- Token Terminal

- Posts

- Weekly fundamentals – A New Era for Uniswap?

Weekly fundamentals – A New Era for Uniswap?

Weekly fundamentals – A New Era for Uniswap?

Introduction

This week’s newsletter covers the OG DeFi protocol Uniswap – the leading decentralized exchange protocol. The discussion below was inspired by Uniswap Foundation’s recent “fee switch” governance proposal on the Uniswap DAO forum.

Let’s jump in!

1. Why did people get excited about the recent Uniswap DAO governance proposal?

The proposal comes from an entity with authority. It was brought forward by the Uniswap Foundation, which means that it bears significant authority and therefore has a better chance to pass.

Prior “fee switch” proposals have failed to get enough support. The proposal presents a model for how the DAO could turn on the fee switch, so that a percentage of the trading fees would accrue to UNI tokenholders.

The proposed model would likely become a standard for other DAOs. If passed, the fee distribution model would likely be adopted by most DAOs that have yet to turn on their fee switch.

Industry mindshare moves from memes to fundamentals. If passed, Uniswap would become one of the top revenue-generating protocols in the crypto market overnight. This would likely lead to crypto investors starting to pay more attention to protocols’ financial traction and usage vs. memes.

Assuming no blockers, a Snapshot vote for the proposal will be posted today (March 1, 2024) and an onchain vote next week on March 8, 2024. Follow the progress here:

The Uniswap protocol facilitated $437.7b in trading volume over the past year. That volume resulted in traders paying an aggregate of $588.3m in trading fees. Because Uniswap hasn’t activated its fee switch, it earned $0 in revenue from those fees.

Should a fee switch (=Uniswap cuts into LPs’ revenue) not result in a change in trading volume, a protocol fee could have generated up to $147.1m in revenue to UNI tokenholders over the past year.

Assuming that a 10% protocol fee gets implemented, Uniswap would become the 9th most revenue-generating protocol in crypto, ranking between OP Mainnet and Avalanche.

2. What is and who owns “Uniswap”?

There are at least three (3) different constituents we should separate between:

Uniswap Labs ($EQUITY). Uniswap Labs, the company that initially built the Uniswap Protocol, and currently contributes engineering resources to the Uniswap DAO. Below is a list of some of the consumer-facing products owned by Uniswap Labs (not the Uniswap DAO):

Uniswap App = web interface

UniswapX = aggregator

Uniswap Wallet = mobile wallet

Uniswap DAO ($UNI). Uniswap DAO, an Internet-native organization owned by the UNI tokenholders. It owns and governs the following developer-facing onchain products:

Uniswap Protocol v1-v4

Uniswap Foundation (NON-PROFIT). Uniswap Foundation, a lead contributor in the Uniswap DAO, with a focus on governance and growth initiatives.

3. How does the Uniswap Protocol make money?

The Uniswap Protocol is a decentralized exchange (DEX). The Uniswap Protocol is a decentralized spot exchange, where traders (demand-side) pay trading fees every time they buy/sell tokens. Currently, 100% of the trading fees go to the liquidity providers (supply-side). In other words, the Uniswap DAO has applied a 0% take rate (protocol fee) on the exchange.

The Uniswap DAO can apply a meaningful take rate. According to the smart contracts, the Uniswap DAO could at any time decide to activate a fee switch that changes the take rate from 0% to anything between 10%-25% of the trading fees paid in each pool.

If activated, the Uniswap DAO could end up generating a lot of revenue. To put the numbers in perspective: last year, traders paid ~$588.3m in trading fees to liquidity providers. 25% of that would result in ~$140m in annual revenue for the UNI tokenholders. What’s the catch? It’s unsure how liquidity providers will react to the DAO coming at their revenue.

4. Uniswap’s traction

Charts that illustrate Uniswap’s market dominance and continued growth. The below tables and charts show Uniswap’s traction and performance on Ethereum, within the DEX market sector, and more.

