- Token Terminal

- Posts

- DeFi is becoming financial infrastructure

DeFi is becoming financial infrastructure

+ data & product updates

Each week in The Snapshot, we share data-driven insights, highlight new listings, and showcase our latest product updates.

Read on for the latest edition 👇

Fintechs, exchanges, and stablecoin issuers are plugging into DeFi rather than building proprietary lending systems. This week, we cover PayPal, Coinbase, and Maple Finance.

All three charts in this week's newsletter were built using Token Terminal Queries, our SQL interface that lets analysts break down standardized metrics into granular, transaction-level drivers across hundreds of apps, assets, and chains.

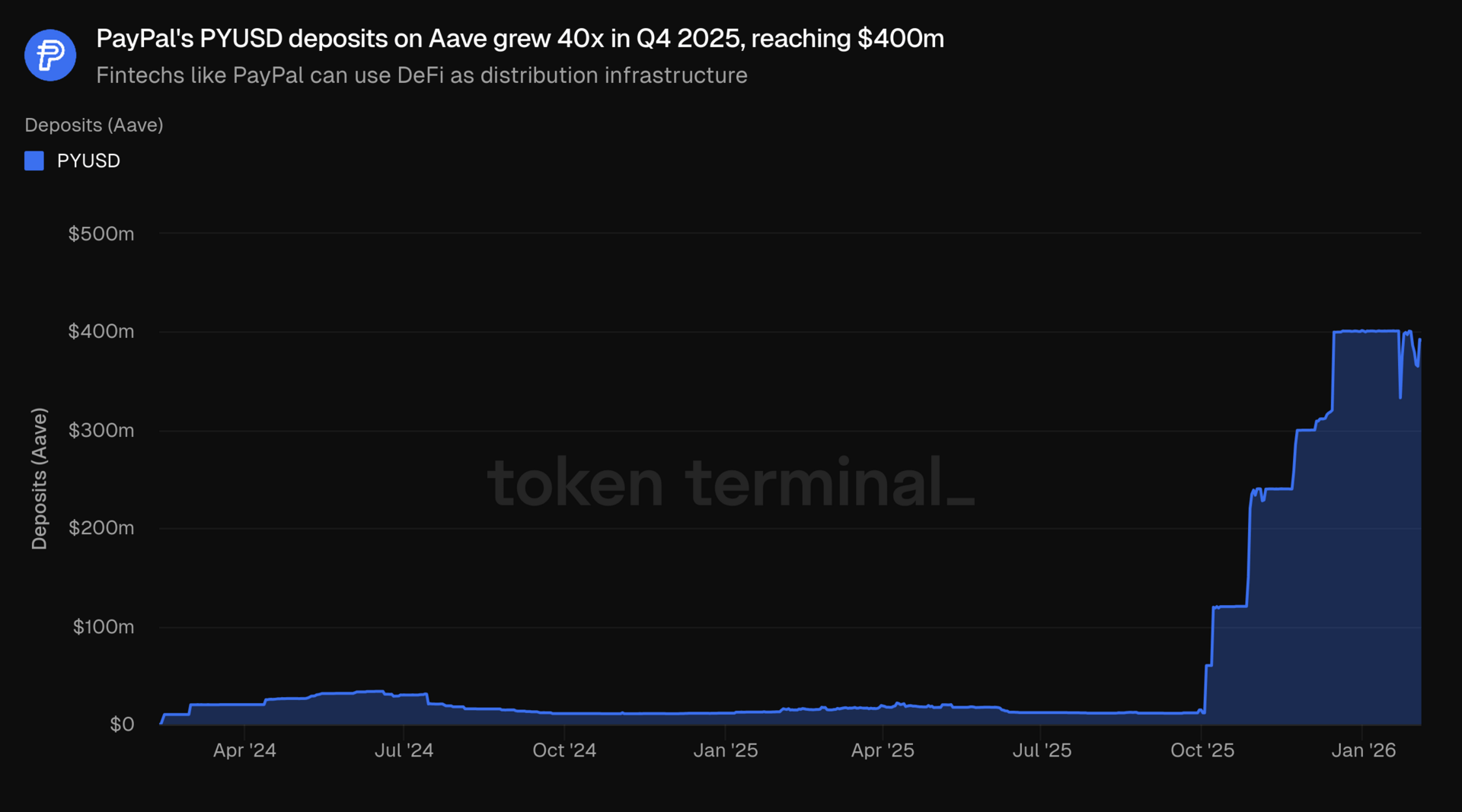

PayPal uses Aave to grow PYUSD onchain

PayPal's PYUSD deposits on Aave grew 40x in Q4 2025, from $10m to $400m. PYUSD is PayPal's dollar-backed stablecoin. PayPal launched an onchain incentives program in October, driving the growth.

PayPal launched onchain incentives to match the 4% yield it pays users in-app. PayPal pays this 4% to users who hold PYUSD on PayPal or Venmo, but not to holders onchain. The incentives, distributed via Merkl, make up for the yield users give up by taking PYUSD into DeFi.

Fintechs like PayPal can use DeFi as distribution infrastructure. Rather than building its own lending product, PayPal plugged into Aave's existing markets to grow PYUSD onchain. If it works beyond the incentive period, other fintechs could follow the same playbook.

