- Token Terminal

- Posts

- Token Terminal x Alea Research

Token Terminal x Alea Research

A partnership to advance the quality and distribution of onchain data & research

We’re excited to announce that our data is now live on Alea Research, a leader in crypto market intelligence and research.

Through this collaboration, Token Terminal will provide onchain data to Alea Research and support their platform and research reports with standardized and institutional-grade onchain data.

“Quality data is the backbone of quality research. In our research workflow, Token Terminal is the foundation we build on every week. Their end-to-end approach to onchain data collection, curation, and delivery allows us to work with data at the most granular level, which gives us the flexibility we need to do high-quality research & analysis.

We’re happy to have found a data provider that can provide us with a comprehensive suite of onchain metrics, where each metric is accompanied by a clear methodology and a transparent audit trail. For onchain data, Token Terminal is the standard.”

Our shared mission is to bring reliable and data-driven protocol reporting at scale to institutional investors. As crypto matures into an institutional asset class, reliable data and rigorous research will be the pillars. Token Terminal and Alea Research will be at the forefront of that transition.

Alea Research recently published an in-depth report on TON, with Token Terminal as the primary provider of onchain data.

Below are some of the key charts featured in the study:

1. Market data

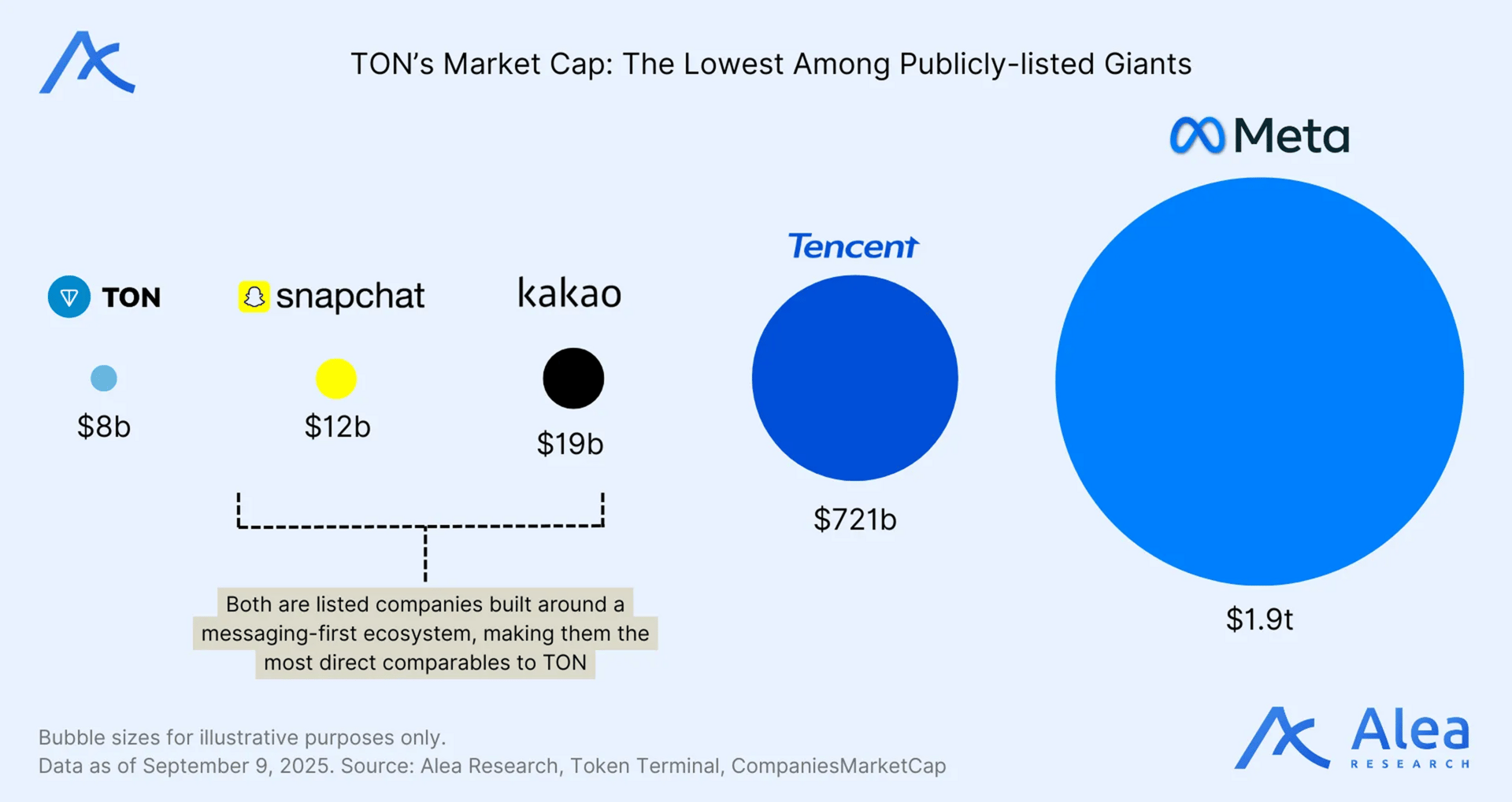

TON’s market cap of $8B remains well below messaging-first peers like Kakao ($19B) and Snapchat ($12B), and is dwarfed by Tencent ($721B) and Meta ($1.9T). Despite its ecosystem integration with Telegram, TON is still valued at the low end of comparable networks.

