- Token Terminal

- Posts

- The issuers & chains that are actually winning in RWAs

The issuers & chains that are actually winning in RWAs

+ data & product updates

Each week in The Snapshot, we share data-driven insights, highlight new listings, and showcase our latest product updates.

Read on for the latest edition 👇

Tokenized assets or RWAs are already a $300b+ asset class

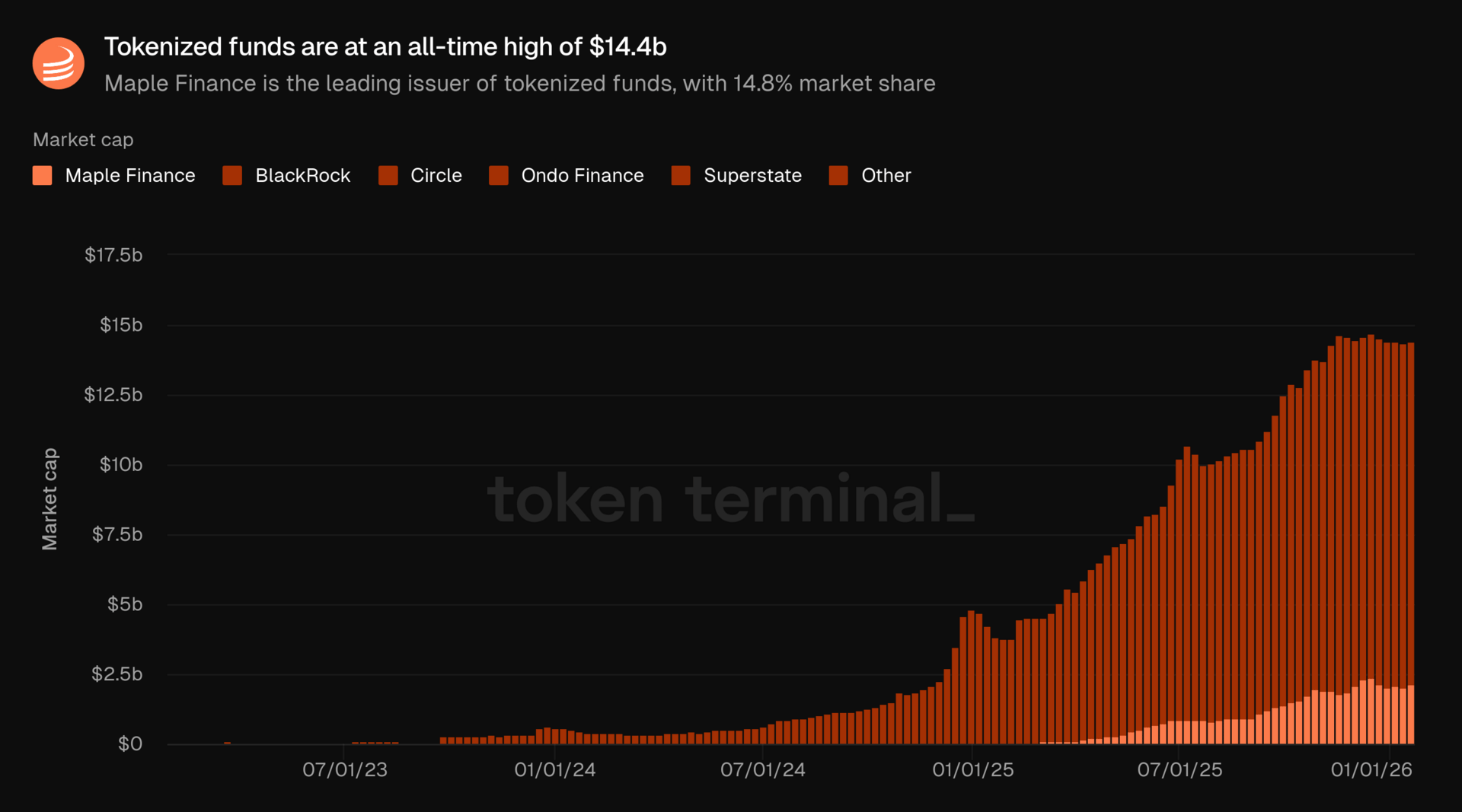

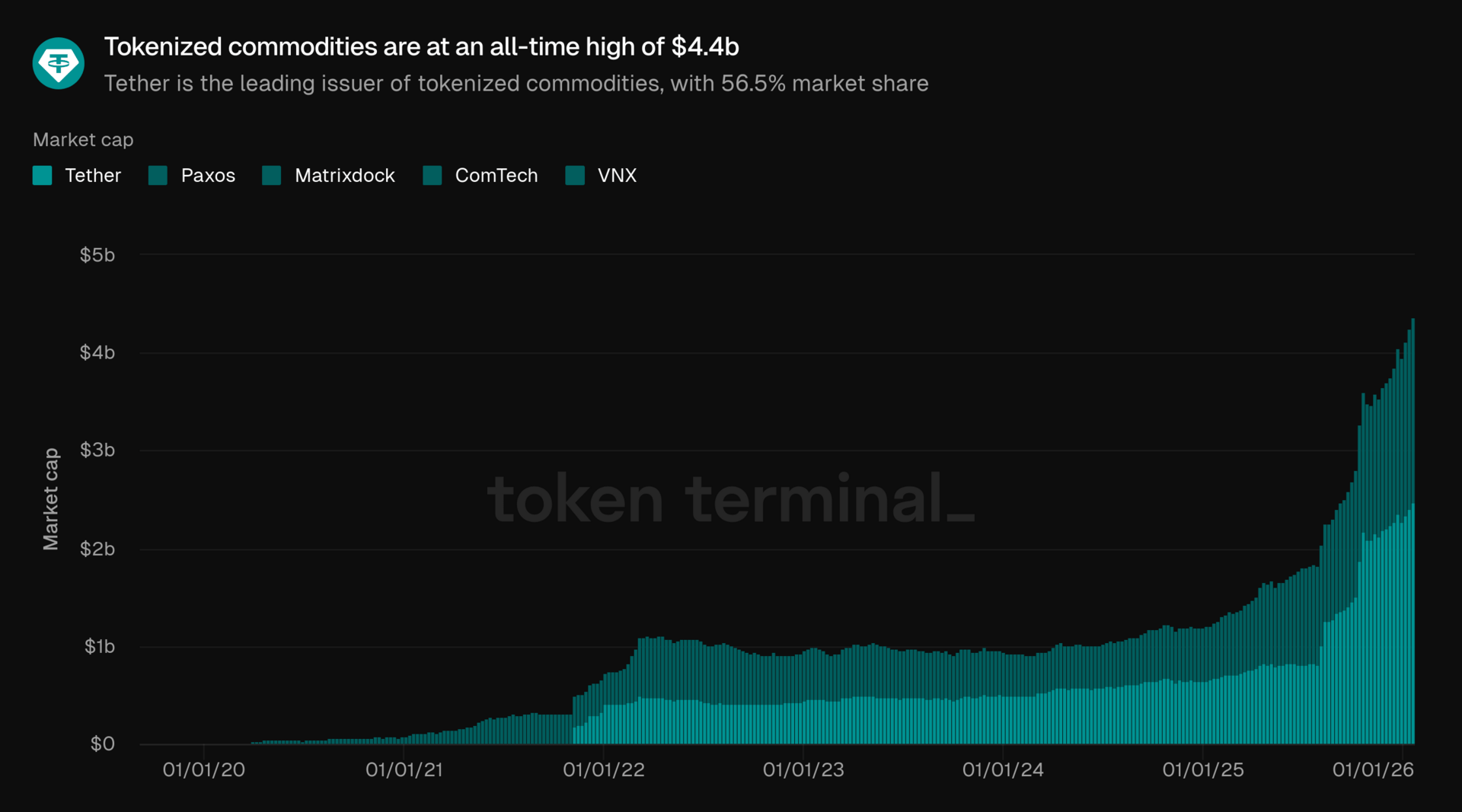

Tokenized assets have crossed $326.5b in combined market cap across four categories. Tokenized assets are traditional financial instruments (fiat currencies, fund shares, commodities, stocks) that settle on public blockchains rather than legacy infrastructure. Stablecoins represent 94% of the total at $307.2b. Funds ($14.4b), commodities ($4.4b), and stocks ($441.2m) make up the rest, with each category seeing record growth in 2025.

