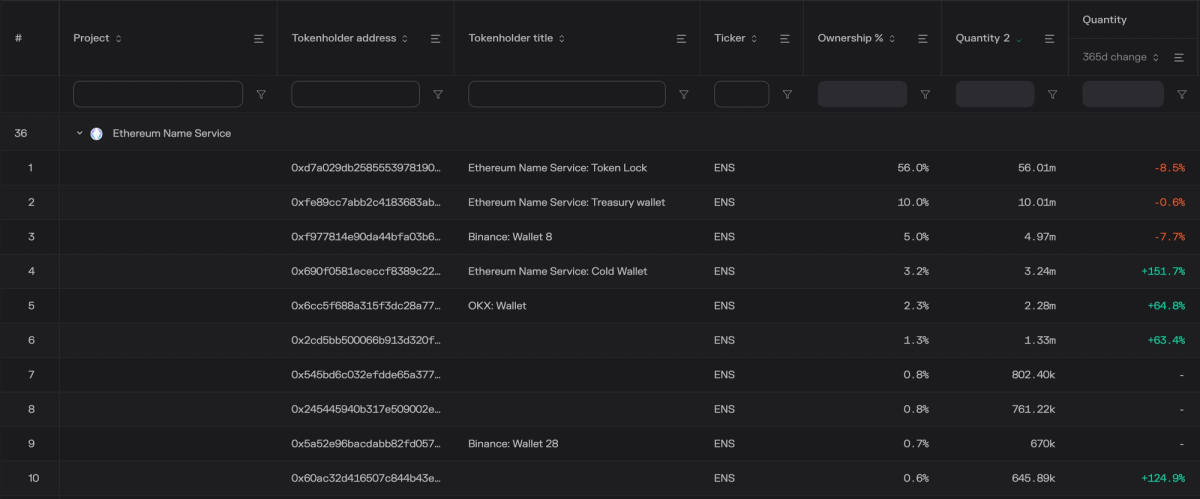

ENS's Top tokenholders as of 23.1.2024, their Token Lock, Treasury wallet and Cold wallet balances are all excluded from the circulating supply.

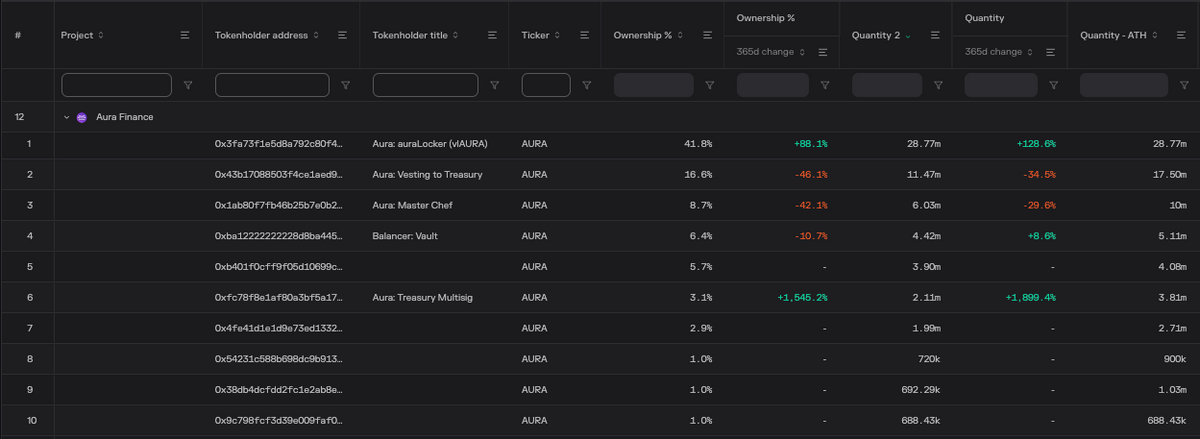

Insights into token flows. An analysis of Aura Finance's Top tokenholders indicates a substantial growth in tokens locked into vlAURA, with an increase of 128.6% over the last year. This growth represents an 88.1% rise in its proportion of the total token supply.

