- Token Terminal

- Posts

- Does Ethereum have a stablecoin moat?

Does Ethereum have a stablecoin moat?

+ data & product updates

Each week in The Snapshot, we share data-driven insights, highlight new listings, and showcase our latest product updates.

Read on for the latest edition 👇

Ethereum’s edge in stablecoins & tokenized assets

Stablecoin issuers don’t choose where stablecoins are issued – users do. Issuers make money by serving those users, which means enabling minting on the chains where demand exists. As a result, issuer incentives naturally align with the success of the chains their customers prefer.

The same logic may extend to tokenized assets more broadly. This week, we examine whether Ethereum has built a structural advantage, or if its lead could shift as alternatives mature.

Stablecoin users continue to choose Ethereum

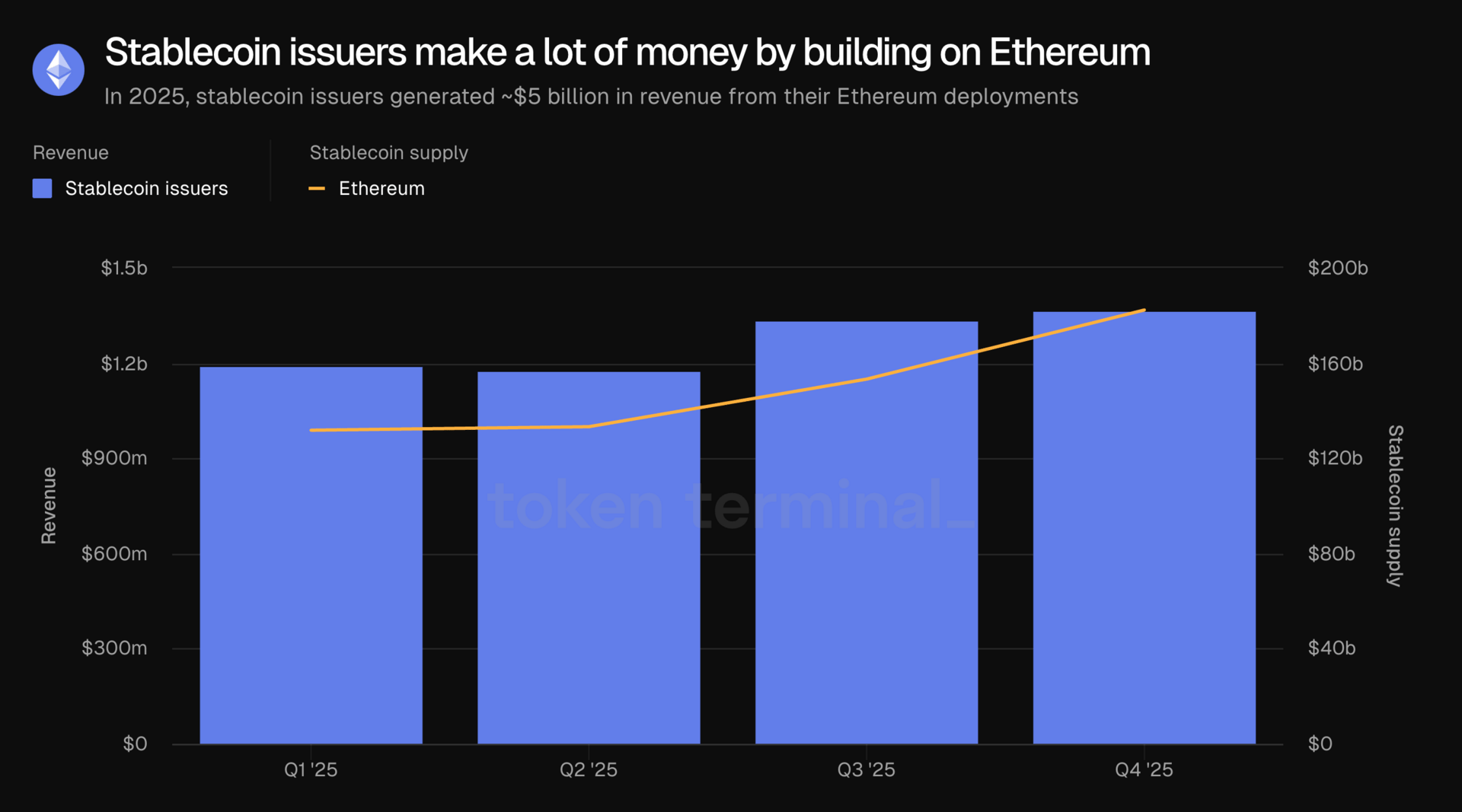

Stablecoin issuers made ~$5 billion in revenue from their Ethereum-based stablecoins in 2025.

