- Token Terminal

- Posts

- https://tokenterminal.com/resources/weekly-fundamentals/ten-things-investors-need-to-know-about-BTC-ETH

https://tokenterminal.com/resources/weekly-fundamentals/ten-things-investors-need-to-know-about-BTC-ETH

Introduction

This week’s newsletter covers Bitcoin and Ethereum, the two most valuable cryptoassets that together represent close to 70% of the total market capitalization of crypto. We explain how these assets have become so valuable, review their usage figures and onchain financials, and talk about how investors might want to approach BTC & ETH from a financial modeling perspective.

Let’s dive in!

1. Structurally superior businesses tend to expand their addressable markets & valuations over time

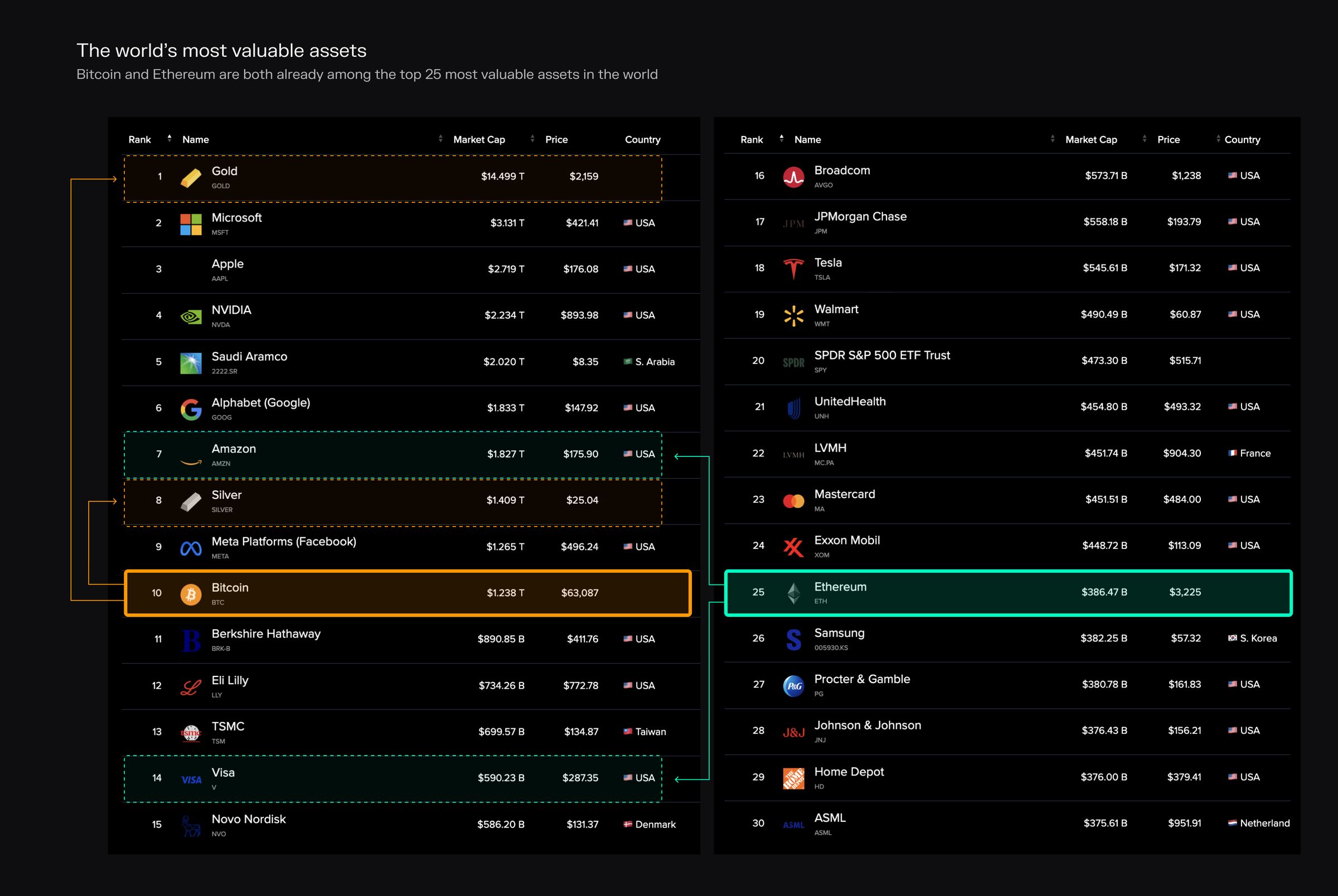

Bitcoin and Ethereum are both already among the top 25 most valuable assets in the world.

