- Token Terminal

- Posts

- Circle’s second act is already here

Circle’s second act is already here

+ data & product updates

Each week in The Snapshot, we share data-driven insights, highlight new listings, and showcase our latest product updates.

Read on for the latest edition 👇

What is Circle?

Circle is a publicly listed fintech company best known as the issuer of USDC, the world’s second-largest stablecoin with a market cap of $77.3 billion.

Circle’s business has historically been defined by USDC, raising the question of whether the company has meaningful growth vectors beyond its flagship product.

The following charts show that Circle is expanding into transaction-based revenues (CCTP), yield-bearing assets (USYC), and new geographic markets (EURC).

1) With the CCTP bridge, Circle is making a push into transaction-based revenues

Native USDC bridge. CCTP is Circle’s cross-chain transfer protocol that burns USDC on the source chain and mints native USDC on the destination chain, unifying USDC liquidity across 15+ blockchains.

Fixes bridge fragmentation. CCTP removes wrapped-USDC bridges and external liquidity pools, reducing bridge risk, capital lockups, and operational complexity for exchanges, wallets, and applications that move USDC between chains.

Fee-based volume growth. CCTP V2 charges onchain Fast Transfer fees at mint and is already processing $28.9 billion in quarterly transfer volume, up 6.3x YoY, turning cross-chain USDC movement into a growing transaction-revenue line for Circle.

2) With the USYC TMMF, Circle is making a push into yield-bearing assets

Tokenized MMF shares. USYC is the onchain representation of the Hashnote International Short Duration Yield Fund, a tokenized money market fund that invests in short-term U.S. government-backed securities and reverse repos.

Onchain yield access. USYC gives eligible non-U.S. institutions 24/7, USDC-settled access to institutional Treasury yields with programmable, near-instant subscriptions and redemptions, solving for slow and operationally heavy traditional fund rails.

Recurring fee engine. USYC charges a 10% performance fee on yield plus subscription and redemption fees, and has scaled to more than $1 billion in assets, creating a growing stream of fee-based revenue for Circle as tokenized money market funds gain share.

3) With the EURC stablecoin, Circle is making a push into the EU market

Euro stablecoin. EURC is Circle’s fully reserved, MiCA-compliant euro stablecoin, issued on Avalanche, Base, Ethereum, Solana, and Stellar and redeemable 1:1 for euro.

Solves euro liquidity gap. EURC provides regulated euro liquidity for payments, FX, and DeFi in Europe, giving businesses a compliant alternative to unregulated euro tokens and extending Circle’s stablecoin model beyond USD.

Interest and fee upside. EURC adds euro reserves and fiat–stablecoin conversion flows to Circle’s interest and transaction-fee revenue base, and its market cap has grown 150% YTD to $367.4 million, making it the largest euro stablecoin and a fast-growing contributor to Circle’s stablecoin economics.

Access the charts here.

Project updates:

+ 79 basic project listings, including dTRINITY, Stable, Stream, and 56 gaming projects in the Sei Network ecosystem.

Interested in getting listed? Read more here.

Asset updates:

Listed 25 stablecoins, including Angle Staked EURA, Ethena Staked USDe, f(x) USD Saving, Savings Dai, and Staked Frax USD.

Metric updates:

Added an asset off peg metric for dollar-based stablecoins, tracking deviations from the $1 peg. This metric is available for stablecoins like USDT, USDC, USDS, and USDe.

Added Venus breakdowns to Queries. Users can now use SQL to access granular data on metrics like active loans, TVL, and more for BNB Chain’s largest lending project.

Platform improvements:

Studio: Create charts featuring any asset on the tokenized assets page. For example, users can create charts featuring tokenized stocks like TSLAX with metrics such as asset price, asset holders, and circulating asset market cap.

Studio: Create ratio charts with flexible units to better compare multiples across projects or market sectors. For example, users can now view the ratio between Ethereum’s FDV and ecosystem TVL as a standard ratio, number, or percentage.

Market overview: Improved treemap readability in smaller environments, making it easier to scan at a glance. For example, users can quickly access information like Tether’s share of stablecoin supply or Aave’s share of lending fees.