Ethereum added ~$50 billion in new stablecoin supply over the past year. That is, customers that deposited USD with issuers chose to mint most of their stablecoins on Ethereum.

A stablecoin issuer generates revenue primarily from the yield it earns on the collateral assets. The revenue assigned to Ethereum is based on a pro rata calculation. E.g. if 70% of an issuer's stablecoin supply is on Ethereum, then 70% of its revenue is assigned to the Ethereum deployment.

Ethereum’s liquid DeFi ecosystem attracts stablecoin users

A quick look at Circle, the 2nd largest stablecoin issuer, reveals that ~70% of its stablecoin supply lives on Ethereum.

Circle’s customers want to mint stablecoins on a chain that has a liquid DeFi ecosystem. This unlocks opportunities to e.g. earn yield at scale by depositing stablecoins into lending marketplaces like Aave. Aave’s Ethereum deployment hosts over $10 billion in stablecoin deposits at the moment – those deposits alone would place Aave as the second largest chain by DeFi TVL.

A multibillion dollar DeFi ecosystem attracts both new and existing stablecoin minters, which makes the chain’s DeFi ecosystem even more liquid, which attracts even more stablecoin minters, and so on – a classic liquidity network effect at work.

Ethereum could recapture users from competing chains

The onchain activity on Ethereum, when measured by transactions and active addresses, is at an all-time high.

A liquid DeFi ecosystem combined with ongoing scalability and performance upgrades makes Ethereum increasingly attractive for users.

Ethereum could be in a position to “recapture” liquidity and users from L2s and competing L1s over the coming 12-18 months, should the current trendline continue to hold.

