- Token Terminal

- Posts

- The Fundamentals of Tron

The Fundamentals of Tron

A data-driven look into Tron’s onchain financials & alternative KPIs.

In this article, we go through Tron’s onchain financials & alternative KPIs and see how they benchmark against the competition. Tron is a layer 1 blockchain network that was launched in 2017. Since its launch, Tron has become the most known for hosting the exponential growth of Tether’s USDT stablecoin, which has grown from $0 to $50B in outstanding supply since its launch in May 2019.

For the purpose of this article, we’ve chosen Arbitrum, Base, Solana, Avalanche, and BNB Chain, i.e. chains that also focus on facilitating cost-efficient payments, as the primary comparables for Tron.

Let’s jump in!

Market capitalizations

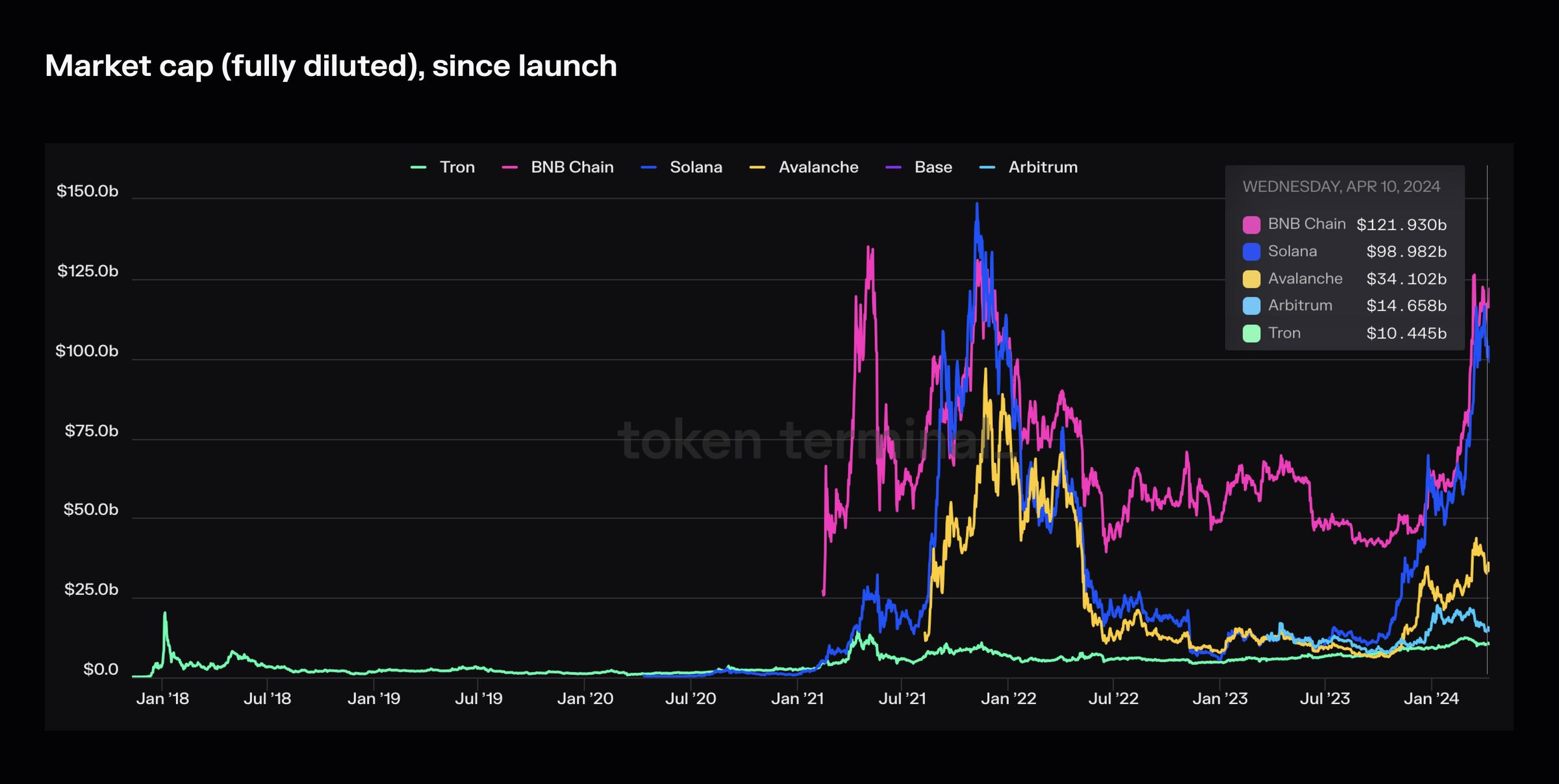

Market cap (fully diluted) since launch and past 30D.