2. Standardized financial & usage metrics

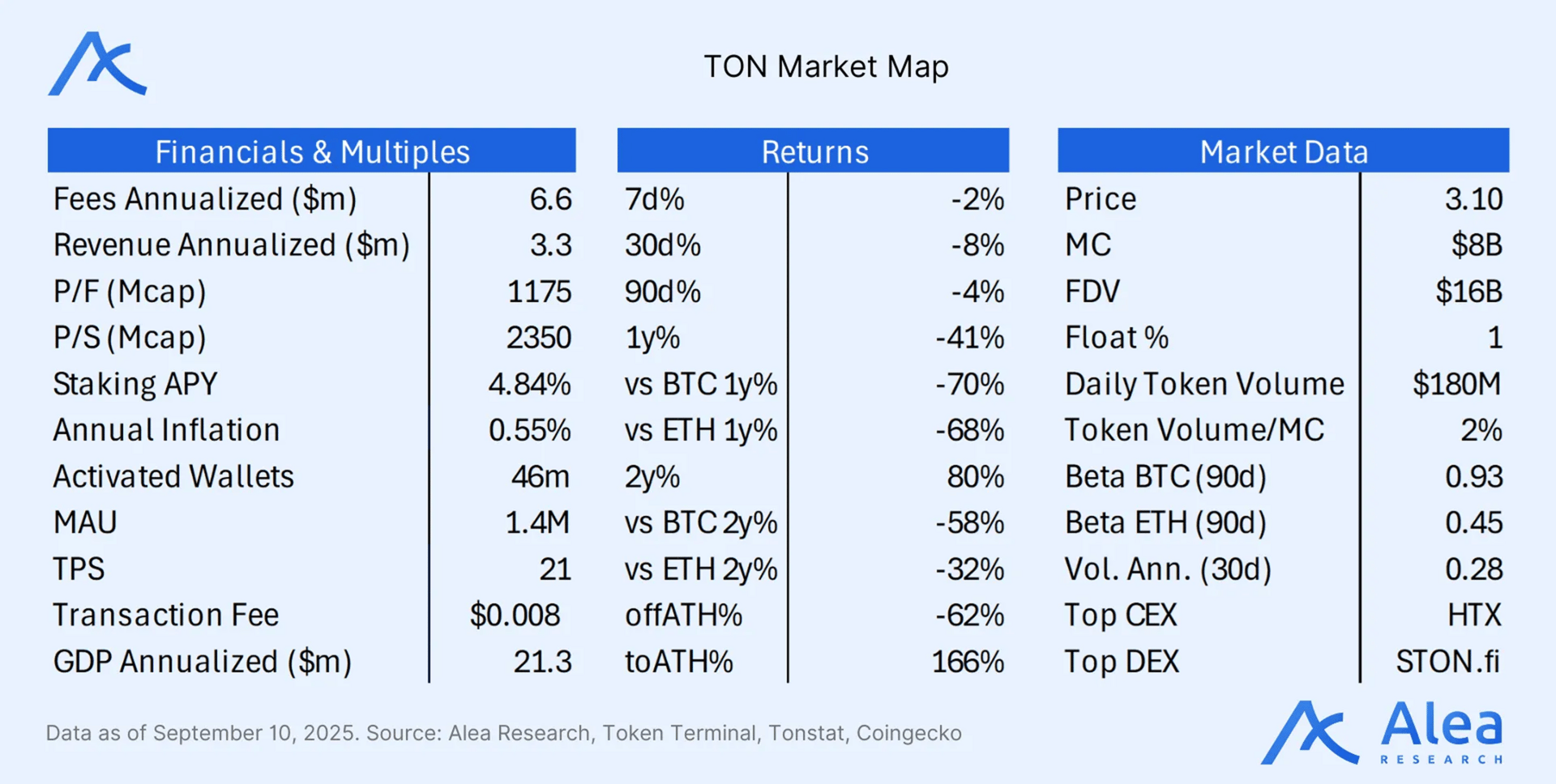

TON generates $6.6M and $3.3M in annualized fees and revenue, respectively, and trades at high multiples, with a P/F ratio of 1,175x and P/S ratio of 2,350x.