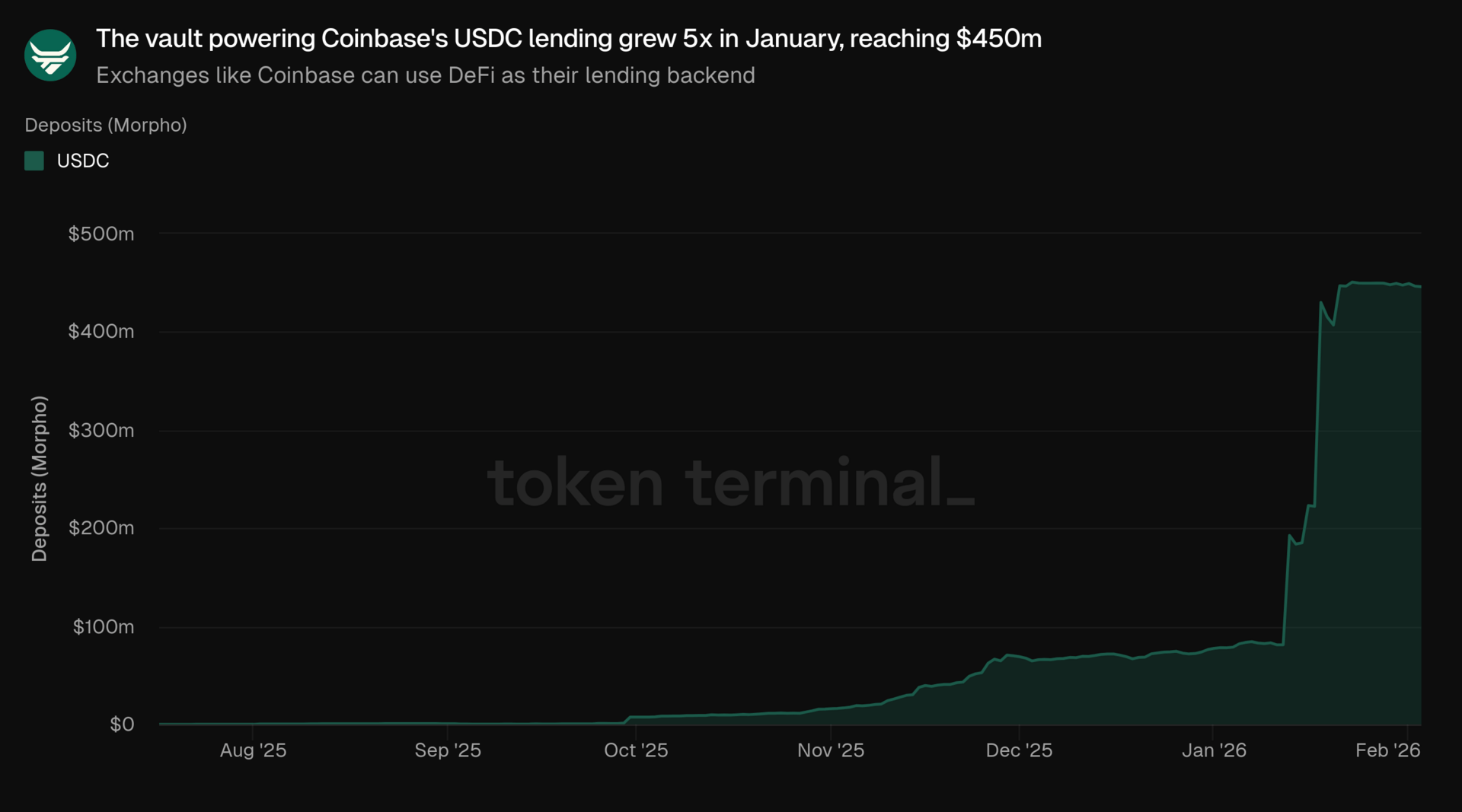

Coinbase uses Steakhouse & Morpho to power USDC lending

The vault powering Coinbase's USDC lending grew more than 5x in January, reaching $450m. The vault is managed by Steakhouse Financial on Morpho. Nearly all of it (~$428m) is lent to borrowers posting cbBTC as collateral, earning depositors 4.21% APY.

When Coinbase users deposit USDC in the app, their funds flow into Steakhouse's vaults on Morpho. Other Coinbase users can then borrow against their BTC using these funds. Neither side leaves the Coinbase app, although the vault is also accessible directly on Morpho.

Exchanges like Coinbase can use DeFi as their lending backend. Rather than developing its own lending contracts, Coinbase outsourced the infrastructure to Morpho and Steakhouse. If more exchanges take this approach, DeFi protocols could become the default backend for CeFi lending products.

Maple uses Aave to scale syrupUSDC on Base

Maple Finance's syrupUSDC deposits in Aave's Base market grew 39x since launching on January 22, from $5.9m to $230m. syrupUSDC is Maple Finance's yield-bearing stablecoin. It earns yield from Maple's institutional lending business and is already the 3rd largest asset by supply in Aave's Base market.

Aave's E-Mode likely drove fast adoption by giving syrupUSDC holders immediate borrowing power. E-Mode lets users borrow more against assets that trade at similar prices. Holders can borrow USDC or GHO at up to 90% LTV and loop (deposit, borrow, redeposit) to multiply their yield.

Stablecoin issuers like Maple can use DeFi lending markets as a distribution layer. Rather than building lending liquidity from scratch, Maple listed syrupUSDC in Aave's Base market, where holders can already borrow from $398m in USDC and $8m in GHO liquidity. If more issuers follow Maple's approach, Aave could cement itself as the default scaling method for yield-bearing stablecoins.

Basic project listings:

Interested in getting listed? Read more here.

Quarterly reports:

Q4 2025 reports are now live for:

Token Terminal’s quarterly reporting initiative features data-driven analysis of project performance, growth drivers, and strategic outlook with commentary from the project teams. More Q4 reports will be published over the coming weeks.

Search for "Q4 2025 Report" on Discover to access them.

Discover: Charts

Discover now includes a dedicated Charts tab, giving users direct access to Token Terminal's library of curated charts. The charts that Token Terminal's research team produces are now browsable and filterable by chain, market sector, project, metric, product, and asset directly on the platform. Each chart can be opened in Studio for further customization and analysis.

Explore the Charts tab on Discover here.

Check out Token Terminal for data-driven market insights.