Let’s start by looking at how the market currently values these projects. It’s possible to argue that an investor should always view all other metrics in relation to the valuation, which is why we start with that.

Market cap (fully diluted):

BNB Chain: $122B

Solana: $99B

Avalanche: $34B

Arbitrum: $15B

Tron: $10B

Base: N/A

Two networks are at the $100B valuation mark. Tron’s TRX is currently valued at ~10% of BNB and SOL. TRX is the lowest-valued network among its comparables. The valuation for Base is currently N/A, as Coinbase has not yet issued a native token for the L2. However, looking at BNB’s (also an ‘exchange token’) current market cap of $122B, it is possible that Coinbase is thinking about launching a token for Base later on.

Onchain financials

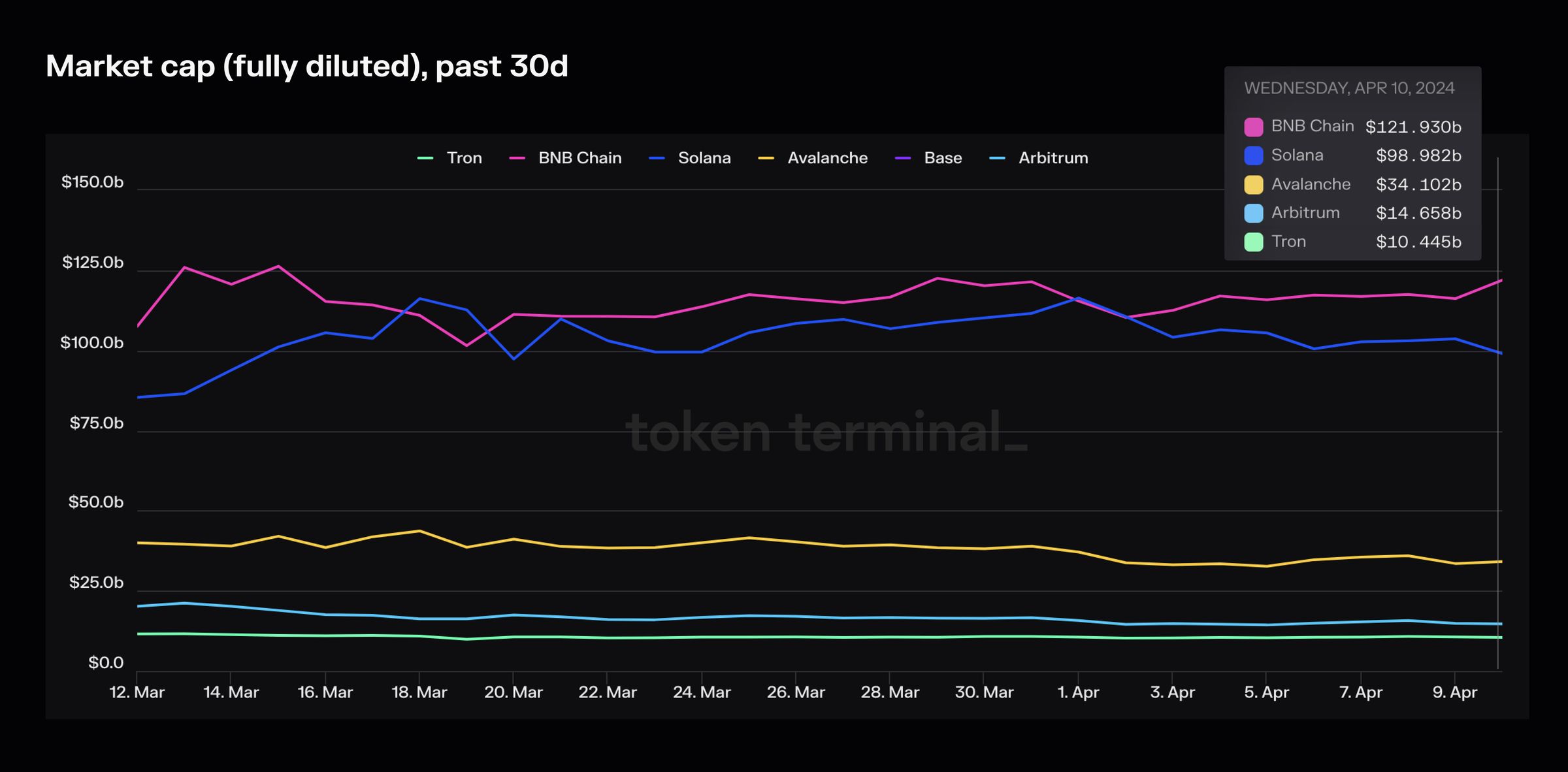

Daily transaction fees since launch and past 30D.

Now that we’ve established the values that the market assigns to these networks, let’s examine how much transaction fees they generate per day. The transaction fees indicate how much users are willing to pay to interact with the applications on each network.

Daily transaction fees:

Tron: $4.4M

Solana: $2.1M

BNB Chain: $774K

Base: $613K

Avalanche: $63K

Arbitrum: $38K

Tron generates the most transaction fees per day, by a meaningful margin. However, both Solana and Base have seen high growth rates in transaction fees over the past month. Avalanche and Arbitrum stand out as chains with extremely low fees compared to the others.