Ethereum stands to benefit from growing stablecoin adoption

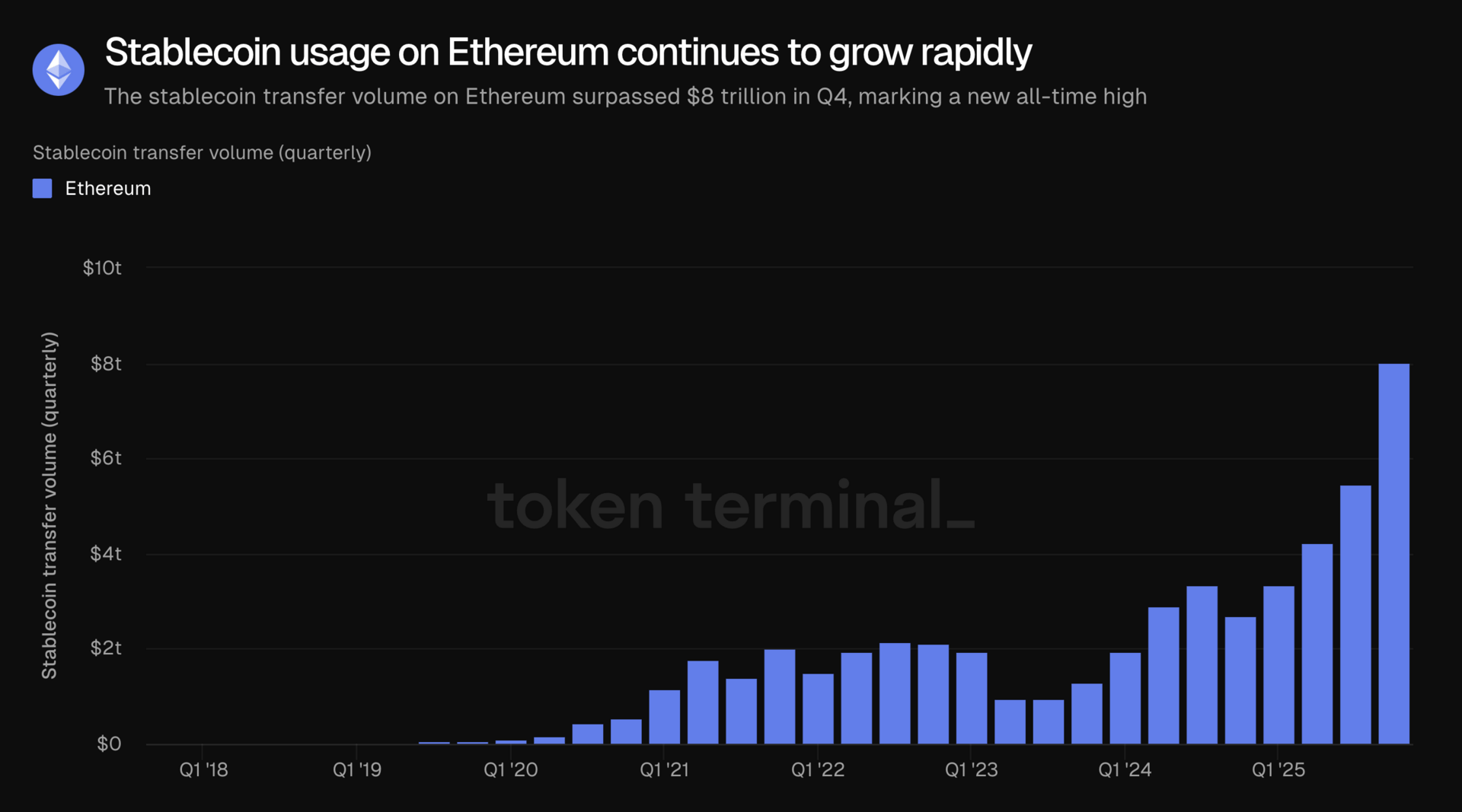

Stablecoin usage, not only issuance, on Ethereum is at an all-time high, with Q4 stablecoin transfer volume reaching $8 trillion.

The combination of improved chain performance, liquid DeFi ecosystem, and ~$180 billion in stablecoin supply puts Ethereum in a unique position to grow stablecoin usage.

The global stablecoin supply is expected to grow by ~10x over the next few years, and Ethereum stands to benefit the most as the chain that hosts the largest share of stablecoins.

Access the charts here.

Project updates:

Listed XSwap, an AMM-based DEX on XDC Network. XSwap enables swapping and liquidity provision for XRC-20 tokens (XDC's token standard). The project also operates a launchpad for new token launches on the network.

Listed Mantra, an L1 blockchain built on Cosmos SDK designed for real-world asset (RWA) tokenization. Mantra provides compliance-focused infrastructure, including identity verification modules and regulatory reporting tools, enabling permissioned applications on a permissionless chain.

Listed PrimeFi, an omnichain lending protocol built on LayerZero. PrimeFi allows users to deposit collateral on one chain and borrow on another while keeping loans over-collateralized.

Listed Oku Trade, a DEX meta-aggregator built on top of Uniswap v3. Oku aggregates swap and bridge routes across 35+ chains, offering market orders, limit orders, and liquidity position management.

+ 3 basic project listings: VVS Finance, Curvance, and Variational.

Interested in getting listed? Read more here.

Asset updates:

Metric updates:

Added Take rate, a metric that measures the percentage of fees that a project retains as revenue.

For example, for each dollar of interest paid by borrowers on Aave, the Aave DAO captures 13.1% of the payments.

Added Revenue for Uniswap after the UNIfication fee switch proposal passed.

For example, Uniswap has captured $867.9K in revenue since the proposal passed on December 25th.

Platform improvements:

Tokenized assets: Added reference asset filtering, allowing users to filter by the underlying real-world asset backing each tokenized asset.

For example, users can filter by GOOGL to view all tokenized versions of the stock.

Projects: Product pages now include ecosystem stats and deployment chain information.

For example, users can view key metrics like total value locked, trading volume, and fees on Uniswap V4’s product page.