Traditional finance is moving onchain in waves. Stablecoins scaled first, reaching $307.2b from sub $1b in 2019. Funds accelerated in late 2024 as entrants like BlackRock launched treasury products. Commodities surged alongside gold's rally above $4,800/oz. What worked for stablecoins is now repeating in funds, commodities, and stocks.

The addressable markets are massive. Equities and funds each exceed $100 trillion globally; gold and silver alone total nearly $40 trillion. Onchain penetration remains around 0.1%. Even modest migration implies significant growth for the players enabling it. This newsletter examines the issuers and chains driving growth across each category.

Leading issuers: Tether, Maple Finance, & Ondo Finance

Tether has added over $47b in stablecoin supply since January 2025, roughly matching the combined growth of all other issuers. USDT remains the dominant liquidity instrument for crypto, now representing over 60% of all stablecoins.

Maple Finance leads BlackRock in tokenized funds with 14.8% market share. Maple's syrupUSDC and syrupUSDT credit funds have grown to over $2.1b combined as demand for onchain yield products accelerates.

Tether Gold's market cap has more than tripled since January 2025, riding gold's rally to record highs above $4,800/oz. XAUT now holds 56.5% of the tokenized commodities market, offering 24/7 trading and DeFi composability for gold exposure.

Ondo Finance holds 54.4% of the tokenized stocks market since launching Ondo Global Markets in September 2025. Ondo GM offers 165+ tokenized stocks, including GOOGL, CRCL, TSLA, and NVDA.

Leading chains: Ethereum & Solana

Ethereum now hosts roughly $60b more in stablecoin supply than it did in January 2025, extending its lead as the dominant chain. Over $188b in stablecoins now settle on Ethereum L1, more than all other chains combined.

Ethereum hosts over half of all tokenized funds as institutions like BlackRock and Fidelity deploy their flagship products on the L1. Multichain expansion is underway, yet Ethereum remains the entry point for TradFi.

Ethereum hosts 98.7% of all tokenized commodities, the highest single-chain concentration across any tokenized asset category. Nearly all tokenized gold settles on Ethereum, led by XAUT ($2.5b) and PAXG ($1.9b).

Solana leads Ethereum in tokenized stocks, capturing 38.8% of the fastest-growing tokenized asset category of 2025. Solana was reportedly selected for Backed Finance's xStocks due to its high performance, low latency, and thriving ecosystem, enabling 24/7 equity trading.

Access the charts here.

Project updates:

2 basic project listings:

TermMax, a fixed-rate lending protocol on Ethereum and Arbitrum that uses an AMM model to offer borrowing and lending at fixed rates with set maturity dates.

Zama, an open-source cryptography company building fully homomorphic encryption (FHE) infrastructure for blockchains, enabling computation on encrypted data.

Interested in getting listed? Read more here.

Asset updates:

Listed 60+ new assets on the Tokenized assets page. Highlights include:

Backed Finance: 50+ tokenized stocks (xStock products) covering equities like AMD and the Russell 2000 index.

Hastra: PRIME, a tokenized fund on Solana that provides access to yields from tokenized home equity credit products.

Quarterly reports:

Q4 2025 reports are now live for:

Each report provides data-driven analysis of project performance, growth drivers, and strategic outlook, featuring commentary directly from the project teams. As our fundamental data is already integrated into Binance, the natural next step was to turn those metrics into regular, quarterly tokenholder reports.

These reports are part of a broader effort to raise the bar for ongoing quarterly reporting in crypto, bringing it closer to TradFi standards. More Q4 reports will be published over the coming weeks.

Search for "Q4 2025 Report" on Discover to access them.

Tokenized assets on Token Terminal

Tokenized assets on Token Terminal launched in November with 300 assets covered. Since then, coverage has expanded to 1,333 assets, one of the most comprehensive RWA datasets in the industry.

The page features three main sections:

Overview: Track key metrics with multi-year time series charts grouped by asset, issuer, market sector, or chain.

Leaderboards: Identify which assets, issuers, and chains are growing fastest.

Data table: Screen all RWAs in one place, with advanced filtering by asset, issuer, reference asset, market sector, and chain.

If you're an RWA issuer and your product isn't yet listed on Token Terminal, get in touch. We're actively expanding coverage to ensure comprehensive and accurate representation of this rapidly growing market sector.

Access the full dataset here.

Check out Token Terminal for data-driven market insights.

Want API access? Schedule a demo or explore our documentation.