Valuation multiples

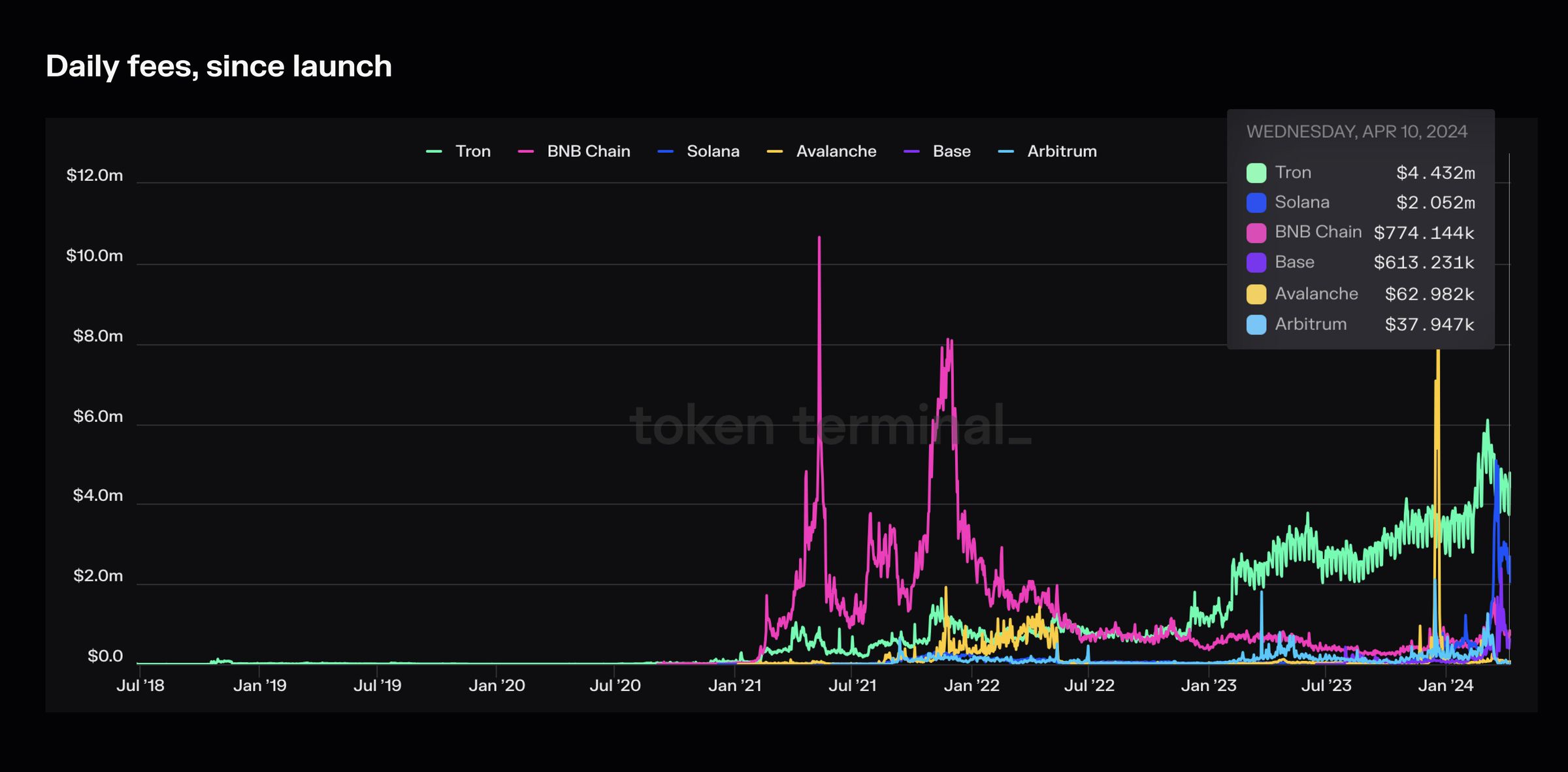

Price to fees (P/F) ratio (fully diluted) past 365D and past 30D.

The following metric can be derived from the fully diluted market and annualized transaction fees: price to fees (P/F) ratio. The P/F ratio tells us how the market values the chain relative to the usage it sees in the form of transaction fees – a low multiple might indicate that a network is undervalued and vice versa.

Price to fees (P/F) ratio (fully diluted):

Tron: 6x

Solana: 95x

Arbitrum: 356x

BNB Chain: 333x

Avalanche: 877x

Base: N/A

Tron is valued at ~6x its annualized transaction fees, whereas all other competitors have P/F multiples around or above 100x. Arbitrum, BNB Chain, and Avalanche stand out as the most ‘overvalued’ networks based on their P/F multiples.

Alternative KPIs

Active users (daily) since launch and past 30D.

As another indicator of usage, let’s look at the daily active users (unique sender addresses) metric for each network. This figure tells us how wide the user base of the chain is, i.e. whether the demand to transact comes from a concentrated or a diversified base of users.

Active users (daily):

Tron: 1.6M

BNB Chain: 1.2M

Solana: 949K

Base 359K

Arbitrum: 330K

Avalanche 55K

Tron has the highest daily active user count among its comparables, but is closely followed by both BNB Chain and Solana. Base and Arbitrum tie for 4th place, whereas Avalanche comes significantly behind all other comparables.

Core developers past 365D and past 30D.

Finally, let’s look at how many core developers each network has. This figure tells us how many engineers are needed to keep the network up and running. The headcounts below are calculated based on unique GitHub users that, within a rolling 30-day period, have made commits to repositories that reside under each network's primary GitHub organization.

Core developers:

Solana: 76

BNB Chain: 64

Avalanche: 43

Arbitrum: 37

Base: 32

Tron: 14

Tron seems to have the smallest core development team among its competitors, however no individual team stands out as outsized compared to others. These small core development teams illustrate the leverage that engineers have in crypto – a handful of people can build extremely valuable, global, and transparent networks.

Table of comparables.

Key takeaways

Tron represents ~10% of BNB’s and SOL’s market capitalizations.

Tron generates the most transaction fees per day among its competitors, ~2x more than Solana and ~7x more than BNB Chain.

Tron is valued at only ~6x its annualized transaction fees, whereas all of its competitors have a P/F multiple around or above 100x.

Tron has the highest daily active user count, albeit both BNB Chain and Solana come in as close 2nd and 3rd.

Tron has the smallest core development team among its peers, however no individual team stands out as ‘outsized’ compared to others.

Relevant links: