- Token Terminal

- Posts

- Could Lido (LDO) be due for a reversal?

Could Lido (LDO) be due for a reversal?

+ data & product updates

Each week in The Snapshot, we share data-driven insights, highlight new listings, and showcase our latest product updates.

Read on for the latest edition 👇

Lido's adoption and valuation tell different stories

Lido's market cap has fallen over 90% from its 2021 peak while assets staked sit near all-time highs at $28.6b. Fully diluted market cap currently sits at $525.2m. Assets staked have grown steadily since 2022, largely unaffected by the token's price decline.

Lido's dominance comes from network effects. stETH is deeply integrated across DeFi as collateral and liquidity, with wstETH ranking among the largest collateral assets on Aave. The protocol has also invested in decentralization to address concentration concerns, while refocusing entirely on Ethereum after sunsetting support for other chains.

Lido is a levered bet on Ethereum. Revenue scales with both the amount of ETH staked and the price of ETH. If institutional adoption drives ETH higher and staking participation increases, Lido's revenue compounds on both axes.

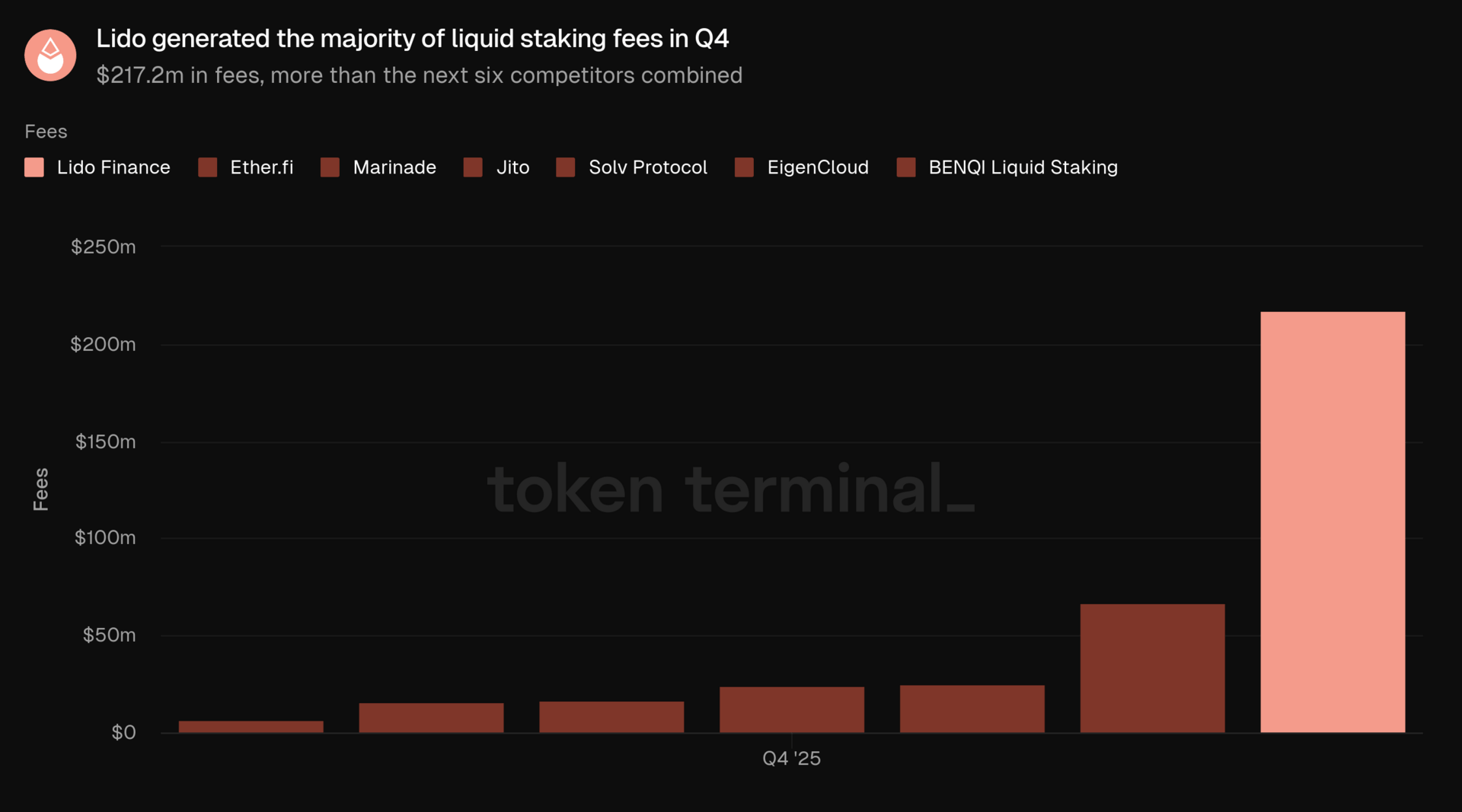

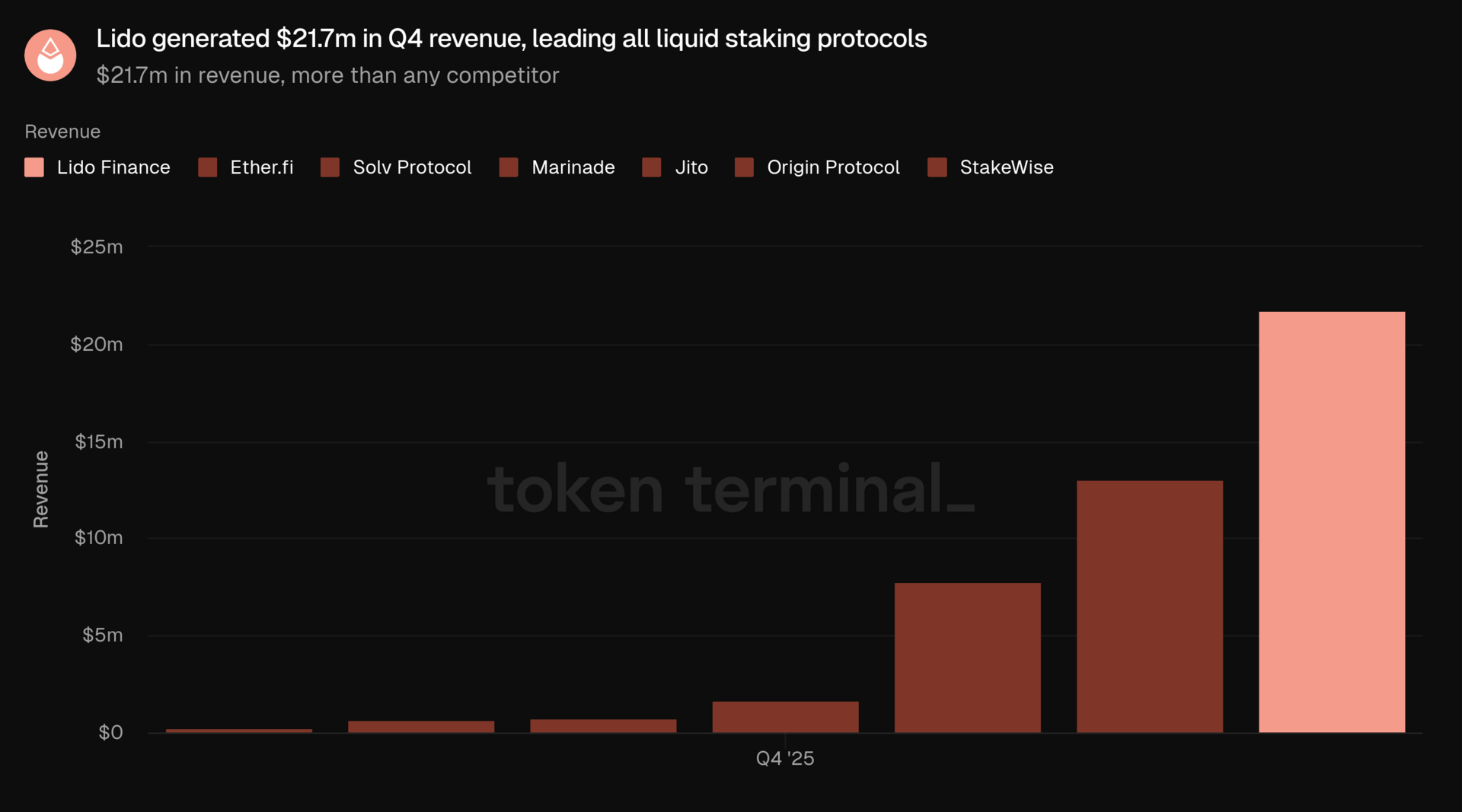

Lido leads in liquid staking deposits, fees, and revenue

Lido holds $28.6b in staked assets, more than double EigenCloud at $12.9b. Its deposits exceed the combined total of Ether.fi, Jito, Rocket Pool, Coinbase, and StakeWise.

Lido generated $217.2m in fees during Q4 2025, more than the next six competitors combined. Fees measure gross staking rewards earned by depositors before the protocol takes its cut. Lido applies a 10% fee on staking rewards, which is counted as revenue for the protocol.

Lido generated $21.7m in revenue during Q4 2025, leading all liquid staking protocols. The DAO's recently proposed $10m annual buyback program would represent roughly 12% of annualized revenue returned to LDO token holders. Lido Earn, a recently launched gateway to DeFi strategies built on stETH, could add another revenue layer if adoption scales.

Access the charts here.

Project updates:

20 basic project listings, including:

Monero, a privacy-focused cryptocurrency using ring signatures and stealth addresses to hide transaction data by default.

Pleasing Gold, a tokenized gold issuer where each PGOLD token represents one troy ounce of LBMA-certified physical gold with redemption available in Hong Kong.

DGLD, a tokenized gold issuer on a Bitcoin sidechain where each token represents one-tenth of a troy ounce of Swiss-vaulted gold.

Neutrl, a synthetic dollar protocol generating yield through delta-neutral strategies and OTC locked-token arbitrage.

Main Street, a delta-neutral yield protocol on Sonic offering msUSD, a stablecoin generating yield from options arbitrage.

Interested in getting listed? Read more here.

Asset updates:

Listed 66 new assets on the Tokenized assets page. Highlights include:

Tokenized stocks from Remora Markets, including NVIDIA, Tesla, and Strategy, plus tokenized commodities like Gold, Platinum, and Palladium.

Stablecoins from Mento Labs, including USD, EUR, GBP, JPY, and emerging market currencies like Nigerian Naira and Kenyan Shilling.

Quarterly reports:

Q4 2025 reports are now live for:

Token Terminal’s quarterly reporting initiative features data-driven analysis of project performance, growth drivers, and strategic outlook with commentary from the project teams. More Q4 reports will be published over the coming weeks.

Search for "Q4 2025 Report" on Discover to access them.

Queries: SQL access to Token Terminal's data warehouse

Queries gives analysts direct SQL access to Token Terminal's data warehouse, going beyond our standardized metrics to raw blockchain data, decoded smart contract events, and market primitives across 100+ chains.

Recent updates include the ability to reference existing Queries, API access to Query results, and a redesigned AI Query editor. The tool provides ~1,000x more granular data than standard reporting, letting teams drill from high-level KPIs down to transaction-level drivers.

Check out Token Terminal for data-driven market insights.