Aura Finance's 10 largest tokenholders as of 23.1.2024

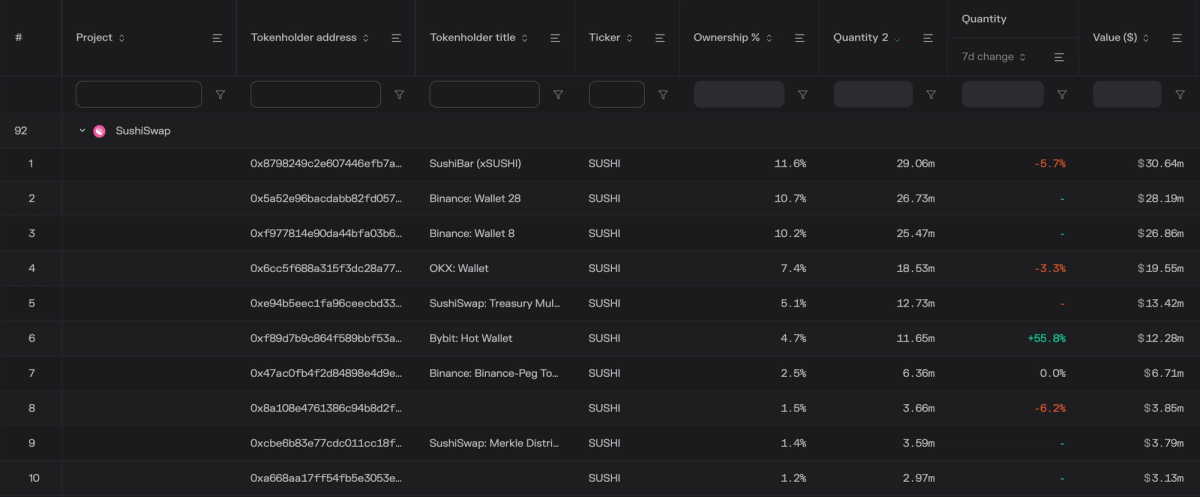

Analyze major tokenholder activity. An in-depth review shows that SushiSwap's largest tokenholder, the xSUSHI staking contract, experienced a 5.7% reduction in its SUSHI token balance over the past 7 days.