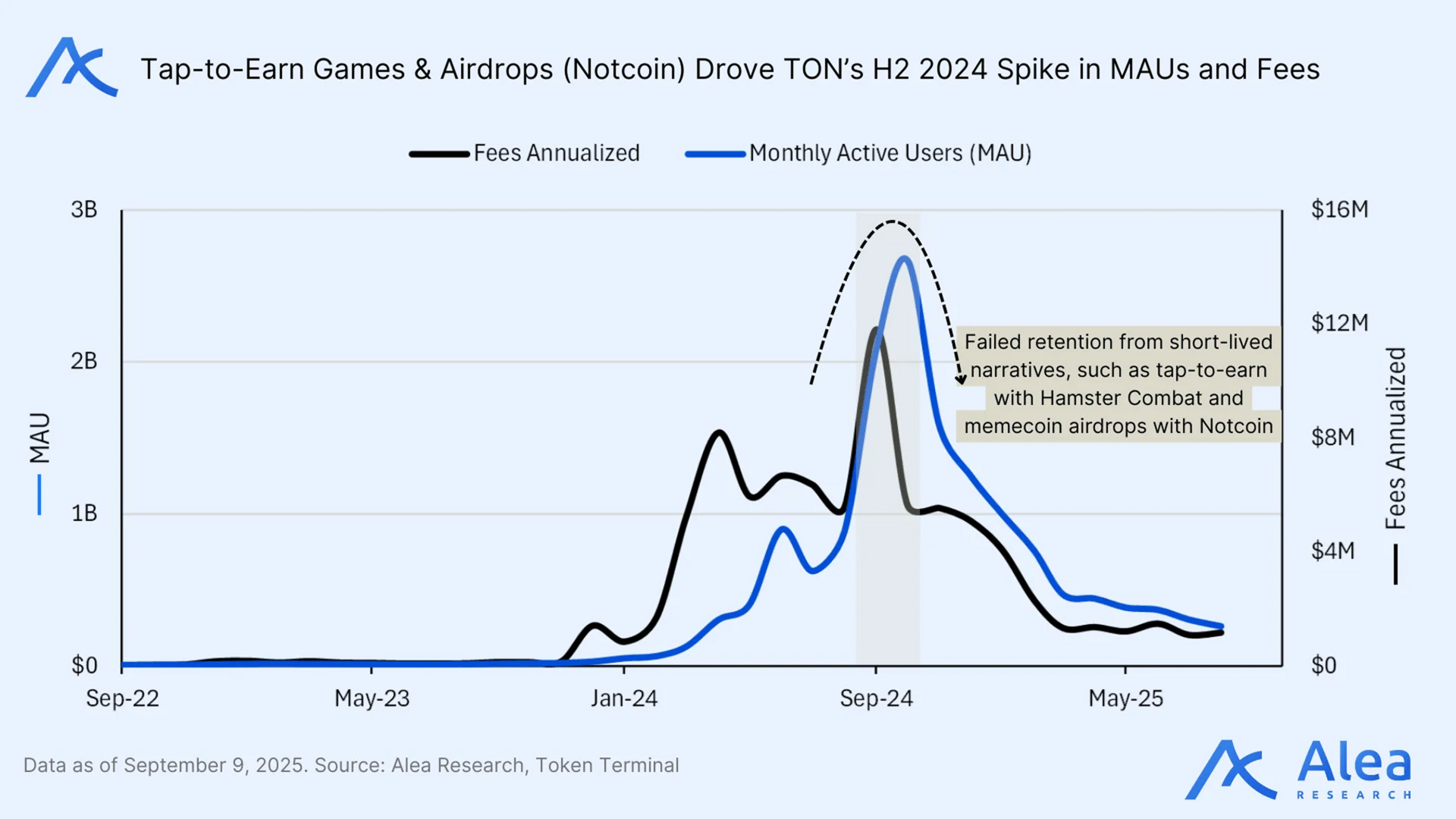

User activity and fees surged in late 2024 due to Notcoin and Hamster Combat campaigns, but the growth quickly declined after the incentives ended.

