- Token Terminal

- Posts

- Stablecoins: America’s most GENIUS export yet?

Stablecoins: America’s most GENIUS export yet?

+ data & product updates

Each week in The Snapshot, we share data-driven insights, highlight new listings, and showcase our latest product updates.

Read on for the latest edition 👇

Why stablecoins will become a matter of national economic interest (for 🇺🇸 & 🇪🇺)

Stablecoin growth is real. Stablecoins like USDC make the dollar accessible over the internet. The opportunity to expand the reach and dominance of the USD through stablecoins has not gone unnoticed by the current U.S. administration. The U.S. admin seems to have a clear strategy for how to approach stablecoins, issuers, and public blockchains. How will the EU respond?

Let's dive in!

🇺🇸 Tap into durable stablecoin growth

Stablecoins behave like a durable product: supply and usage grow through cycles.

The U.S. treats that durability as a strategic signal that gives them comfort to double down on stablecoins.

The core question is how to leverage stablecoins to improve USD reach and dominance globally.

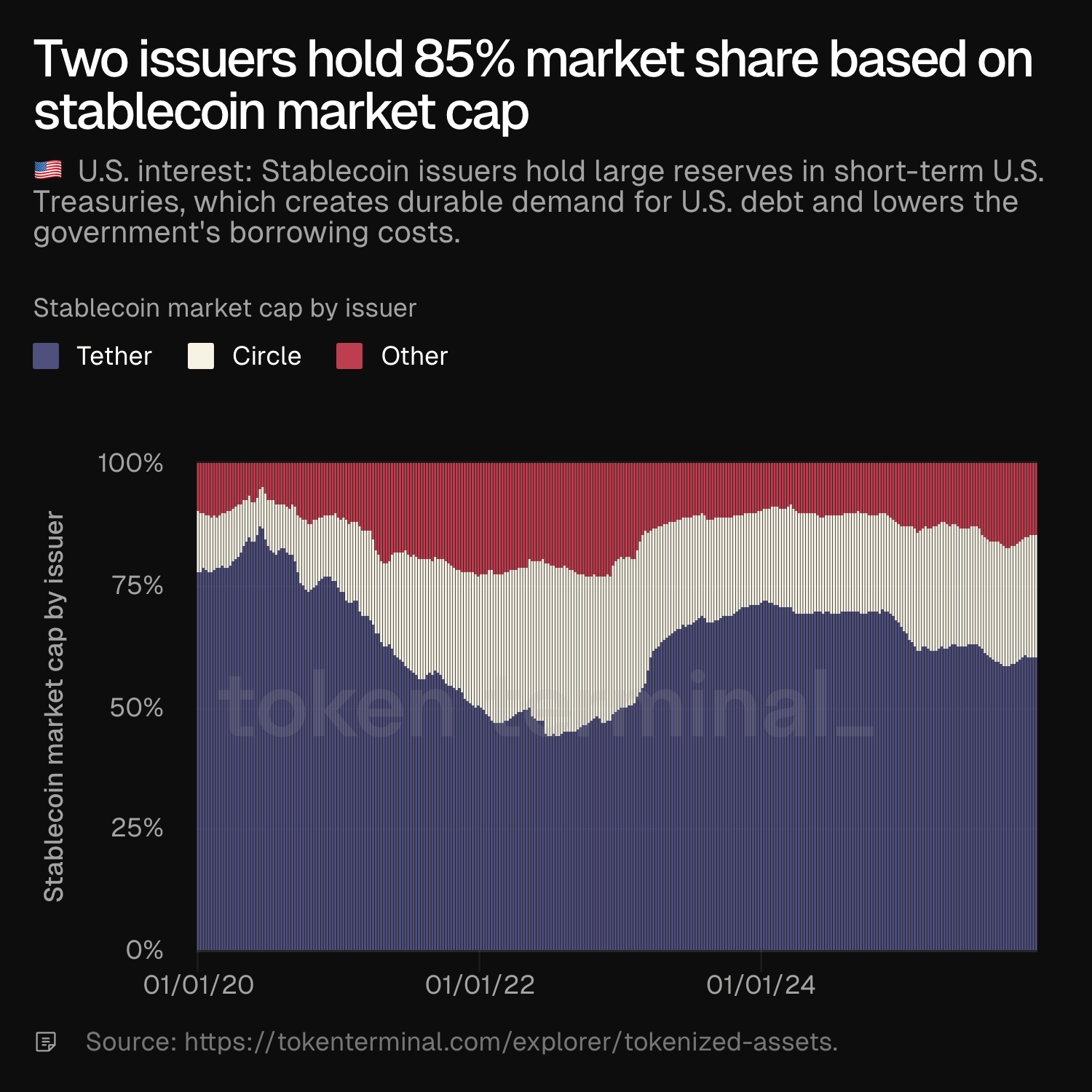

🇺🇸 Control the issuers

Issuers are the choke point: they decide who can mint/redeem at scale and where the dollars flow.

The U.S. goal is to regulate and steer issuers so that USD stablecoins deepen dollar usage globally, especially in emerging markets.