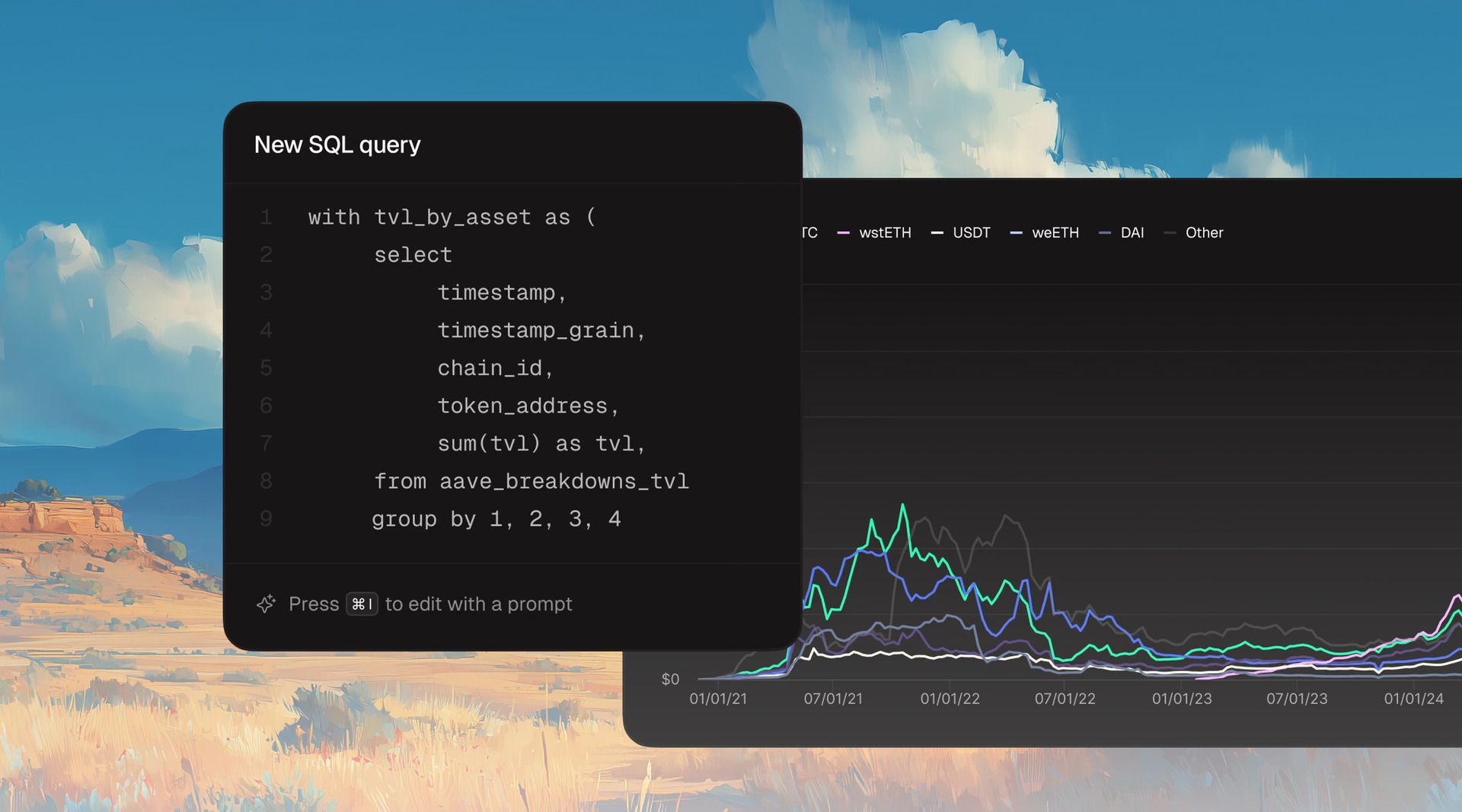

Queries: SQL access to Token Terminal’s data warehouse

In October, we launched Queries, a SQL interface providing direct access to Token Terminal’s underlying data warehouse. Queries lets analysts move beyond standardized metrics to query raw blockchain data, decoded smart contract events, market primitives, and more across 100+ chains.

Since launch, we’ve added several new capabilities: users can now reference existing Queries to build on previous work, access Query results via API endpoints, and use the redesigned AI Query editor for faster analysis. The tool unlocks ~1,000x more granular data than our standard reporting, enabling teams to break down high-level KPIs into detailed transaction-level drivers.

Check out Token Terminal for data-driven market insights.

Want API access? Schedule a demo or explore our documentation.