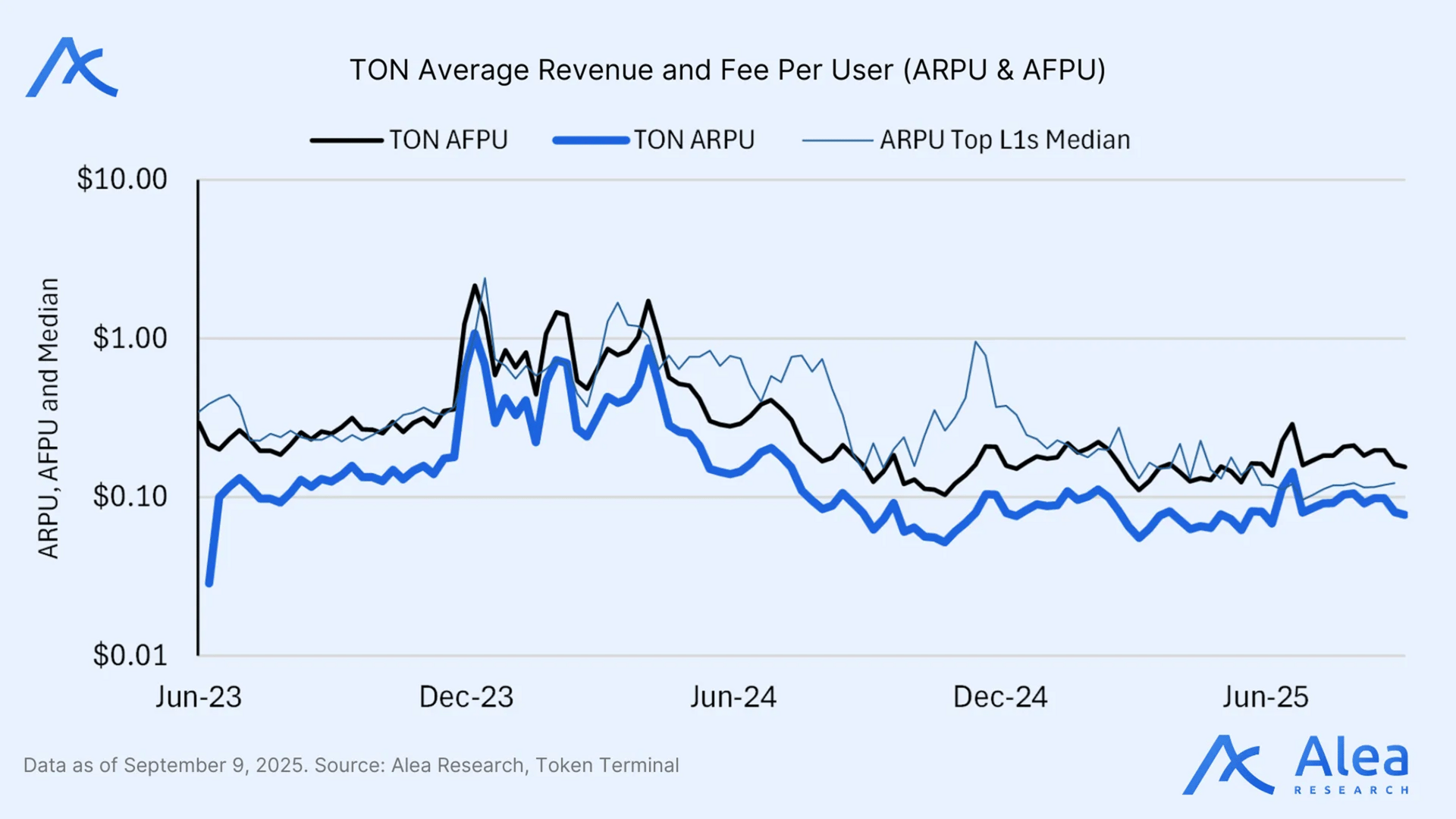

TON’s average revenue per user (ARPU) and average fee per user (AFPU) spiked in late 2023, but have since leveled off. TON’s ARPU is lower than L1 comps, reflecting modest monetization, despite a growing user base.