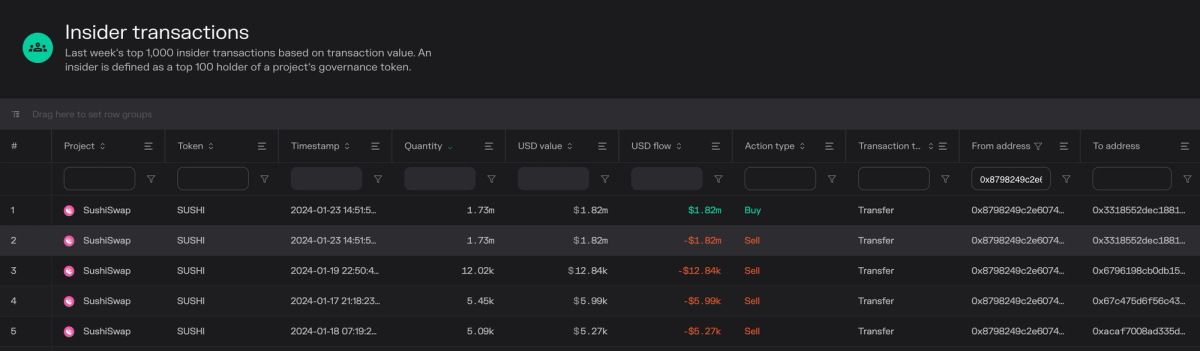

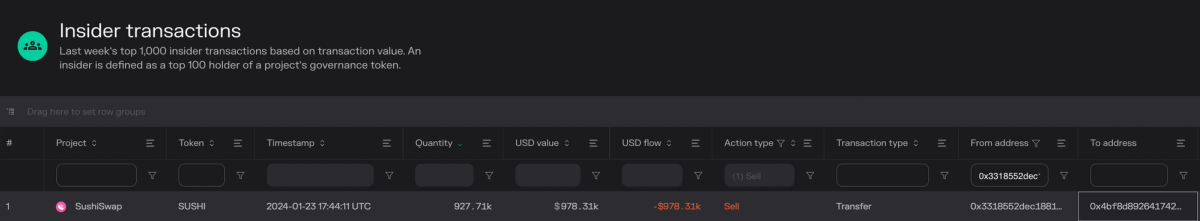

Use the Insider transactions dataset to dive deeper. The Insider transaction table provides a more granular view into recent balance shifts among the top 100 tokenholders, highlighting the specific transactions responsible for these changes. For instance, by applying a filter to the outgoing transactions column (from address) targeting the xSUSHI contract, the recent 5.7% decrease in its SUSHI token balance can be attributed to a significant withdrawal by a single large holder.

The insider transactions dataset filtered with the xSUSHI contract as the ‘From address’. The duplicate entry for the transaction with a ‘Buy’ and ‘Sell’ action type respectively tells us that both of the participants are top 100 tokenholders for SUSHI.

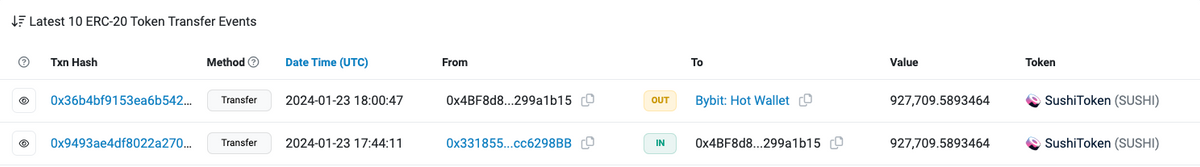

Following the trail, it was observed that the tokenholder in question transferred approximately half of their withdrawn assets to another address. This other address proceeded to deposit its entire balance into Bybit, a popular centralized exchange (CEX).

The insider transactions dataset filtered with the xSUSHI contract as ‘From address’.

Latest ERC-20 transfers for the address which half of the withdrawn funds ended up in.

In summary, a quick analysis revealed that the 5.7% decrease in the xSUSHI contract's SUSHI balance — SushiSwap's largest tokenholder —resulted from a withdrawal by another top 100 tokenholder. This tokenholder then transferred half of their withdrawn SUSHI to a CEX.

Who holds the most tokens?

Below is a breakdown of the top categories of accounts that tend to hold substantial portions of governance tokens across different protocols.

Exchanges, market makers and other centralized entities

Centralized exchanges and market makers, including giants like Binance, OKX, and Kraken, are often among the largest holders of tokens in established projects. Their significant holdings play a crucial role in ensuring liquidity and market access, representing a considerable percentage of the total token supply. This concentration of tokens on off-chain platforms underscores their pivotal role in influencing trading activities, liquidity flows, and the price stability of these tokens.

Vesting contracts

Vesting contracts are specialized smart contracts designed to distribute governance tokens according to a predefined schedule, primarily to founders, team members, and early investors. Given the early stage of crypto adoption, it's common for these project-owned accounts to be major token holders. These contracts reflect a commitment to long-term project growth and help manage market impact by controlling the release of new tokens, thereby influencing both the token's price and investor decisions.

DeFi lending and exchange pools

Lending and exchange pools from key DeFi projects are also common among the top tokenholders, especially for well-established, older protocols. This highlights the token's integration within the broader DeFi ecosystem, promoting its use in various activities like lending, borrowing, and yield farming. The presence of these tokens in DeFi pools not only boosts their utility and accessibility but also plays a key role in enhancing liquidity.

Explore the top tokenholders of projects listed on Token Terminal from our Top tokenholders dashboard.