Uber started off as a drop-in replacement for taxis in San Francisco. Over time, as the Uber network grew, it became apparent that it could replace car rentals and redefine transportation & the need for cars in general. Today, Uber handles long-haul freight, with more expansionary business lines to come (self-driving cars, ML/AI labeling work, etc.). If you could map out these market expansions, it’s likely you would’ve pursued Uber as an investment in its early days.

Bitcoin started off as a payment network on the outskirts of the Internet. Over time, as the Bitcoin network grew, it became apparent that it could replace physical gold as a store of value ‘investment’. Today, we hear investors talking about BTC replacing parts of their stock and real estate portfolios.

Ethereum started off as an application platform for open source developers. Over time, as the Ethereum network grew, it became apparent that it could host increasingly more powerful and valuable applications on its platform, analogous to how cloud computing service providers grew their customer base over time. Today, we hear investors talking about ETH growing into a global settlement network akin to Visa.

2. Power laws rule the open source & global crypto market

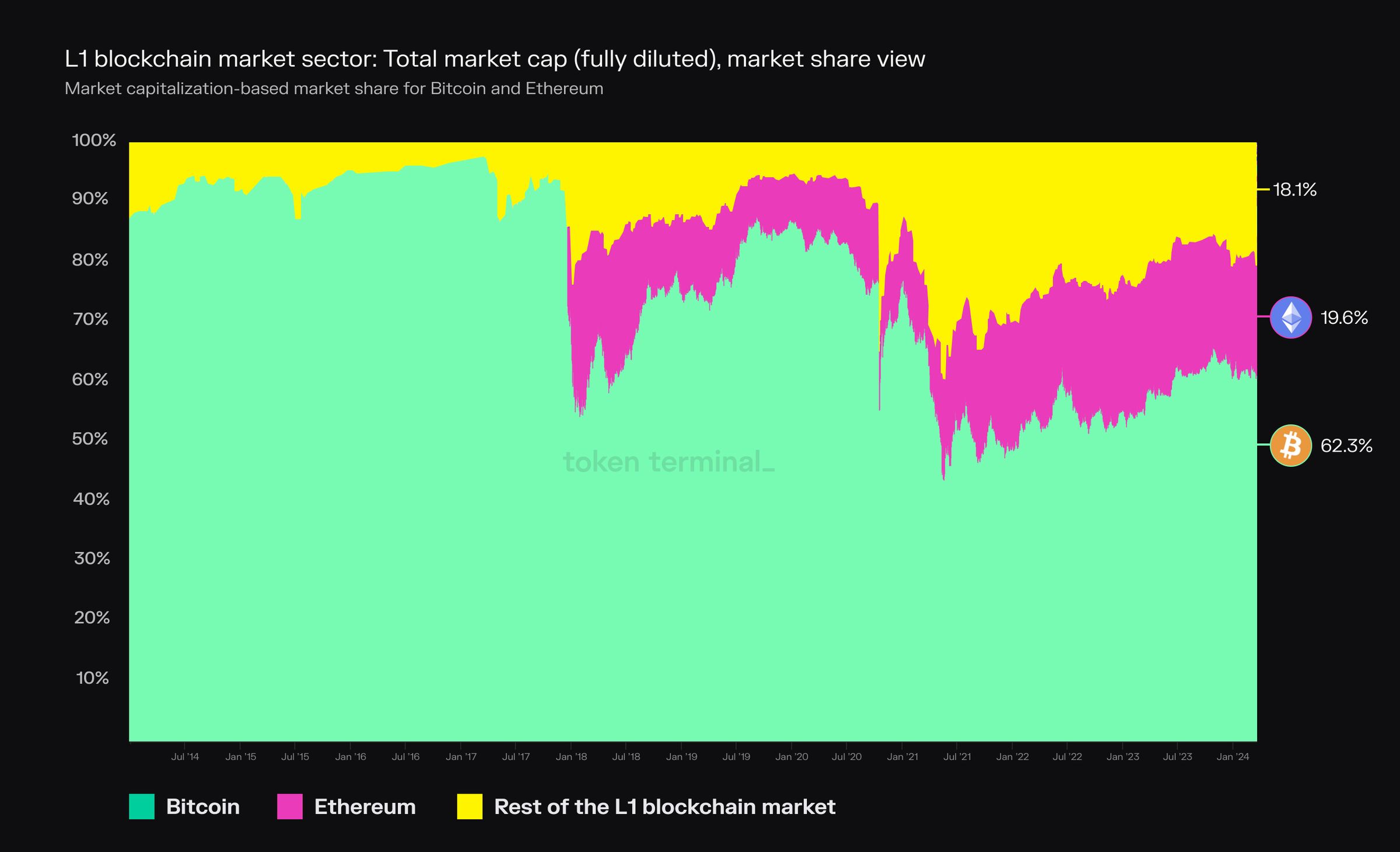

Market capitalization-based market share for Bitcoin and Ethereum.