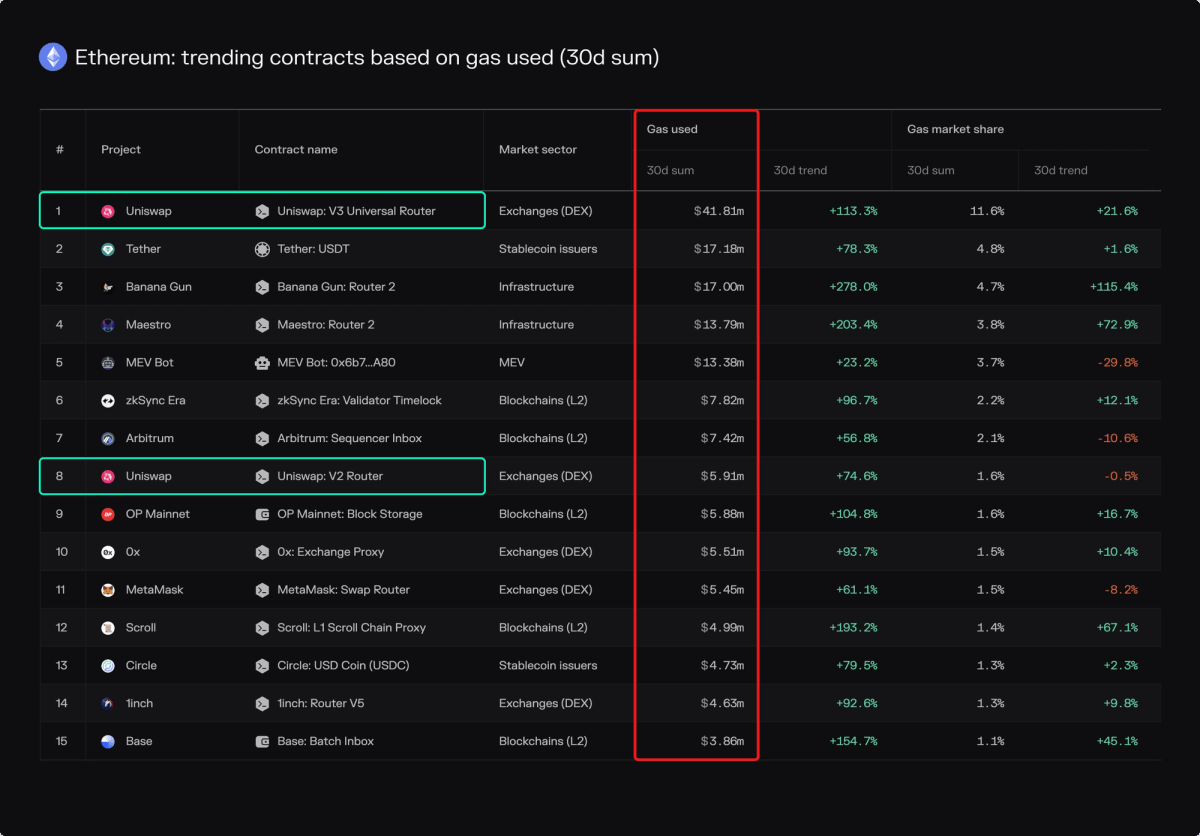

Key takeaway: Uniswap contracts consume more than 10% of all gas (transaction) fees on Ethereum.