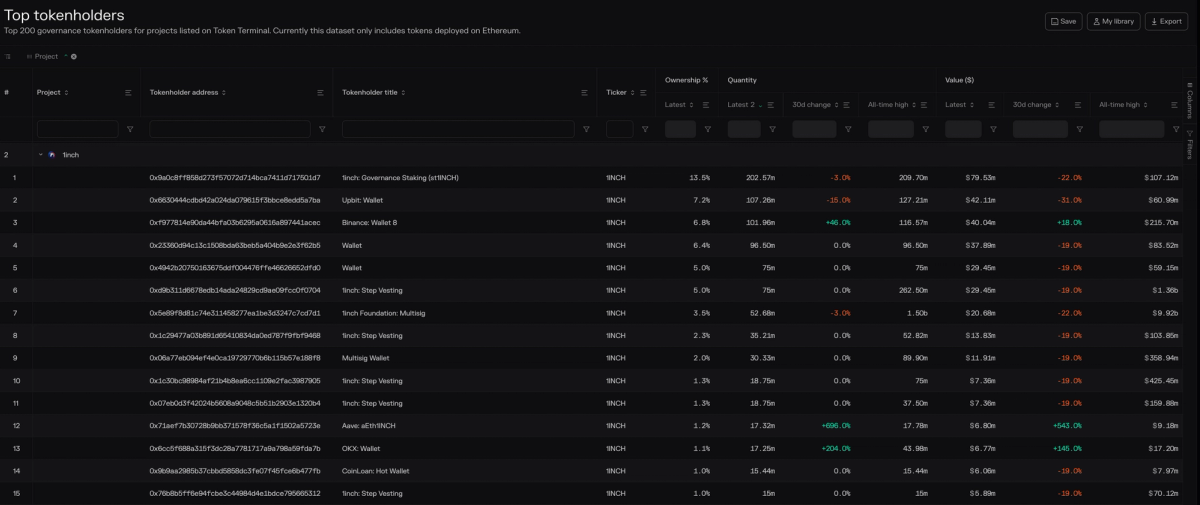

1inch

Top 1INCH tokenholders.

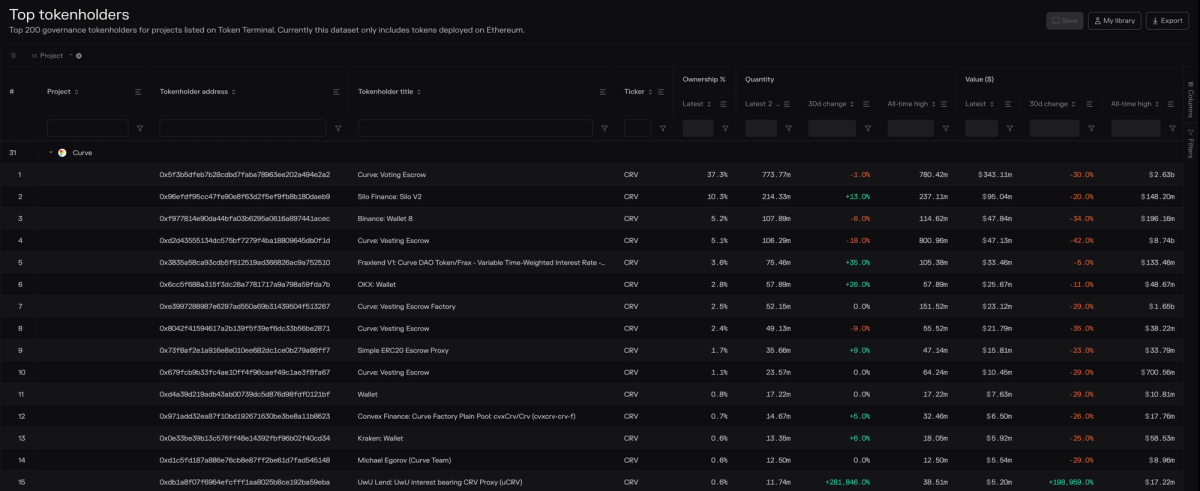

Curve

Top CRV tokenholders.