The reserve requirements in the GENIUS Act push compliant issuers into Treasuries, which creates incremental T-bill demand and lowers U.S. borrowing costs at the margin.

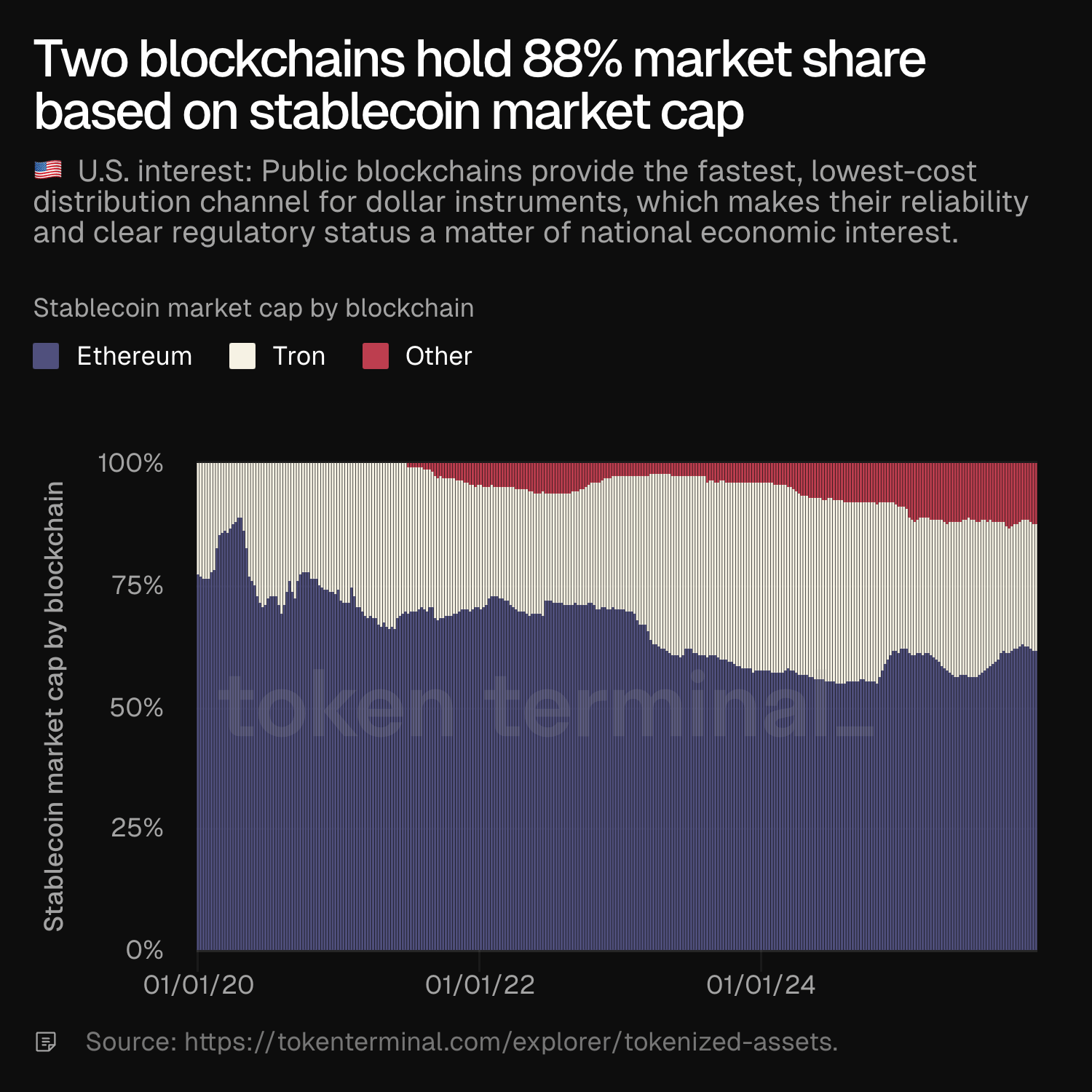

🇺🇸 Promote public blockchains

Public blockchains are the rails: they determine settlement cost, speed, and access.

Concentration on a few networks creates strategic risk, so the U.S. incentive is to maximize competition and investment at the blockchain layer.

The main lever is regulatory clarity that unlocks innovation and makes public blockchains the best distribution channel for USD stablecoins worldwide.

