- Token Terminal

- Posts

- The silent winners of 2025: Paxos & Steakhouse Financial

The silent winners of 2025: Paxos & Steakhouse Financial

+ data & product updates

Each week in The Snapshot, we share data-driven insights, highlight new listings, and showcase our latest product updates.

Read on for the latest edition 👇

Vault curators emerge as a new DeFi business category

Vault curators have emerged as a distinct layer in DeFi, with Steakhouse Financial alone managing ~$1.8b in deposits on Morpho. Curators allocate capital across multiple lending markets, handling strategy design, and ongoing risk monitoring on behalf of depositors.

Vault curators emerged because Morpho's modular design enables strategies that traditional lending protocols cannot easily support. Protocols like Aave set supply caps and market parameters through governance. Morpho allows curators to build tailored multi-market strategies and, through active management, potentially capture demand that governance-constrained protocols leave unmet.

Vault curation is becoming a meaningful DeFi business category. Steakhouse's ~$1.8b in deposits exceeds the ecosystem TVL of major chains like Aptos (~$1.7b). At a 10% performance fee on an assumed 5% average yield, that deposit base would imply roughly $9m in annual revenue for the curator, which reportedly employs less than 20 people.

Paxos: the infrastructure behind PYUSD and USDG

The total market cap of assets issued by Paxos has grown from ~$1b to ~$6.7b since January 2025. Paxos is the regulated issuer behind PayPal's PYUSD, the Global Dollar Network's USDG, and the tokenized gold product PAXG. While partners like PayPal handle distribution, Paxos provides issuance infrastructure and regulatory compliance.

Paxos has positioned itself as the trusted backend for partners who want stablecoin products without building blockchain infrastructure. PayPal and the Global Dollar Network consortium (Kraken, Robinhood, Galaxy Digital, etc.) chose Paxos because of its regulatory credentials, including an OCC national trust charter in the U.S., MAS license in Singapore, and MiCA compliance in Europe.

However, Paxos' infrastructure-first model means limited economics at the issuer level. Both USDG and PYUSD pass on a majority of the reserve yield to their users. As a result, Paxos earns a smaller percentage of the reserve yield, but is better positioned to scale through enterprise partnerships, where the customers have more control over the economics.

Solana's stablecoin landscape is diversifying

Non-USDC/USDT stablecoins now account for ~20% of Solana's total stablecoin supply, up from ~3% a year ago. Beyond USDC, Solana now hosts PYUSD, USDG, USD1, EURC, FDUSD, and over a dozen other deployments, including non-dollar stablecoins like the Swiss franc (VCHF) and Euro (EURC).

Solana-native applications are also launching their own stablecoins. Phantom (the leading Solana wallet) launched CASH; Jupiter launched jupUSD. This signals that Solana's app ecosystem is mature enough for native teams to expand their offerings to multiple financial products.

For Solana, this diversification reduces concentration risk and signals issuer confidence. A year ago, a regulatory issue affecting Circle (USDC issuer) would have threatened Solana's entire stablecoin base. Today, a diversified issuer set makes the network more resilient, and the fact that new issuers are choosing Solana is a vote of confidence in the ecosystem.