Lido Finance

Top LDO tokenholders.

👓 Insights from Token Terminal research

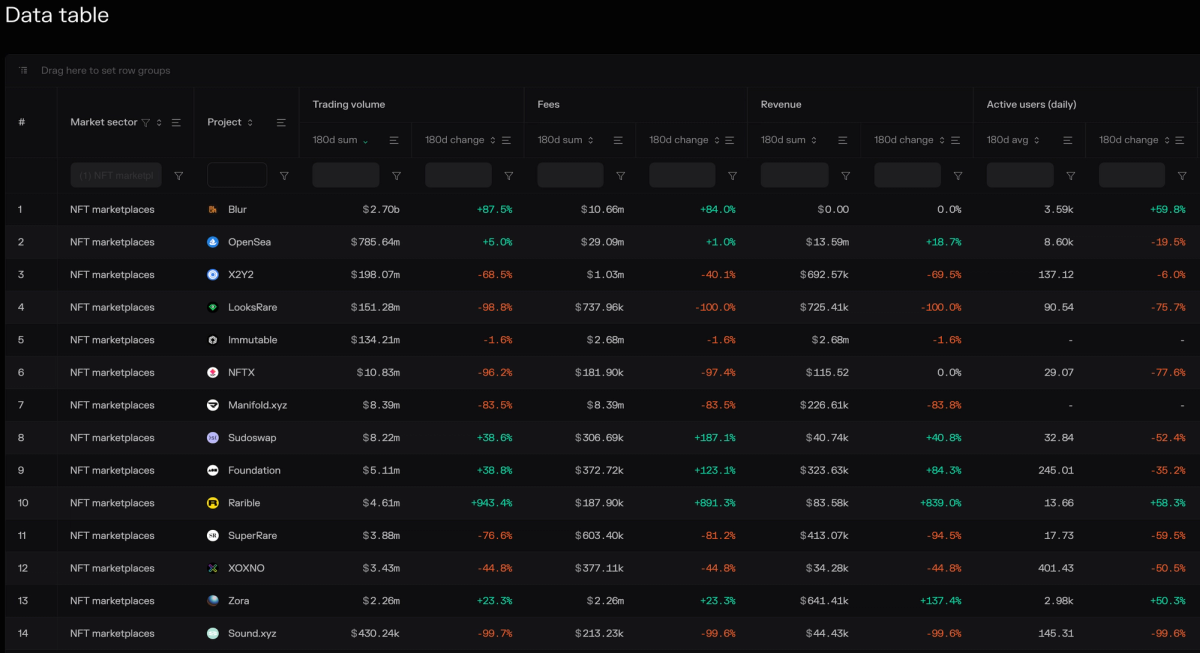

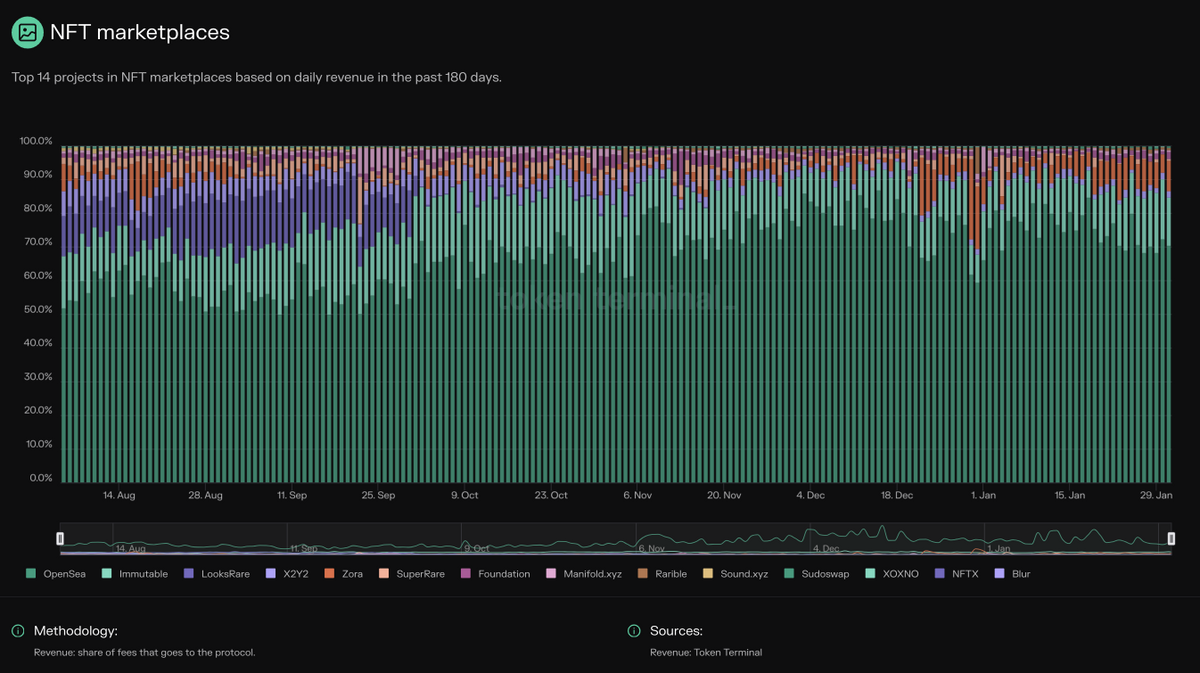

State of the NFT marketplaces sector

Top 14 projects in NFT marketplaces based on daily trading volume in the past 180 days.

Top 14 projects in NFT marketplaces sorted based on 180-day trading volume.

Blur has continued to capture market share in the NFT marketplace sector, capturing close to 80% of the total trading volume. The increase is notable, with Blur's trading volume up 87.5% over the past 180 days. Blur's dominance has significantly impacted OpenSea's market share, which has fallen to ∼16% from ∼40% before the launch of Blur in late '22.

Trading volumes on platforms such as LooksRare and X2Y2 have seen a significant decline, indicating a shift in the dynamics of NFT marketplaces. These platforms, which had previously seen high trading volumes largely driven by trading incentives, have witnessed dramatic reductions in activity. Over the past 180 days, LooksRare's trading volume plummeted by nearly 99%, and X2Y2's fell by over 68%. This pattern suggests a consolidation of NFT traders towards platforms offering superior features, lower fees, or stronger communities, possibly signifying the NFT market's maturation towards prioritizing utility, user experience, and long-term value over immediate rewards.

According to LooksRare's team, they have recently been prioritizing onchain gaming. This strategic shift is likely a response to declining trading volumes and a consolidating market. This pivot toward gaming could enhance the platform's appeal and provide a unique value proposition in the competitive NFT landscape.

For stakeholders and investors, the evolving market landscape highlights the importance of looking beyond initial volume spikes driven by incentives and focusing on platforms with sustainable growth strategies. This could involve platforms that are innovating with user-centric features, integrating with broader ecosystems, and actively developing their product to enhance the user experience.