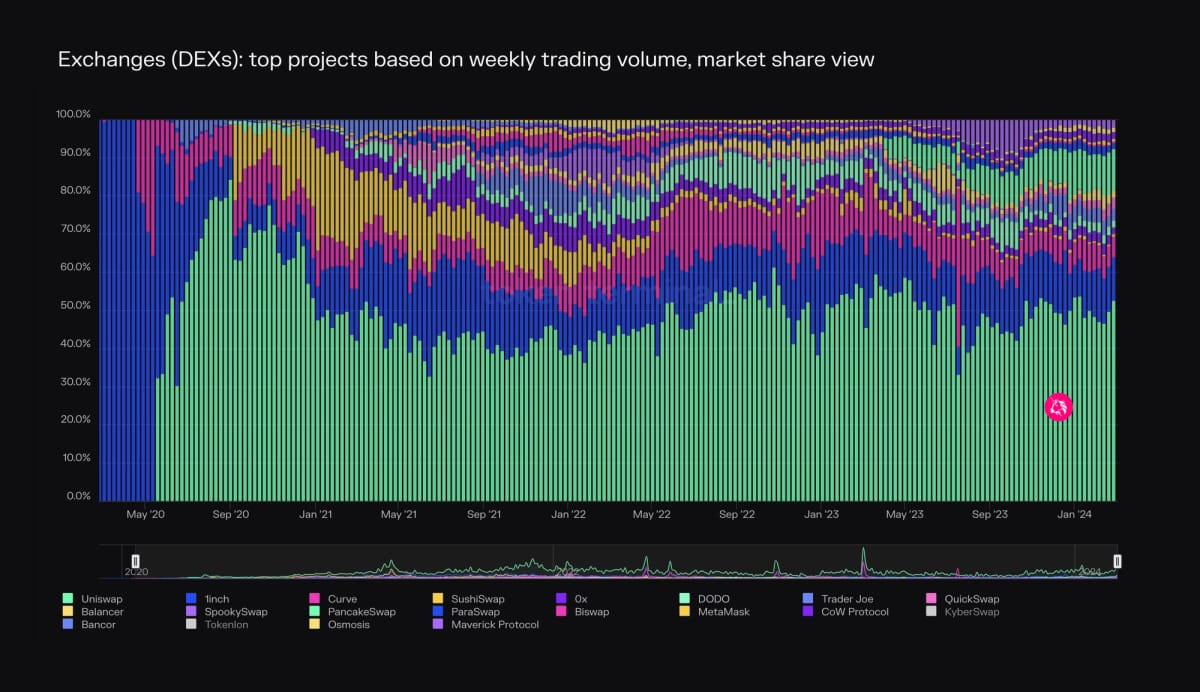

Key takeaway: Uniswap has ~50% market share in the decentralized exchange (DEX) market sector.

Key takeaway: Uniswap is the most used application (aka not a blockchain) in the crypto industry.

Key takeaway: Uniswap is a great example of “developer leverage”: ~40 core devs → ~$1.7 trillion in trading volume.

Key takeaway: Uniswap DAUs show sustainable long-term growth, while the market cap is slowly picking up.

Key takeaway: Uniswap is already multichain, and Arbitrum is its biggest non-mainnet platform.

📣 Insights from our community

Data-driven insights from analysts using Token Terminal PRO

(New Post) Expected Value In Crypto & Building Infinite Blockspace

There is an overabundance of people building new L1s/L2s/LSTs & other infrastructure...and an undersupply of people attempting to build new applications in crypto.

This essay looks at why this happens, how this… twitter.com/i/web/status/1…

— Michael Dempsey (@mhdempsey)

4:26 PM • Feb 29, 2024

Ethena has generated more than $4m in revenue in just a month since the launch

At this rate it’s one of the few protocols making hard money in the space

Cc @tokenterminal

— Seraphim (@MacroMate8)

11:15 PM • Feb 28, 2024

👥 Daily active users for two web3 social applications: @OpenChat (~2.6k) and @friendtech (282).

DAU definitions:

📲 OpenChat: # of distinct users online on a daily basis.

🛒 friend tech: # of distinct "key" buyers & sellers on a daily basis.

⛓️ Note: since OpenChat's whole… twitter.com/i/web/status/1…

— Token Terminal (@tokenterminal)

5:00 PM • Feb 28, 2024

BUT WHAT IF THEY FORK IT THO

— Antonio | dYdX (@AntonioMJuliano)

2:48 PM • Mar 1, 2024