The crypto market grew from $0 to a few trillion in ten years. At the time of writing, the aggregate market cap for crypto sits at $2.5T, across 2.4M different cryptoassets. Assuming that the current growth trajectory for crypto continues, it’s likely that we’ll see a global and interoperable capital markets union get built from the ground up before existing institutions get to implement theirs.

To date, the primary use cases for crypto have been (i) investment in a new monetary/store of value asset (BTC), and (ii) the development of permissionless open source applications (ETH). The currently leading cryptoassets within these categories, BTC & ETH, represent close to 70% of the total crypto market capitalization. However, the pace at which new competing projects are launched is rapidly increasing, evident from the 2.4M cryptoassets figure.

The investor appeal in crypto stems from the permissionless & global nature of blockchains. The winning projects in crypto have the potential to outgrow their Web2/TradFi counterparts or competitors because of the global network effect that a permissionless marketplace model can offer.

3. The relative dominance of BTC & ETH will inevitably fade over time

Market capitalization-based market share for Bitcoin and Ethereum.

The crypto market was “BTC-only” for a long time. It’s only natural that the relative market shares of both BTC & ETH continue to go down over time, as blockchains emerge as the commonplace infrastructure for global finance and commerce.

“As markets grow, the unit for which you can create a viable business shrinks.” Even if the relative market shares go down for both networks, it doesn’t mean that BTC & ETH couldn’t still have significant growth ahead of them. The market cap of gold has come up significantly from its early days, even if gold today represents only a small fraction of the global commodity, stock, art, and real estate markets.

Crypto wealth & signal is still mostly tied to BTC & ETH. Understanding when and how the large holders of BTC & ETH start to diversify their portfolios into “alternative coins” (aka tokens listed on Token Terminal), can give investors an edge in finding the next breakout cryptoasset.

4. The monthly usage activity on both Bitcoin and Ethereum has been “up only”

Monthly active users (unique addresses) for Bitcoin and Ethereum.

Despite the price volatility, the long-term usage trend for both Bitcoin and Ethereum has been trending up. Today, the Bitcoin network hosts 12M monthly active users (unique addresses), whereas Ethereum hosts 7M. It’s worth highlighting that in both cases, the number of unique real-world entities or users is likely to be smaller than the above figures, since individual organizations and consumers can control multiple addresses on these networks.

Bitcoin’s active address figures might be even more ‘overstated’ than Ethereum’s. The Bitcoin data structure (UTXO) differs from the Ethereum data structure (account model), which might inflate Bitcoin’s usage numbers on a relative basis. The reason is that one single entity naturally tends to operate multiple addresses on the Bitcoin network through change addresses (this same issue is only partially present on Ethereum).

For both Bitcoin and Ethereum, accounting for the usage activity on their adjacent ‘L2 networks’ becomes increasingly important. L2 blockchains built on Ethereum collectively host over 12M MAUs already. Similarly, the L2 (or sidechain, depending on how technically accurate one wants to be) ecosystem on Bitcoin is also experiencing rapid growth, even if most Bitcoin L2s are still in the early stages of their development. Our ‘economic’ definition of an L2: an adjacent blockchain that shares a % of its (transaction fee) revenue with an underlying host blockchain.

5. Both Bitcoin and Ethereum can be valued through fee-based multiples

All-time transaction fees paid on Bitcoin and Ethereum.

Price to Fees (P/F) valuation multiples for Bitcoin and Ethereum.

All users of Bitcoin and Ethereum pay transaction fees when interacting on the network. These payments generate a revenue stream (Fees) that can be used to derive valuation multiples for both networks.

Different use cases, different usage levels. To date, Bitcoin has generated $3.6B in transaction fees, all paid to miners on the network. To date, Ethereum has generated $18.4B in transaction fees, and only a small portion has been paid out to validators on the network, while the majority of the fees have been burned to the economic benefit of all existing ETH holders.

The Price to Fees (P/F) ratio compares the (fully diluted/circulating) market cap to annualized transaction fees. A high multiple indicates that the network is extremely valuable, even in the absence of meaningful transaction fee payments. A high P/F ratio that sustains over a longer period of time might also signal that investors are comfortable assigning the network’s native asset some other premium (e.g. monetary/store of value status).

6. Ethereum generates revenue to both ETH holders & validators, whereas Bitcoin generates revenue only to miners

Onchain revenue for Bitcoin and Ethereum.