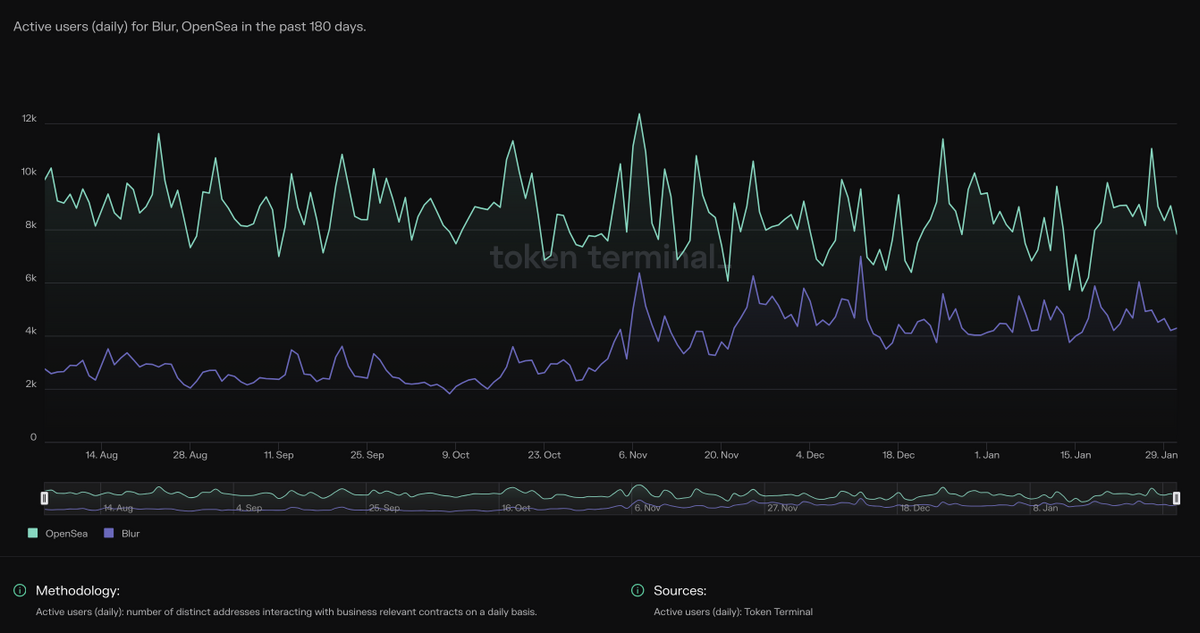

Blur vs. OpenSea

Despite Blur's significant share of total trading volume, OpenSea continues to lead in terms of revenue and daily active users (DAU). This situation of dual leadership in the market underscores a competitive landscape where high trading volumes do not necessarily translate to higher revenues, highlighting the distinct strategies and value propositions of each platform.

OpenSea charges a 2.5% fee (revenue) on all secondary sales, whereas Blur charges 0% while enforcing a minimum 0.5% royalty fee (supply-side fees). This difference in fee structures seems to be a non-issue for casual traders dealing in lower volumes. However, for active traders managing larger volumes of capital, fees are a significant factor in their platform choice.