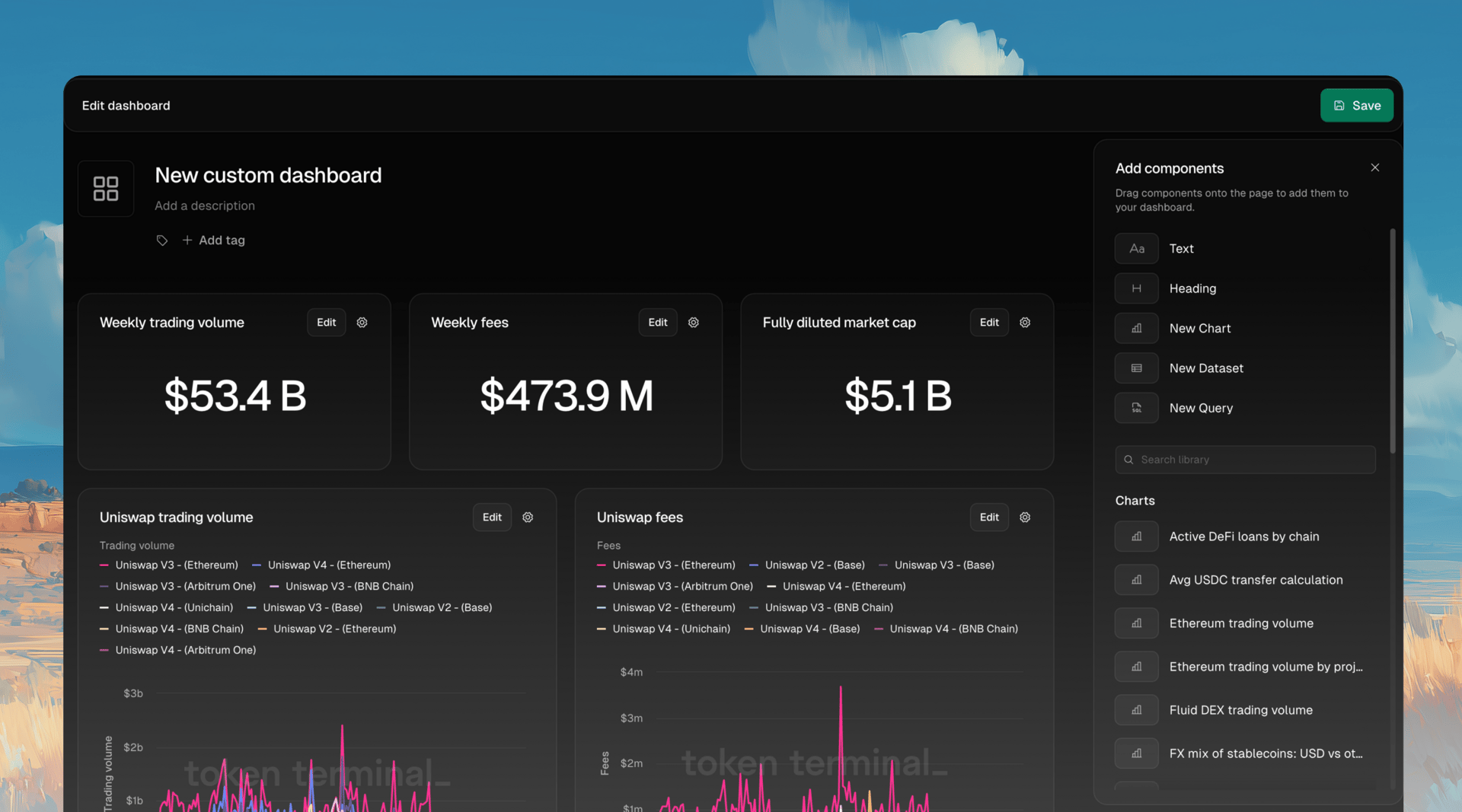

Build custom dashboards with Studio

Studio is Token Terminal's no-code workspace for creating custom charts, datasets, and dashboards using standardized onchain data. Studio has four components:

Dashboards: Combine charts, datasets, queries, and text into shareable dashboards.

Charts: Create custom visualizations using standardized onchain data across hundreds of chains and projects.

Datasets: Build custom tables from ready-made templates with flexible filtering and grouping.

Queries: Write SQL directly against Token Terminal's underlying data warehouse for granular, transaction-level analysis.

Get started with Studio here.

Check out Token Terminal for data-driven market insights.

Want API access? Schedule a demo or explore our documentation.