In the Bitcoin network, 100% of transaction fees go to the miners. This means that BTC holders do not earn any revenue from the network. It also means that Bitcoin cannot be modeled based on traditional revenue multiples.

On Ethereum, a significant portion (~80%) of each transaction fee is burned. This burn mechanism is conceptually similar to a company’s share buyback, as it decreases the outstanding supply of ETH to the economic benefit of existing ETH holders. This means that Ethereum can be modeled using traditional revenue multiples. At the time of writing, Ethereum generates ~$140M in transaction fee revenue per week.

7. Miners and validators need to get paid (enough)

Token incentive spend for Bitcoin and Ethereum.

A permissionless blockchain cannot operate securely without economically incentivized miners and validators. The economic incentives ensure that both miners & validators are motivated to follow the rules of the blockchain they contribute to securing. A lack of meaningful economic incentives could make them motivated to try to attack the network instead.

Miners and validators make money in 2 ways: transaction fees & token incentives. As stated earlier, each user that transacts on a blockchain needs to pay a transaction fee to get their transaction included in a block. Token incentives or rewards come in the form of new issuance of BTC & ETH to the miners & validators that contribute new blocks to respective blockchain.

In the absence of transaction fees, a network needs to compensate its miners or validators with token incentives. When it comes to transaction fees, Bitcoin is not as economically sustainable as Ethereum. This is also evident from its ~5x higher token incentive spend. In other words, Bitcoin uses token incentives (BTC issuance) to compensate miners for the, relatively speaking, low transaction fee revenue on the network.

8. Ethereum is among the few profitable cryptocurrencies in the world

Onchain earnings for Bitcoin and Ethereum.

What’s the definition of Earnings in this context? Earnings is defined as revenue - expenses. Revenue represents the % of transaction fees that accrues to the economic benefit of a blockchain’s tokenholders. Expenses include the token incentives paid out to miners or validators of the blockchain.

Why is Bitcoin unprofitable? As explained above, Bitcoin generates $0 revenue to BTC holders, but pays substantial token incentives to miners, which generates a (dilutive) cost to the other owners of the network (existing BTC holders). This dynamic results in the network being unprofitable.

Why is Ethereum profitable? Ethereum earns meaningful revenue from transaction fee burns, and after the transition to PoS, pays relatively low token incentives to validators. This dynamic results in the network being profitable.

9. Both Bitcoin and Ethereum have an unprecedentedly high ‘market capitalization per core contributor’ figure

Core developer headcount for Bitcoin and Ethereum.

Let’s start by breaking down the numbers for both:

Bitcoin: $1.2T / 16 = $75B market capitalization per core contributor.

Ethereum: $430B / 207 = $2.1B market capitalization per core contributor.

Core contributor data source: Unique GitHub users that on a monthly basis contribute to the repositories that are under the protocol’s main GitHub organization.

The above values are examples of the “developer leverage” that is available for blockchain builders. Bitcoin at a $1.2T market capitalization, and with little to no changes over the past 15 years, is a miraculous feat. Ethereum as a more dynamic system requires a bigger core development organization around it, which is still small compared to an equivalent Web2 or TradFi organization of similar market capitalization.

This developer leverage is unlikely to go away. It’s possible that we’ll see many other blockchain projects follow a similar path, with outsized value creation per core contributor. On the decentralized application side, Uniswap is one prominent example of how much impact a small developer team can have when building on top of a blockchain.

10. It’s possible to model Ethereum as a company, and with real-time financial & alternative data

Monthly income statement & core KPIs for Ethereum.

Let’s break down the above table section by section:

Income statement:

Fees: How much are users paying to use the network?

Supply-side fees: How much is paid to validators?

Revenue: How much of the fees are burned?

Token incentives: How much new ETH gets issued?

Earnings: What’s the difference between revenue (fees burned) vs. expenses (new ETH issued)?

Market data:

Price: What’s the unit price of ETH?

Circulating supply: What’s the outstanding supply of ETH?

Market cap: What’s the unit price * outstanding supply of ETH?

ETH trading volume: How much is ETH traded on exchanges (centralized & decentralized)?

Token turnover: How much is ETH traded relative to market cap?

ETH tokenholders: How many unique addresses hold ETH?

Valuation multiples:

P/F ratio: What’s the ratio between ETH’s market capitalization and annualized transaction fees?

P/S ratio: What’s the ratio between ETH’s market capitalization and annualized revenue (burned transaction fees)?

Alternative KPIs:

Active users: How many unique addresses pay transaction fees on Ethereum?

Core developers: How many unique GitHub users contribute to the core Ethereum protocol?

Code commits: To what extent do the core developers contribute new updates to the core protocol?