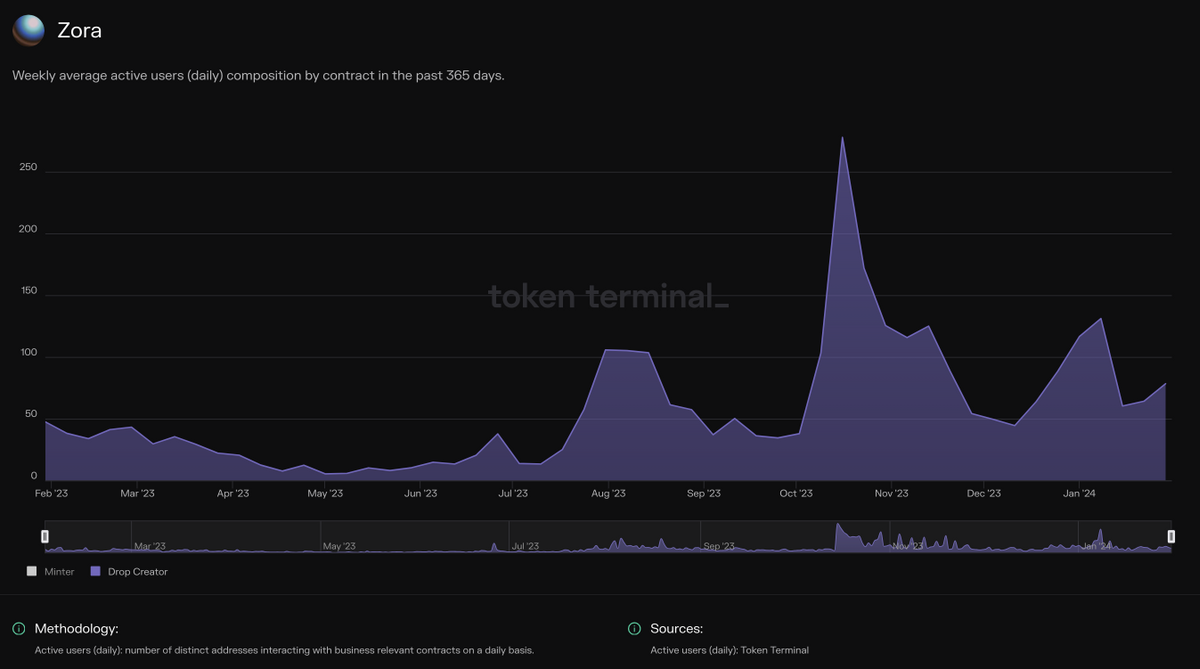

Zora is bringing creators onchain

Weekly average drop creators in the past 180 days.

Weekly average minters in the past 180 days.

Following the surge in activity triggered by Coinbase's ‘Base, Introduced’ NFT drop in February '23, Zora has experienced a downtrend in the number of minters. While we've seen Zora's capability to attract major one-off collaborations, the subsequent decline in minters raises concerns about the platform's long-term demand and ability to retain users.

Despite this, there's a noticeable increase in creators choosing to mint directly onchain, indicating Zora's appeal within the creative community for promoting the web3 ethos. Nonetheless, the discrepancy between an increasing number of creators and the slower pace of demand raises questions about the appeal of the collections or the platform's strategy in maintaining a growth model that attracts and retains top-tier creators.

Retention rate for Zora's monthly active user (MAU) cohorts since Jan '23.

📂 Data Room

Handpicked insights from the Token Terminal Data Room

Overview of Blur Blend

Blur Blend is a peer-to-peer perpetual lending protocol that supports arbitrary collateral, including NFTs. Blend has no oracle dependencies and no expiries, allowing borrowing positions to remain open indefinitely until liquidated, with market-determined interest rates.

Blend matches users who want to borrow against their non-fungible collateral with whatever lender is willing to offer the most competitive rate, using a sophisticated off-chain offer protocol.

By default, Blend loans have fixed rates and never expire. Borrowers can repay at any time, while lenders can exit their positions by triggering a Dutch auction to find a new lender at a new rate. If that auction fails, the borrower is liquidated and the lender takes possession of the collateral.

New collections added to Blur Blend / BLUR price

To be available for borrowing or lending on Blur Blend, new NFT collections must be allowlisted. Currently, 19 collections are available. Since its launch in May '23, several new collections were added, but after early July, there was a pause in allowlisting new collections for several months until the end of the year, when Lil Pudgys and Moonbirds were introduced.

In the above chart, we use the BLUR token price as a proxy of general interest towards the NFT space. We can observe a correlation between the BLUR price and the addition of new collections to Blend. For instance, at the end of the year, as BLUR prices surged, new collections were also allowlisted. This period also saw an increase in Blend and Blur trading volumes.

The Blur team appears to be strategically enhancing Blend's coverage in response to growing interest in NFTs. While the team's focus may have shifted towards Blast, their Layer 2 solution optimized for digital collectibles, they continue to support and develop their other products.

Raw and decoded onchain data from 14 chains, accessible via Google BigQuery. Explore our Data Room offering: https://tokenterminal.com/product/data-room

📣 Insights from our community

New "trending wallets" feature on @tokenterminal reveals which wallets drive blockchain usage:

Over half of the largest gas-consuming wallets, 8 out of 15, are transacting USDT on Tron. Most of these wallets are affiliated with Binance: $11M in gas for 6M transactions last month— matthew sigel, recovering CFA (@matthew_sigel)

3:16 PM • Jan 31, 2024

Derivatives and lending revenue side by side

Given the cash derivatives are throwing off, protocols will have to target a faster growth rate to win. GL flying close to the sun

— Nick Cannon (@inkymaze)

7:09 PM • Jan 28, 2024

Explore Terminal Pro: https://tokenterminal.com/product/pro