3. Standardized stablecoin metrics

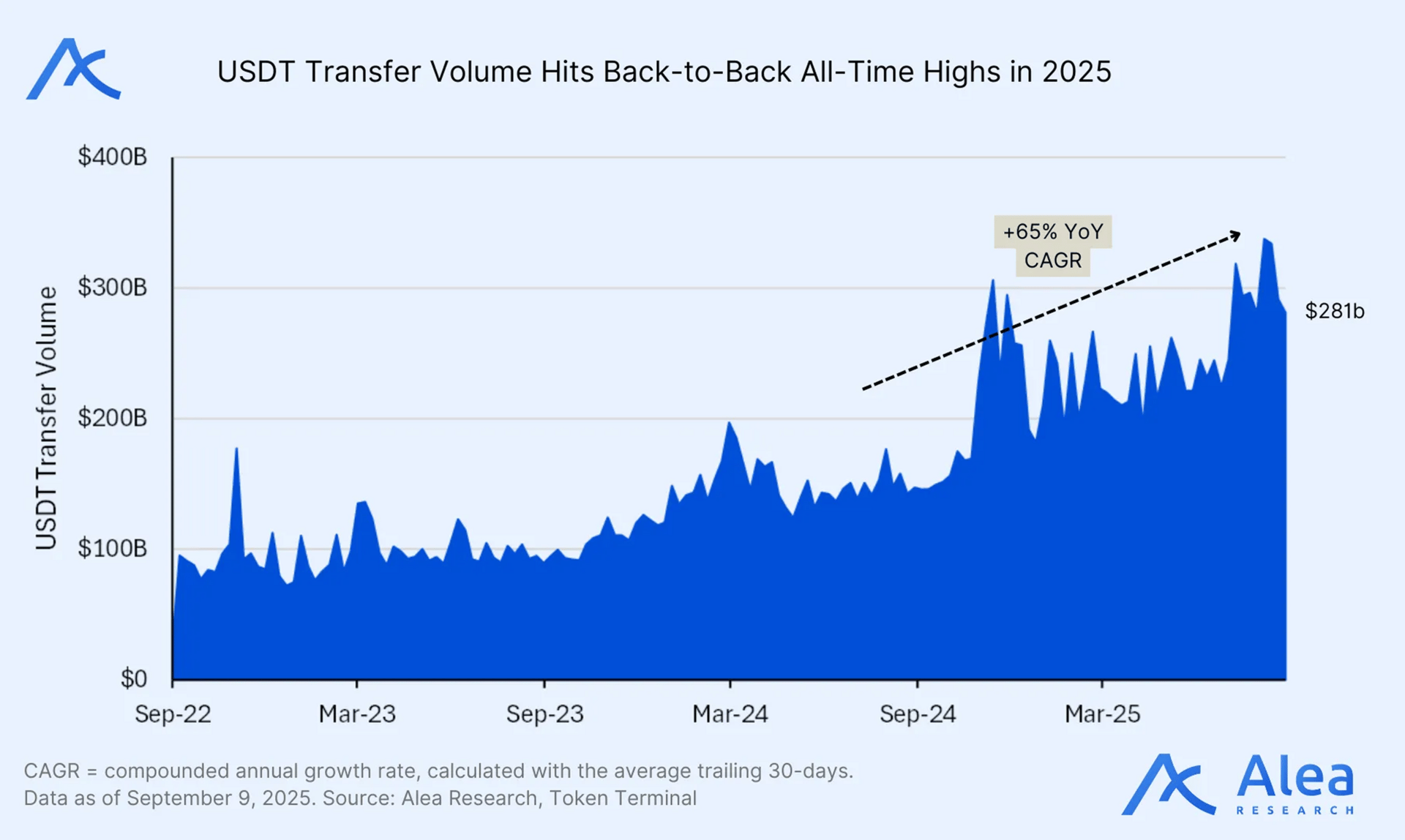

USDT transfer volume on TON hit record highs in 2025, reaching $281B with a 65% CAGR. Stablecoin transactions have become a central driver of economic activity on the chain.