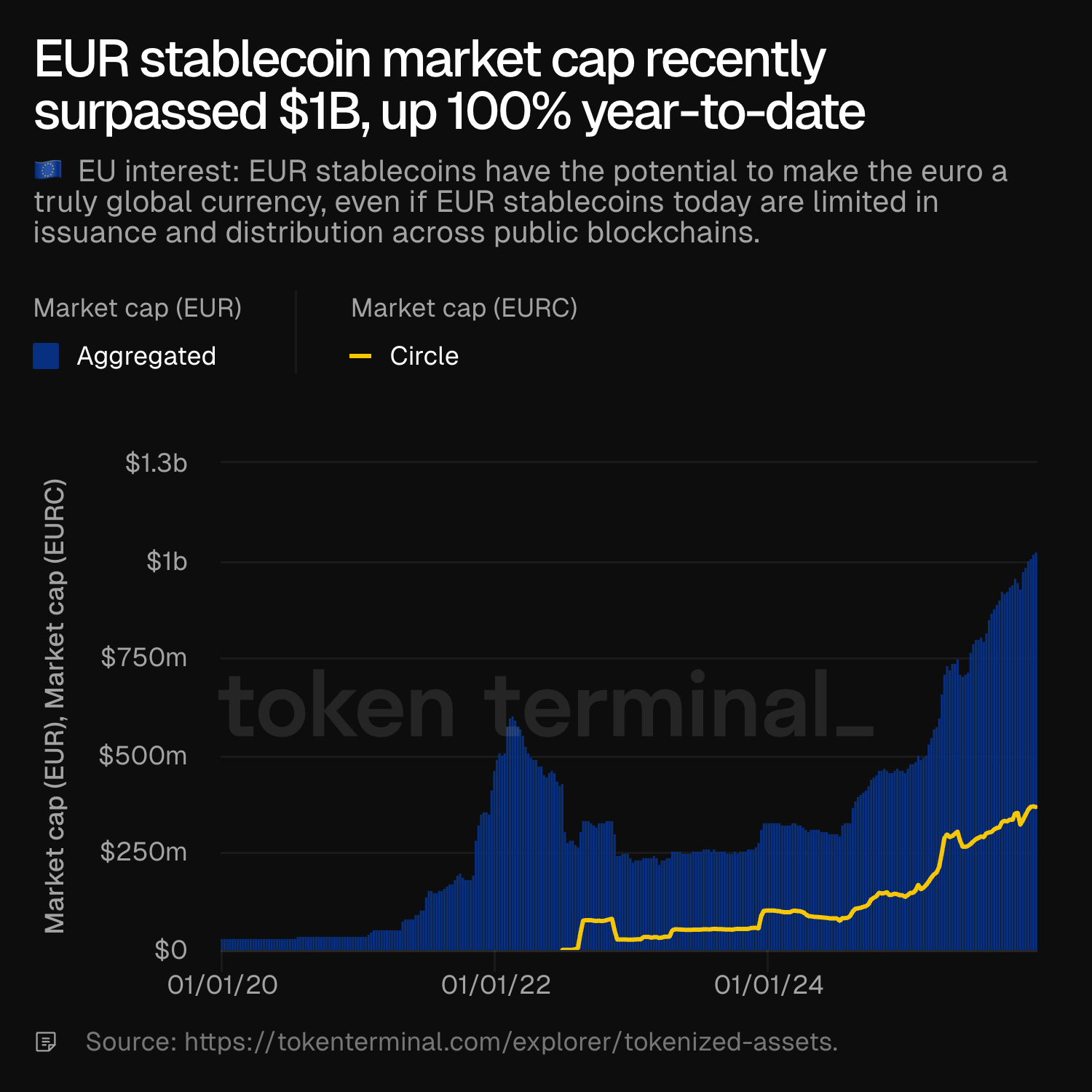

🇪🇺 Replicate the USD playbook for EUR

The EU sees the U.S. stablecoin strategy as a template for how to distribute a currency digitally.

The strategic question is how to enable EUR stablecoins to scale fast enough to compete with entrenched USD stablecoins.

That requires the EU to take a pro-stablecoin stance, with clear rules for issuers, who in the end are those that can ensure that euro-denominated stablecoins remain competitive globally.

Access the charts here.

Project updates:

Listed Flow, an L1 using Cadence, its own programming language inspired by Swift and Rust. Cadence is designed for secure, scalable smart contract development with built-in protections against common vulnerabilities.

Asset updates:

Interested in getting listed? Read more here.

Metric updates:

Added BOB support for Euler. BOB is a hybrid Bitcoin L2 that enables EVM-compatible smart contracts.

Users can now access granular data on Euler's BOB deployment, including TVL, active loans, and more.

Platform improvements:

Blockchains: Added product-level ecosystem views, enabling analysis of ecosystem metrics for multi-product blockchains.

For example, users can get an overview of the HyperEVM ecosystem (a product of Hyperliquid).

Tokenized assets: Added market sector filters to the Tokenized assets page, enabling segmentation across stablecoins, tokenized commodities, funds, and stocks.

For example, users can filter for tokenized stocks to only view assets like GOOGL.d.

Token Terminal x Google

Token Terminal has partnered with Google to ship major upgrades to Solana's public dataset on BigQuery. Core tables now use daily partitions instead of monthly, reducing single-day query costs from $100+ to roughly $4. We also added clustering to high-volume tables, bringing app-focused queries down to about $0.02 per run.

Alongside the cost improvements, we've deployed decoded public datasets for pump.fun, Jito, Raydium, Orca, Marinade, and Jupiter on the Google Cloud Marketplace. These datasets let analysts query common instructions (swaps, deposits, claims) directly without building decoding infrastructure.

Solana is the first chain in a broader effort to make high-quality, publicly queryable blockchain data more accessible on Google Cloud. We plan to extend this work to additional networks over time.

Read the full announcement here.

Check out Token Terminal for data-driven market insights.

Want API access? Schedule a demo or explore our documentation.