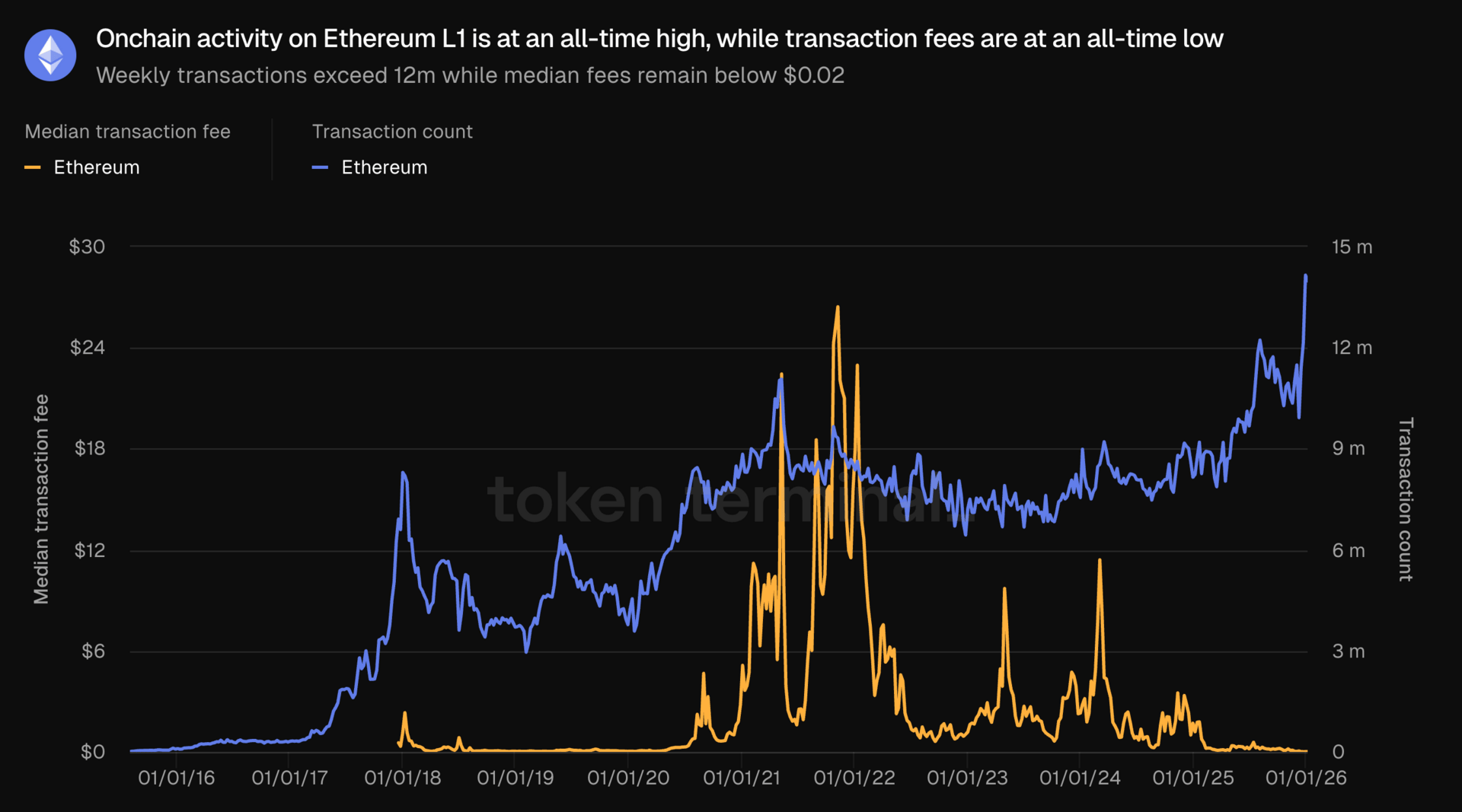

Ethereum L1 hits record transactions at record-low fees

Ethereum L1 transaction counts have reached all-time highs, while median transaction fees remain near all-time lows. Weekly transactions recently surpassed 12m, with median transaction fees below $0.02 - a stark contrast to 2021-2022 when fees regularly exceeded $20.

Ethereum’s recent scaling upgrades have materially reduced L1 fee pressure, restoring mainnet usability at scale. The introduction of blobspace via EIP-4844, alongside continued rollup adoption, has shifted the most price-sensitive activity off L1. This has reduced congestion on mainnet, allowing transaction volumes to reach new highs without the fee spikes that historically constrained L1 usage.

More predictable and consistently low L1 fees are making Ethereum mainnet attractive again for application builders. As the cost differential between L1 and L2 execution narrows, teams that benefit from Ethereum’s native liquidity, composability, and security are reassessing mainnet deployment. This dynamic is beginning to show up in builder behavior, including L2-native applications exploring or announcing expansions to Ethereum L1 as the economic trade-offs change.

Access the charts here.

Project updates:

+6 basic project listings: Rootstock, Aquarius, Soroswap.Finance, Blend, Neverland, and Quai Network.

Interested in getting listed? Read more here.

Asset updates:

Listed 143 new assets on the Tokenized assets page across 12 issuers, increasing coverage by 11%. Highlights include:

BENJI, Franklin Templeton's tokenized money market fund, now migrated to several chains, plus sgBENJI and gBENJI on Stellar.

FRNT, the first fiat-backed stablecoin issued by a U.S. public entity (Wyoming Stable Token Commission).

syrupUSDT and syrupUSDC, yield-bearing stablecoins from Maple.

iUSD, a stablecoin from InfiniFi.

jupUSD, a stablecoin from Jupiter.

CASH, a stablecoin from Phantom.

Platform improvements:

Recent updates to Studio:

Added bulk actions for managing hundreds of charts or dashboards at once.

For example, users can now select several saved dashboards in Studio’s list view and delete them with a single click.

Search now includes dashboard and chart descriptions.

For example, users can now find a specific chart by searching for the description under its title.

Added grouping by market sector and chain together for more granular analysis.

For example, users can now select the “Stablecoin issuers” market sector and “Ethereum” chain filters to analyze stablecoins on Ethereum.

Get started with Studio here.

Token Terminal x Nansen

Token Terminal's onchain data is now integrated into Nansen, including Nansen AI, an agentic app that allows investors to trade and manage portfolios using real-time onchain insights.

Through this partnership, Token Terminal provides standardized, institutional-grade metrics like application revenue and earnings to power Nansen's analytics and AI-driven workflows. This enables Nansen users to identify which applications have real, paying customers and how activity trends over time.

“Reliable onchain data is critical for turning activity on permissionless blockchains into actionable intelligence. Token Terminal’s standardized methodology and rigorous data curation allow us to integrate onchain fundamentals directly into Nansen’s AI-powered analytics workflows. Their transparent methodologies and audit trails ensure that insights generated on our platform are both trustworthy and comparable across protocols.”

This partnership underscores a broader trend: leading AI-powered analytics platforms are increasingly relying on Token Terminal as a specialized data vendor for reliable, standardized onchain financial metrics.

Read the full announcement here.

Check out Token Terminal for data-driven market insights.

Want API access? Schedule a demo or explore our documentation.