4. Standardized project & ecosystem metrics

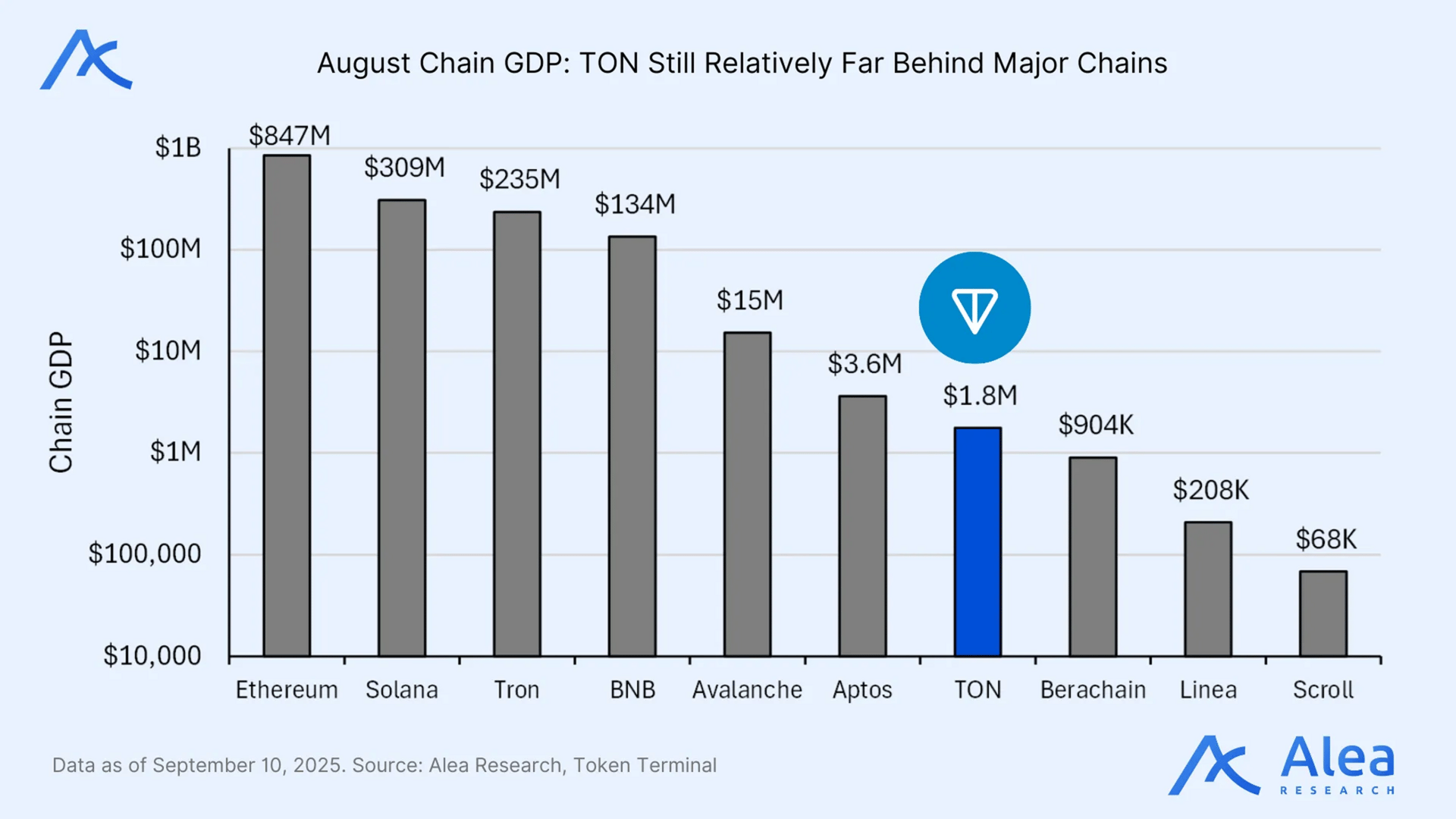

TON’s August chain GDP of $1.8M trails behind major L1s like Ethereum ($847M) and Solana ($309M). Despite strong distribution, TON’s onchain economic footprint is still small relative to its peers.

Stay tuned for more updates as we continue to build the foundation of a transparent and more data-driven crypto industry.